BDO’s stablecoin escrow report displays that issuer USDT Tether’s complete assets exceed consolidated liabilities.

Last evening, Tether, the biggest stablecoin broadcaster in the planet issued an independently corroborated report on the company’s past quarter outcomes.

Tether publishes independent auditor’s report from prime five BDO accounting companies, reinforcing its commitment to transparency and revealing an additional main minimize in industrial paper holdingshttps://t.co/an5O5KX8xd

– Tether (@Tether_to) 19 August 2022

The ownership attestation report was drawn up by the Italian branch of BDO Audit Services Company Limited (BDO), the fifth biggest auditing company in the planet. This is the 5th report published by the corporation, following the past 4 instances in March 2021, June 2021, December 2021 and May 2022.

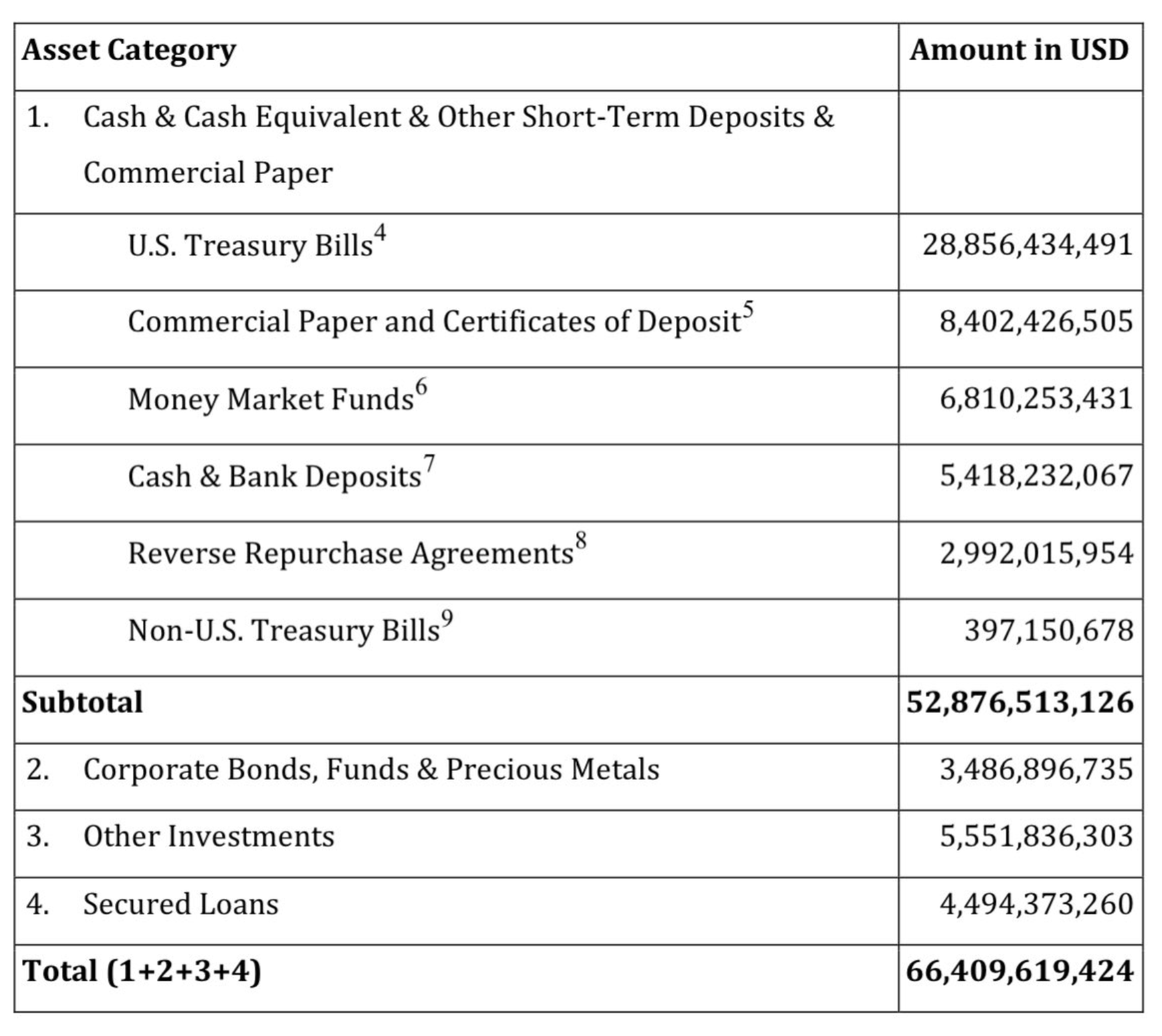

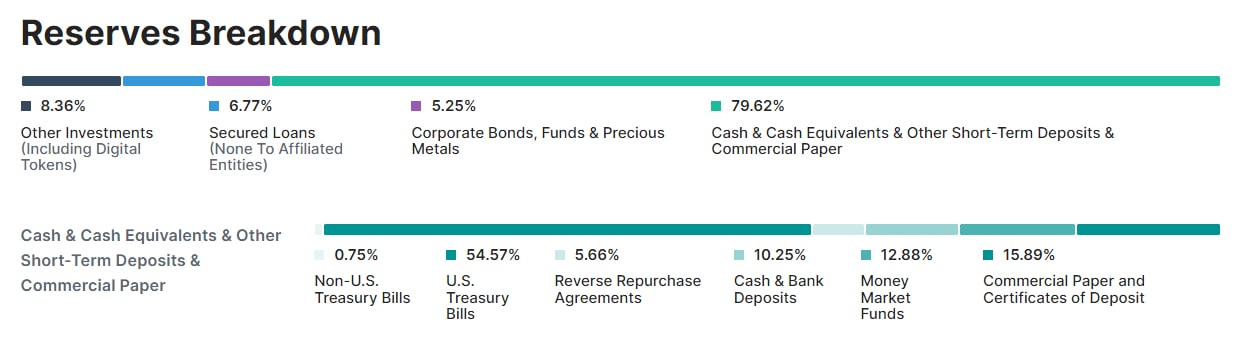

As of June thirty, Tether has thead of the residence 66.four billion bucks, of which income and financial institution deposits elevated 32%, from $ four.one billion to $ five.four billion. BILLIONMr equivalent of consolidated liabilities 66.two billion buckswhich signify virtually 99% of cryptocurrencies.

Amount of industrial paper it was down 58% from the past quarter, from $ twenty billion to $ eight.five billion. This is in line with Tether’s dedication to decrease its holdings of industrial paper. Tether expects this variety to drop to $ 200 million by the finish of August and be phased out wholly by the finish of the 12 months.

Commercial paper is brief-phrase unsecured debt issued by a corporation. This is the holding corporation that most people today be concerned about when it comes to Tether brief phrase loans relevant to the Chinese true estate sector. Therefore, in the previous, Tether has constantly lowered this stake to create purchaser self confidence.

In addition, Tether’s common ratings on industrial paper and certificates of deposit have enhanced from A-two to A-one given that December 2021 report. A-one is judgments increased for brief-phrase debt instruments, demonstrating that Tether can hold the highest top quality liquidity accessible.

