Derivatives are an critical component of any marketplace, be it the stock marketplace, the foreign exchange marketplace or the cryptocurrency marketplace. Traders can use distinct techniques to speculate or decrease their losses as a result of hedging.

In situation you want to investigate the crypto derivatives marketplace. You will need to have an exchange that presents this kind of solutions. Here is a listing of the five finest crypto derivatives exchanges you can refer to.

Binance Future

Binance is the world’s foremost spot, margin and derivatives exchange. Binance has the biggest buyer base and trading volume in the worldwide cryptocurrency marketplace.

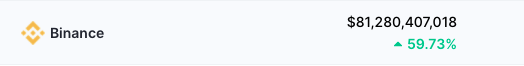

Derivatives volume of Binance Future exchange as of July 26 (Source: Coinecko):

Derivatives on Binance are classified as follows:

- USD margin futures contracts

These are perpetual contracts and the contracts are settled in USDT and BUSD.

- Currency Margin Futures Contracts

These are perpetual contracts and the contracts are settled in cryptocurrencies like BTC, ETH, and so forth.

Leverage tokens enable customers to raise their publicity to a distinct crypto asset.

This is European design solutions trading which can be made use of to maximize income or restrict losses.

Binance has realistic commissions for derivatives trading. There are no deposit charges on Binance. The transaction charges are variable and array from .01% to .05% of the transaction worth. Additionally, customers can cut down this commission by holding BNB.

Binance is a safe exchange, has a two-aspect authentication possibility for customers, and has an fantastic buyer assistance system.

FTX

FTX is a highly effective addition to the cryptocurrency marketplace and was founded in May 2019.

Derivative trade volume of the FTX exchange on July 26 (Source: Coinecko):

Exchanges have a broad array of solutions on the derivatives marketplace, and just about 90% of an exchange’s volume is produced as a result of derivatives alone.

The following are derivative solutions supplied by FTX Exchange:

- Non-reversed Futures Contracts

FTX has non-reversible futures contracts, denominated in stablecoins. For instance, a BTC futures contract is BTC / USD and not USD / BTC

There are two sorts of contract:

Quarterly: These futures contracts expire at the finish of the quarter in which they are issued

Perpetual: These futures contracts do not expire. Instead, each and every hour, every perpetual contract has a financing payment in which the purchaser pays a quick or lengthy charge. This aids to retain the value of the perpetual futures contract in line with the value of the underlying index without the need of ever closing positions at maturity.

- Forecasting markets

This is a futures contract on which you can bet on a authentic globe occasion. This is a conventional type of digital betting.

Some of the out there forward contracts are as follows:

TRUMP-2024 is an FTX futures contract. It will expire at $ one if Donald Trump wins the 2024 US presidential election and $ if not.

Bolsonaro-2022 is a futures contract that will expire at $ one if Jair Bolsonaro wins the 2022 Brazilian presidential election and $ otherwise.

All solutions are priced on the Black-Scholes model. Users can buy a phone or purchase to secure their marketplace portfolio from important important marketplace deviations

Why are futures contracts listed on FTX distinct?

FTX futures are stablecoins that are settled by: you deposit the stablecoin as collateral for all futures contracts and your revenue or reduction is paid out in stablecoins. This usually means you get the USD-primarily based legal spread and payments without the need of the need to have for a financial institution account you can also use the exact same base currency as collateral for all contracts, building it less difficult for you to adjust your place.

FTX futures have a special reserve liquidity system that will participate to supply bankruptcy threat accounts, assisting to keep away from retracements.

FTX futures have effectively-measured and mindful margin calls to keep away from important value distinctions.

FTX has futures contracts for lots of tokens this kind of as BTC, ETH, EOS, XRP, USDT, LTC, ADA, and so forth. The collateral for the futures contracts are stablecoins.

The exchange’s USP is a workforce with pertinent and dynamic knowledge in cryptocurrencies and conventional trading arenas. The FTX improvement workforce comes from some of Wall Street’s foremost quantitative money and tech businesses: Jane Street, Optiver, Susquehanna, Facebook, and Google.

The workforce is extra most likely to have publicity to the conventional secondary marketplace. Members have knowledge in derivatives trading and appear to recognize how derivatives are typically created and what sorts of derivatives are in demand. What Binance is nonetheless making an attempt to do but has so far failed to do, as demonstrated by Binance’s latest delisting of stock trading pairs.

