Further proof has emerged that the Alameda Research fund and the FTX exchange have a shut romantic relationship, even even though the two are declared independent.

To comply with CoinDeskAs of June thirty, 2022, the complete assets of the Alameda Research fund are at this time $ 14.six billion. This information and facts is CoinDesk The information and facts is obtained from an inner circulation report.

However, it is really worth noting that substantially of the fund’s assets are in the kind of FTT tokens from the FTX exchange. In specific, for an quantity of $ 14.six billion pointed out over, the most useful person currency held by Alameda Research is $ three.six billion FTT “unlocked”. Next, in third location is $ two.sixteen billion “FTT is mortgaged”.

In addition, of the $ eight billion in debt that Alameda Research recorded in the report, up to $ 292 million is “FTT is locked”.

Other significant assets owned by Alameda involve $ three.37 billion in several crypto tokens and a sizeable quantity of Solana (SOL), such as: $ 292 million in “unlocked” SOL, $ 863 million in “locked” SOL and $ 41 million in “collateralized” SOL.

The fund also has $ 134 million in money and $ two billion “invested in securities”.

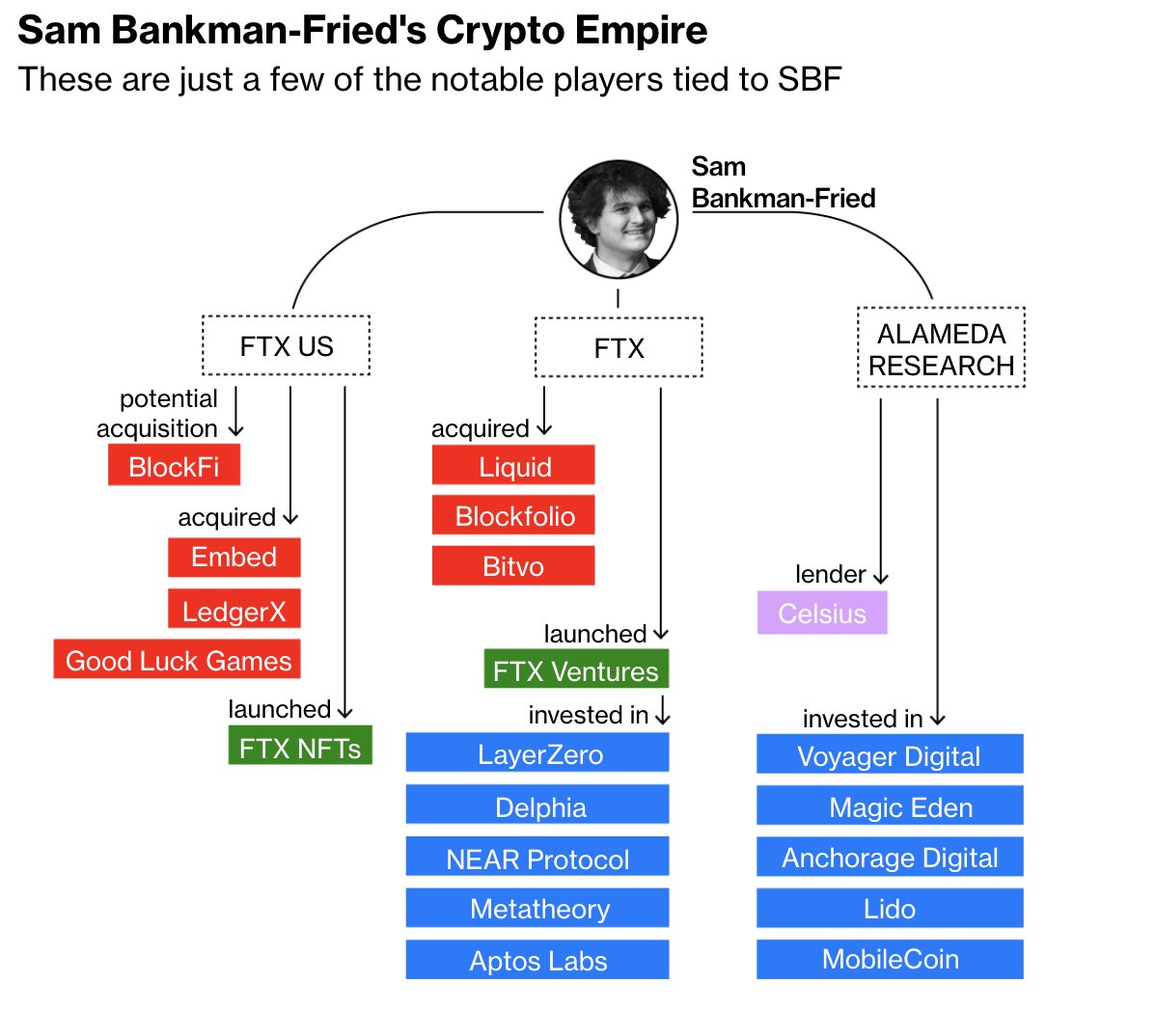

While the Alameda Research fund holds a significant quantity of FTTs is no dilemma, it when once more highlights the shut romantic relationship concerning this title and the FTX exchange. They each share a founder, billionaire Sam Bankman-Fried, who is at this time the CEO of FTX and has been a controversial figure of late due to his proposal to impose rules on DeFi.

There have been quite a few allegations that Alameda is basically a fund made use of to help and make liquidity for “promoted” tasks by FTX, and so use within information and facts and state-of-the-art information to make dollars. The cryptocurrency neighborhood has also compiled a listing of tasks that have been “touched” by FTX-Alameda and have not risen given that, with when sizzling names like Serum (SRM), Maps (MAPS) and Oxygen (OXY) .

In August 2022, the CEO of FTX clarified the romantic relationship concerning the exchange and Alameda. Specifically, Alameda will have a new orientation to participate in liquidity provision and industry creation pursuits for tasks, as very well as OTC trading, when investment pursuits will be for the FTX Ventures fund. Shortly just before that announcement, then Alameda CEO Sam Trabucco stepped down.

Mr. Sam Bankman-Fried also sends an buy to invest in FTTs of up to various million bucks every week, but insists that “this is not investment advice.”

it truly is that time of the week once morehttps://t.co/R8zegY24J4

NON Fiscal Guidance pic.twitter.com/uaaX8miEry

– SBF (@SBF_FTX) October 31, 2022

In addition to FTX-Alameda, Bankman-Fried’s CEO in 2022 also took benefit of the “liquidity crisis” to obtain troubled cryptocurrency organizations, the most current reached an agreement to invest in Voyager’s assets for one.four billion. bucks.

It is reported that FTX is in the course of action of raising capital to proceed mergers and acquisitions in the close to potential.

Synthetic currency 68

Maybe you are interested: