The market’s greatest stablecoin issuer, Tether, explained it will resume lending routines for some close by prospects right after almost a 12 months of suspending support.

Tether resumes stablecoin lending

Tether resumes stablecoin lending

According to the sheet WSJTether Holdings lent brief-phrase stablecoins to some of the company’s lengthy-standing prospects in the 2nd quarter of 2023. The intention of these loans is to stop prospects from working out of liquidity and offering collateral at possibly unfavorable rates.

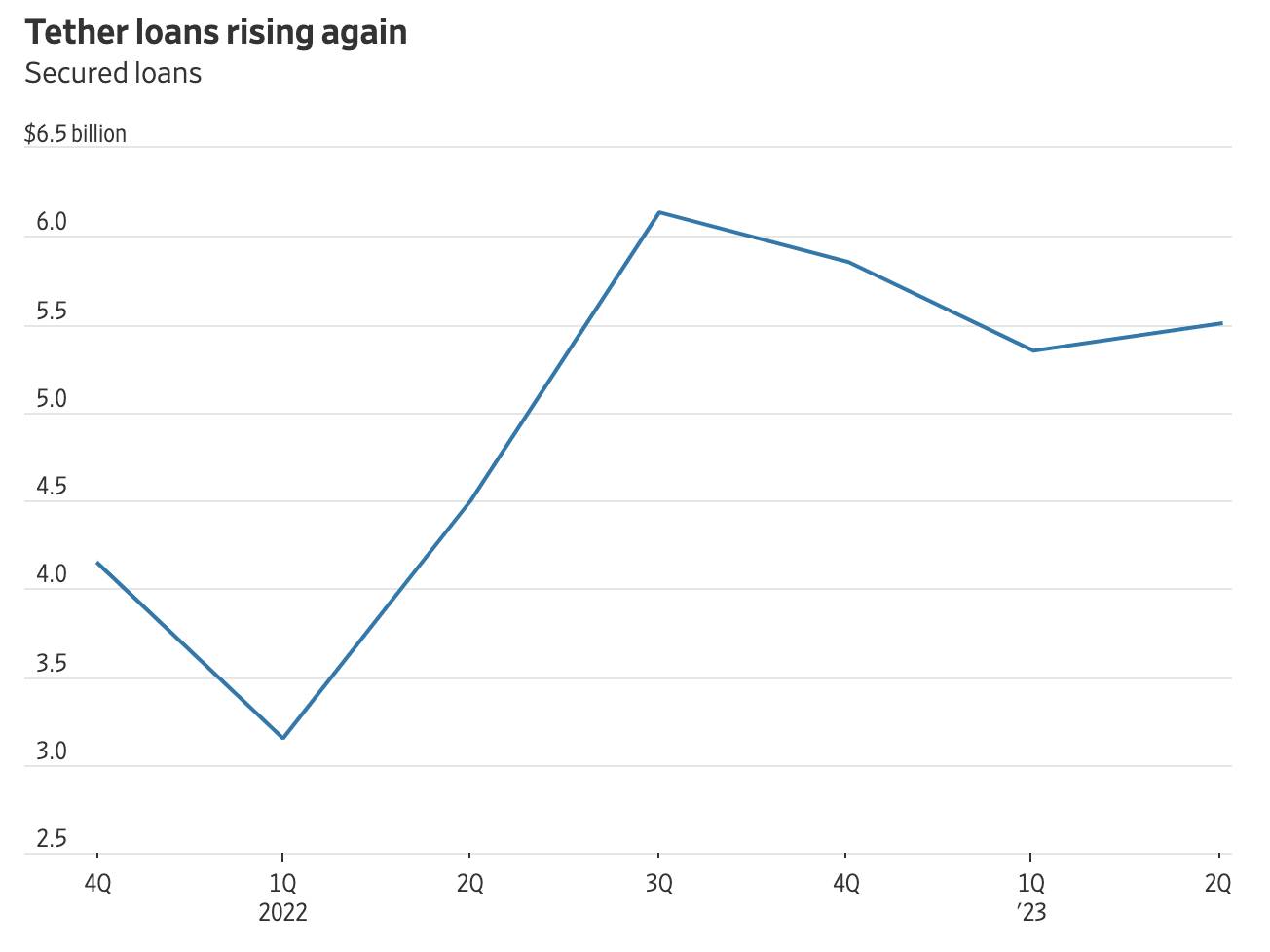

Reality Tether has stopped lending providers considering that December 2022, as the FTX crisis started to spread. At the time, Tether’s borrowings amounted to $six.one billion, accounting for 9% of the company’s complete assets.

According to its Q2 2023 money report, the stablecoin issuer lent $five.five billion as of June thirty, up from $five.three billion in the earlier quarter.

Tether representative Alex Welch confirmed to the WSJ that the organization is creating new loans:

“During the second quarter of 2023, we received a number of requests for short-term loans from customers we worked with. These are all long-standing partners and we set out to meet these requirements.”

Chart of Tether loans in excess of quarters

Chart of Tether loans in excess of quarters

However, this individual explained that the organization will wholly remove these loans by 2024. Furthermore, Tether representatives did not reveal data about their prospects or why these prospects have to promote the mortgaged house at an unprofitable value.

The loans are in excess of-collateralized with liquid assets, but the organization declined to say what these assets are or no matter whether the collateral involves cryptocurrency.

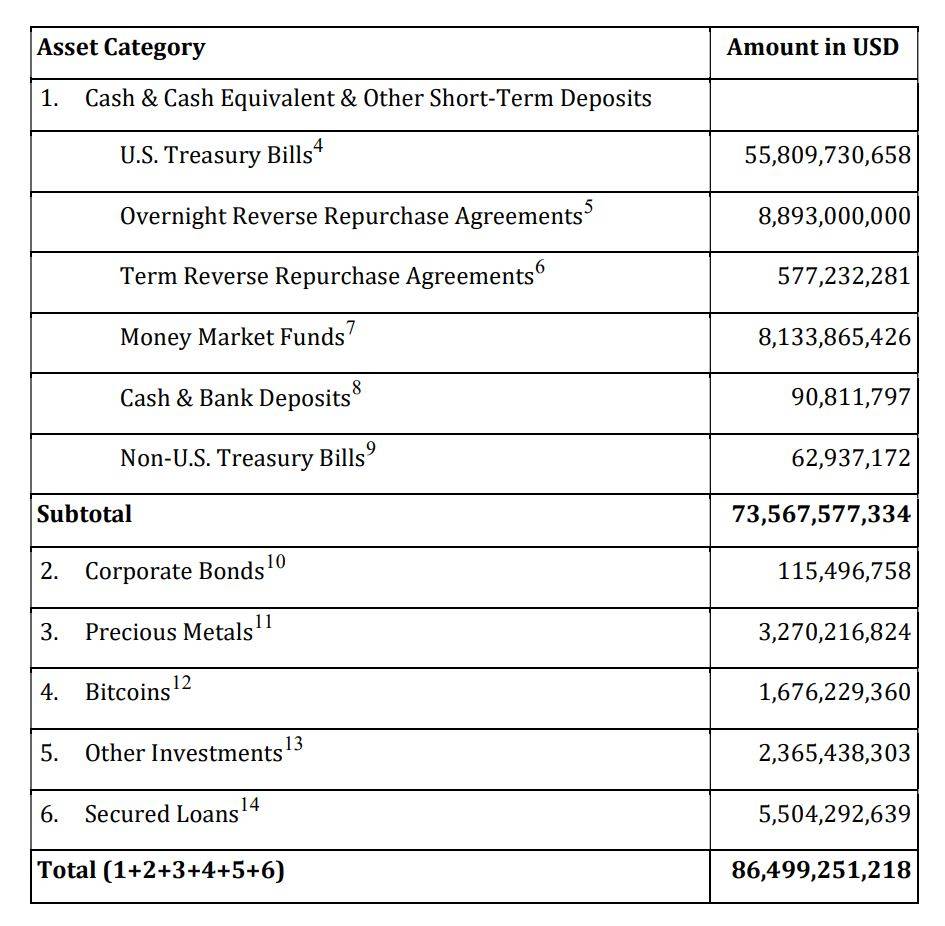

As Coinlive information, Tether created a revenue of $one billion in the 2nd quarter of 2023, bringing the reserve stability to $three.three billion, equal to three.eight% of complete assets. As of June thirty, 2023, Tether’s stability sheet exhibits that it holds almost $86.five billion in assets, of which $83.one billion is utilized to back the issued stablecoin USDT, the rest of the funds comes from the reserve fund.

Assets held by Tether as of June thirty, 2023. Source: Tether

The organization also announced that it will hold up to $72.five billion in USDT collateral assets in the kind of Treasury Bonds, transforming them Tether has turn out to be the 22nd greatest holder of US government debt in the globe.

Coinlive compiled

Join the discussion on the hottest challenges in the DeFi industry in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!