Huobi DM

Huobi Global is a single of the foremost cryptocurrency exchanges with wonderful liquidity. In addition, the exchange is fantastic on all security parameters. In addition to critical solutions this kind of as spot and margin trading, Huobi has important trading volume in the derivatives marketplace.

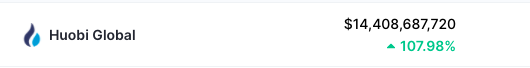

Huobi DM Exchange Derivative Trading Volume on July 26 (Source: Coingecko):

Huobi presents 168 perpetual contracts and 56 futures contracts.

The derivative solutions supplied by Huobi can be classified as follows:

These are delivery contracts that are settled on a particular date.

These are perpetual contracts settled in cryptocurrencies, this kind of as ETH, BTC, and so forth.

These are perpetual contracts settled in USDT.

This is an solutions contract that can be made use of to maximize income or restrict losses.

The trading charges charged by Huobi for derivatives trading are as follows:

| style of contract | Commission of the creator | Buyer’s commission |

| USDT Margin Swap | .02% | .04% |

| Coin Margin Swap | .02% | .05% |

| Futures contracts | .02% | .04% |

| Options | Variable | Variable |

OKEx Futures

OKEx is a massive identify in the crypto room with multi-asset assistance. OKEx is a foremost stock exchange for derivatives trading.

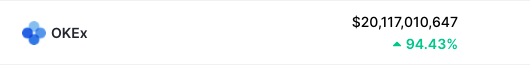

Derivative trade volume of the FTX exchange on July 26 (Source: Coinecko):

The derivatives on OKEx are classified as follows:

These are perpetual contracts that can be positioned on escrow in USD or a different cryptocurrency. This usually means they can be paid in USD or cryptocurrencies.

These are futures contracts that can be USD margin or currency margin. This usually means they can be paid in USD or cryptocurrencies.

This is a European design solutions contract that can be made use of to maximize income or restrict losses.

The OKEx exchange presents 139 forward contracts and 1336 futures contracts. This range of derivatives tends to make OKEx viable for traders who want to trade Altcoin derivatives. Additionally, OKEx is a single of the most liquid exchanges for derivatives trading.

There is also a novice expertise check for individuals who are new to futures and perpetual contracts. OKEx desires traders to enter their derivatives markets with a tiny expertise of how points get the job done. The quiz enables you to discover about margin calls, swaps, futures, financing and withdrawal applications on OKEx.

Basic trading charges on OKEx:

| Type of contracts | Commission of the creator | Buyer’s commission |

| Perpetual contracts | .02% | .05% |

| Futures contracts | .02% | .05% |

| Options | .05% |

This price can be decreased when the consumer reaches the VIP degree.

Another fascinating component of OKEx is that it enables its clientele to pair derivative trading with fiat currencies. This enables you to transact in the currency of your option. And you will not have to switch amongst currencies when withdrawing your money.

Bybit

Bybit is a specialized platform solely for derivatives markets. This bag has been on the marketplace because 2018.

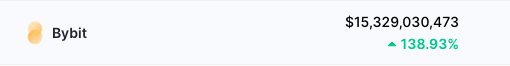

Bybit Exchange Derivative Trading Volume on July 26 (Source: Coingecko):

Bybit derivative solutions are classified as follows:

These are perpetual contracts paid in USDT

- Reverse perpetual with coin margin

These are perpetual contracts that are settled in cryptocurrencies like BTC, ETH, and so forth.

- Reverse futures with margin of currency

These are contracts that are paid for with cryptocurrencies, this kind of as BTC, ETH, and so forth.

Bybit has lengthy been in the cryptocurrency marketplace. What tends to make Bybit this kind of a viable platform is that its principal objective is to satisfy crypto derivatives trading.

Bybit’s transaction charge framework is intuitive. Charges .075% of trades from marketplace participants, but rewards .025% of trades to marketplace makers.

Bybit’s improvement workforce says the platform can manage up to one hundred,000 transactions per 2nd. This tends to make it highly effective for each personal and institutional traders.

As for the consumer knowledge, Bybit is quite clear. It was created to appeal to newcomers and expert traders. There are lots of critical educational sources for newbies to trading on this platform.

Traders can effortlessly entry Bybit on any browser or download the mobile app.

Epilogue

Through the post, Coinlive hopes you can pick out a favourite exchange for your …