With this reported, Tether continues to state that it is wholly attainable to assure the worth of the USDT issued, which is like a “money printing machine”.

In the previous, Tether has normally been criticized for partnering with lesser-regarded auditing companies whose reporting top quality is no increased than typical ground. This time about, the corporation made a decision to companion with the world’s fifth biggest auditing company BDO to certify the report and has pledged to carry on publishing it month-to-month, rather than quarterly as ahead of.

The corporation says this kind of relationships, especially with BDO oversight, are meant to “reinforce their dedication to transparency.” Tether’s CTO stated in the statement:

“We are absolutely committed to retaining our place as the main stablecoin in the industry. The usefulness of Tether continues to be supported by the transparency of its reserves and the primary supply of stability, enabling us to create an engine for the worldwide economic system. “

Starting in May 2021, Tether starts issuing quarterly reviews on stablecoin reserves following a lawsuit in which it was stated that the unit was not transparent concerning ensures. The climax originates from the occasion Bloomberg performed a “shocking” report, revealing the true image behind Tether’s company in October 2021. Just a week later on, each Tether and Bitfinex have been fined $ 42.five million. It is well worth noting that there is an intervention by the US Assets Futures Trading Commission (CFTC). Not only that, the flame towards Tether continues to burn up as Hindenburg Research is inclined to pay out up to $ one million to any person who delivers beneficial details on the “dark side” of USDT.

Tether’s approval report was launched a week following the U.S. government sanctioned the Tornado Cash crypto mixer, contributing to the improve USDT’s existing provide. Currently, USDT continues to hold the world’s biggest stablecoin place by industry cap, in accordance to CoinMarketCap.

Synthetic currency 68

Maybe you are interested: