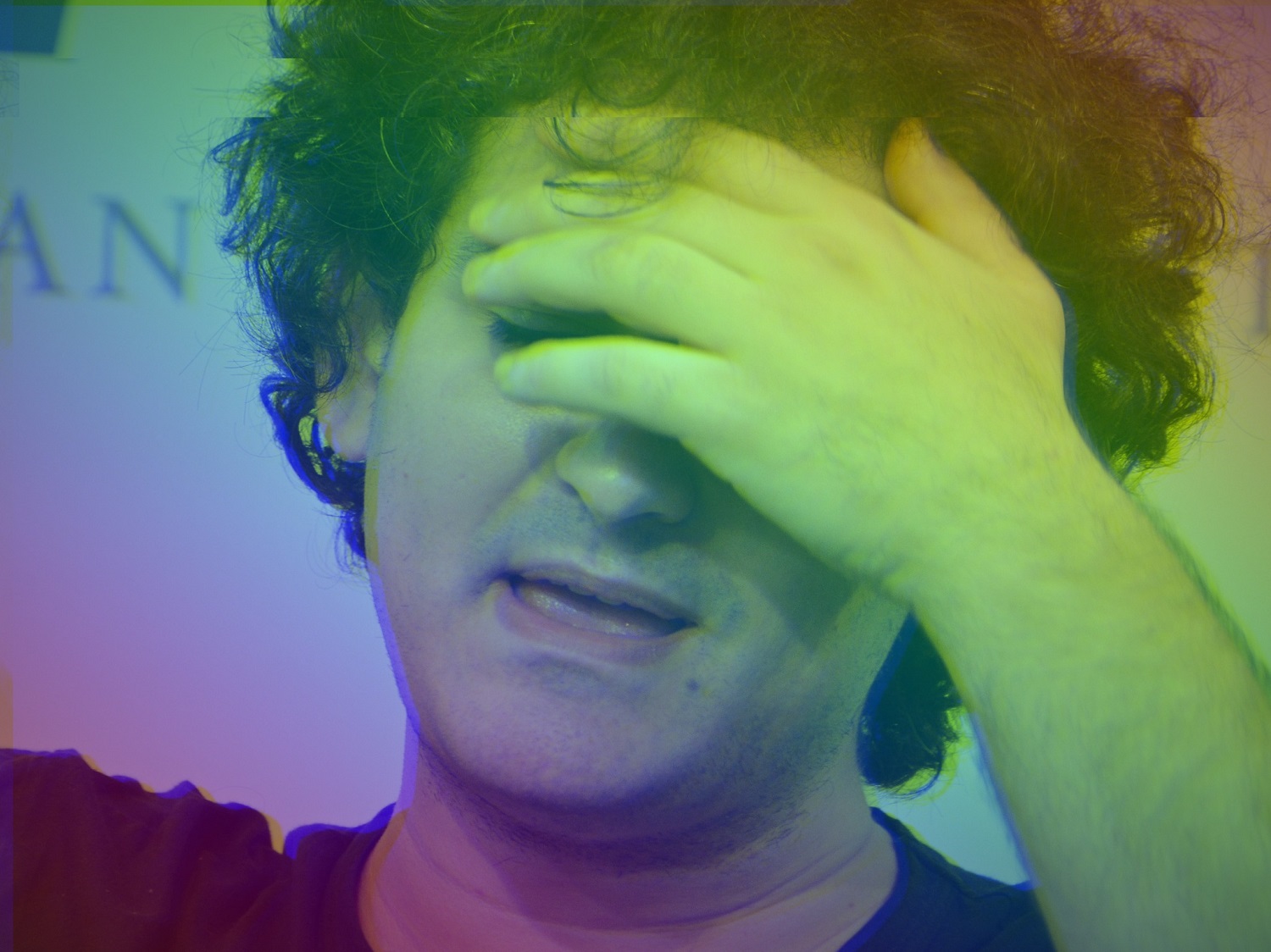

The US Asset Futures Trading Commission (CFTC) is suing Sam Bankman-Fried, FTX exchange and fund Alameda Research for allegedly colluding to commit fraud.

After the US Treasury Department and the Securities and Exchange Commission (SEC) – two entities that concurrently launched fraud fees towards former FTX CEO Sam Bankman-Fried on December 13 – it was the flip of Asset Futures Trading Commission (CFTC).) filed a lawsuit not only towards Mr. Sam Bankman-Fried, but also towards two firms he founded, the FTX exchange and the Alameda Research investment fund.

The lawsuit was filed in Southern District Court in New York, which will also hear allegations from the Treasury Department and the SEC.

TRADING IN COMMODITY FUTURES

COMMISSION,

plaintiff,

v.

SAMUEL BANKMAN FRIED, TRADING FTX

LTD D/B/A https://t.co/nFry343Bq0AND ALAMEDA

Analysis LLC, https://t.co/wYEzfuh3Hd—db (@tier10k) December 13, 2022

In the lawsuit, the CFTC representative alleges that FTX and Alameda Research colluded to use purchaser deposits for improper functions, violating the Terms of Use engaged with consumers. In addition, FTX has also established Alameda-precise mechanisms to have trading rewards on the exchange this kind of as quicker buy execution occasions and no liquidation.

Similar to the Treasury Department and SEC findings, the CFTC also accused FTX leaders of lending revenue to Alameda and then borrowing that revenue from Alameda as persons to invest in authentic estate and personalized curiosity.

Previously, the former FTX CEO suggested the CFTC to create a regulatory framework for the cryptocurrency sector, which contained a lot of provisions unfavorable for the DeFi section. He also lobbied the CFTC to adopt a threat management mechanism created by FTX, promising it to be safe and superior, but not disclosing the reality that there was an exception for Alameda.

Mr. Sam Bankman-Fried has now been arrested by Bahamian authorities at the request of the US Department of Justice, leaving open the chance of extradition to the US to stand trial.

Synthetic currency68

Maybe you are interested: