The enterprise behind stablecoin Tether (USDT) has just launched its most up-to-date audit report as of June 30th.

Tether’s liquidity reserves carry on to decline

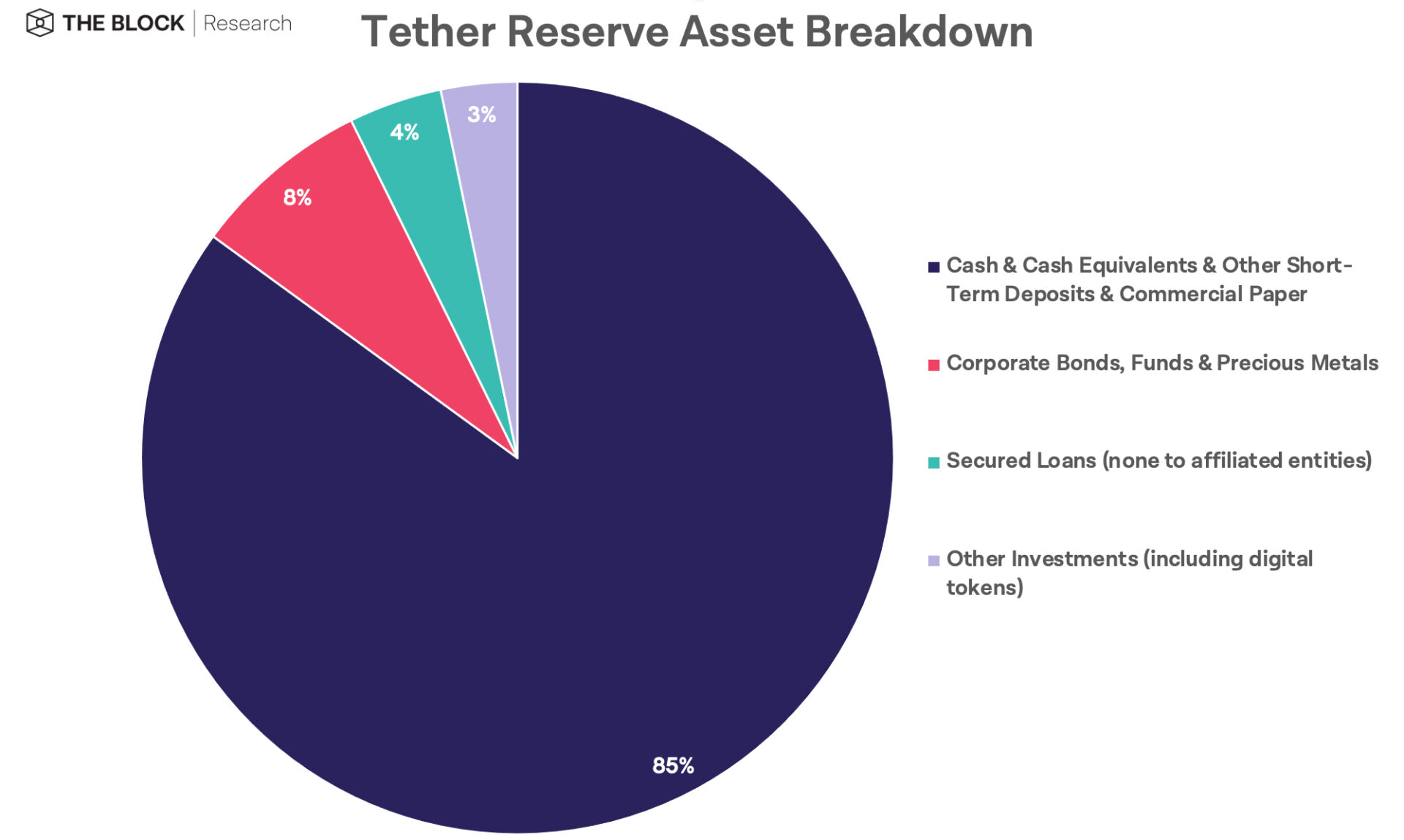

According to the most up-to-date statistics, up to 85% of Tether’s complete capitalization, equal to USDT 62.eight billion, is backed by “Cash, cash equivalents, short-term deposits and bank checks”, up to 14.one% in contrast to the March report.

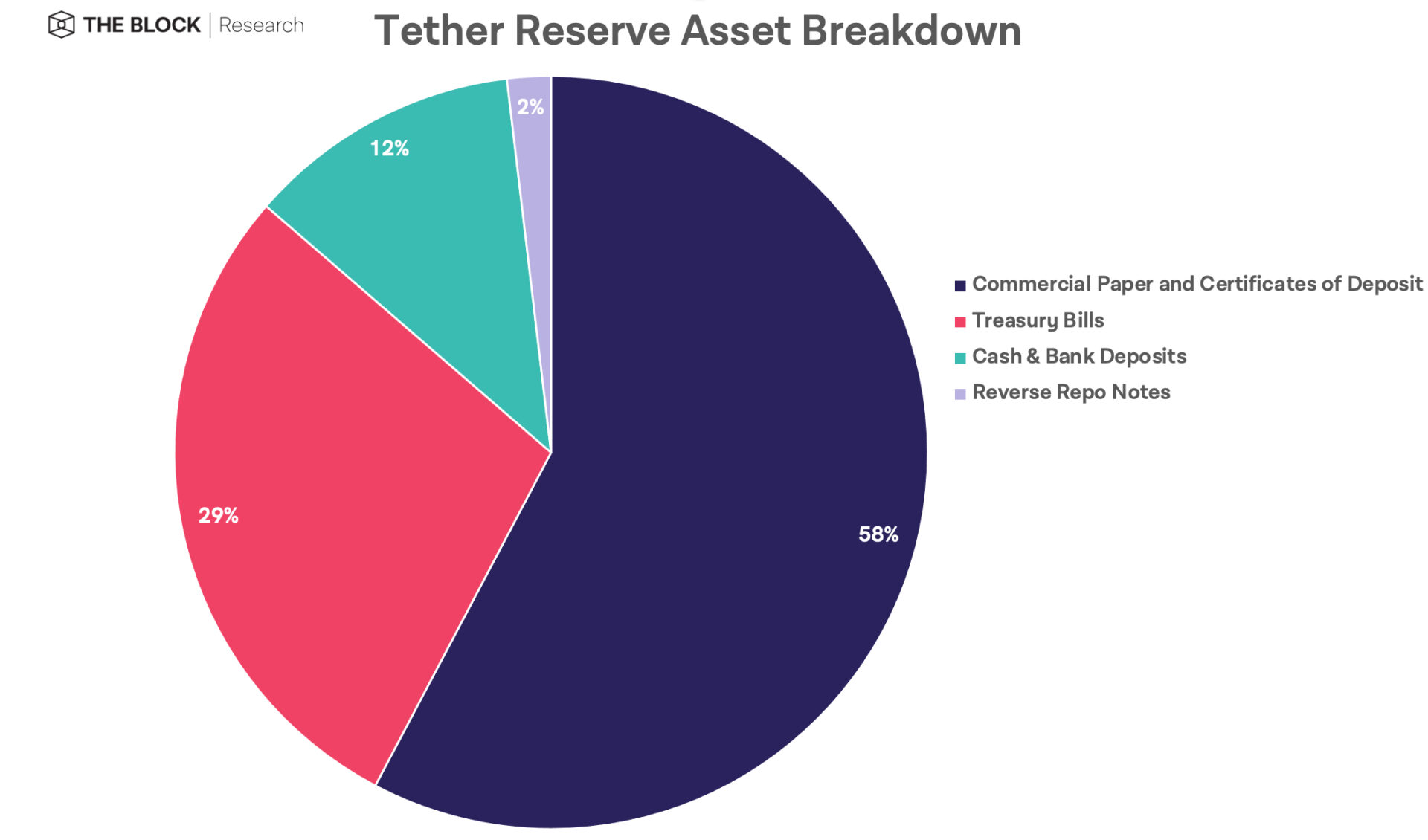

Of these, financial institution checks and certificates of deposit accounted for the vast majority with 58%. Treasury expenses signify 29%, income and financial institution deposits twelve% and repo contracts two%.

Furthermore, Tether in its most up-to-date report grouped two asset lessons “Cash” and “Bank Deposit” collectively. Compared to March, the share of this new asset group decreased from 21.three% to twelve%.

The drop in the income ratio demonstrates that Tether is more and more dependent on other income equivalents to assistance its stablecoin. This move goes towards the company’s preceding dedication that most issued USDT stablecoins will usually have a genuine dollar behind as collateral. This is also Tether’s “Achilles heel” which has been “attacked” by a lot of other rivals in the stablecoin array this kind of as USD Coin (USDC) and Paxos (PAX) in the previous.

Doesn’t Tether want “idle money”?

However, if you appear at it from a further angle, the reality that Tether allocates the vast majority of its income reserves to quick- and medium-phrase successful corporations suggests that the enterprise might have an aggressive income movement tactic. This is demonstrated by the reality that most of the checks and certificates of deposit they hold have a credit score rating of A-one, along with some properties that are rated A-two, A-three and A-one. + More.

Another noteworthy level is that Tether’s asset allocation to government bonds elevated considerably among the initially and 2nd quarters, from three% at the finish of March 2021 to 29% in June 2021.

This is only the 2nd time that Tether has launched dedication information for USDT due to the fact the stablecoin was born in 2014, the initially time at the finish of March 2021. Both reviews had been ready by the audit company Moore Cayman math.

Commenting on the most up-to-date audit report, Paolo Ardoino, Chief Technology Officer of Tether, explained L

“The most up-to-date report confirms after once again that Tether is thoroughly securitized. The reality that the enterprise has a nutritious and ongoing portfolio demonstrates a robust emphasis on liquidity to fuel the development of the enterprise and our progressive items. “

Synthetic Currency 68

Maybe you are interested: