Recently, these of you who use the Polygon network have been encountering some challenges with the pace of transactions. Often, there will be a scenario wherever it is vital to enhance the pace, pump much more fuel in purchase to have priority for processing. However, what is the primary motive for this phenomenon, we uncover the response in the write-up under !!!

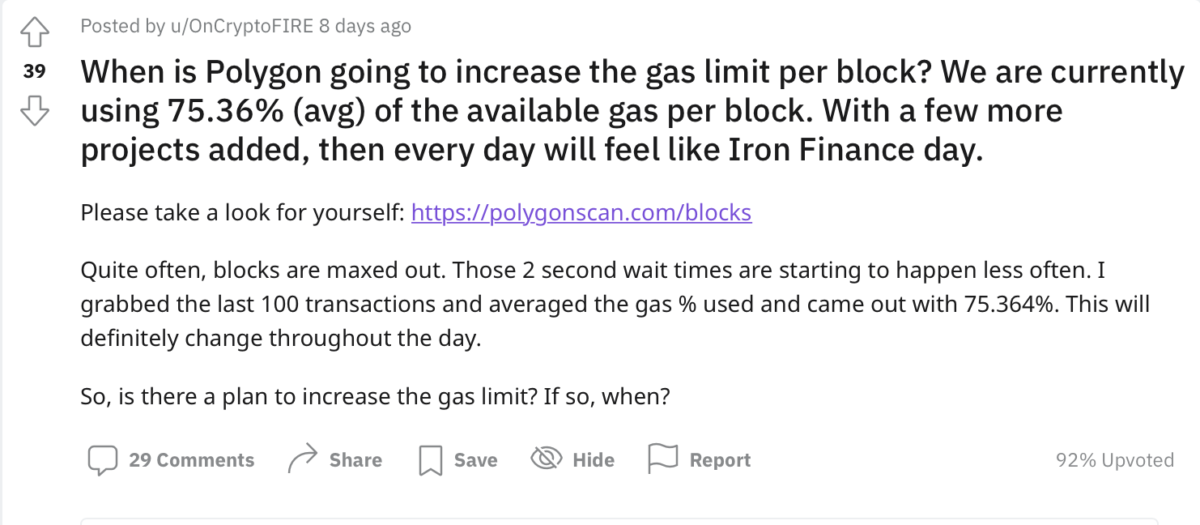

About a week in the past, on the social network Reddit, the rumor spread that the volume of fuel utilized (Gas Used) in each and every block of Matic represented about 70% of the Gas Limit degree.

Note: Each block will have a parameter named Gas Limit (the restrict on fuel charges utilized in a block), miners will only choose transactions in the block for processing, till the complete fuel utilized in the block reaches this restrict.

Also in the submit over, this reddit consumer recommended expanding the block restrict for Polygon. This will partly support miners to have much more room in a block, consequently choosing much more transactions.

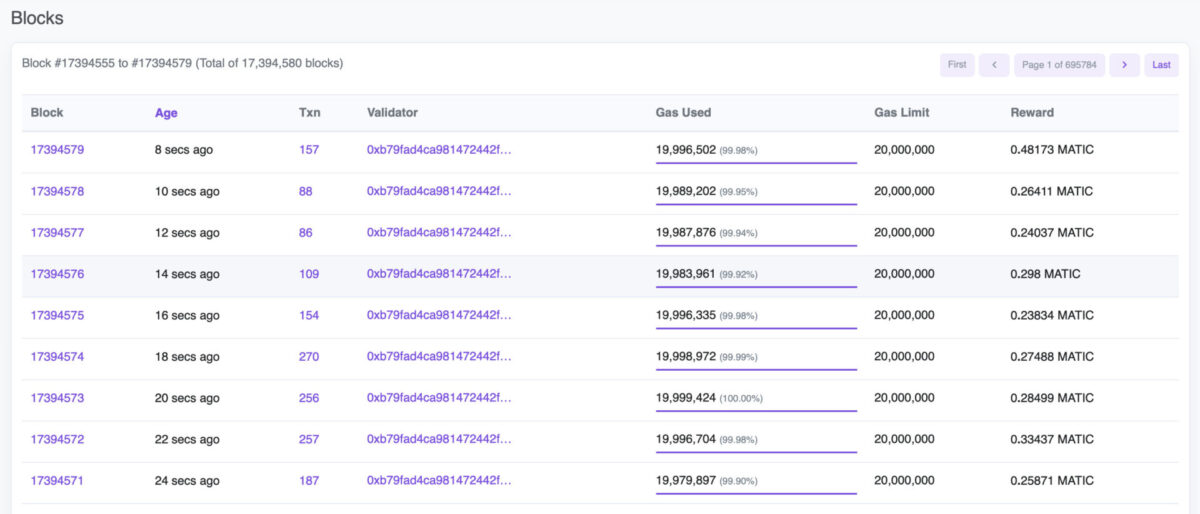

This suggestion would seem realistic, as at the time of creating, the fuel degree utilized regularly reaches 99% of the fuel restrict.

Polygon congestion is also reflected in the user’s inability to set the fuel min (the lowest charge in a transaction) all-around 2000gwei.

Nice do the job guys, now Polygon / Matic is much more unusable than Ethereum… 😿 pic.twitter.com/BYbcusxN4C

– Luke Youngblood (@LukeYoungblood) July 28, 2021

“Great, now Polygon is worse than Ethereum” – an angry account

Even if I know 2000 gwei on matic is not a massive deal and pricey, However, the congestion and steadily growing fuel amounts are a discomfort for these with higher hopes for the matic.

So wherever specifically is the motive?

The to start with motive, undoubtedly come from the polygonal network has robust phases of development. Many Ethereum-derived applications have presently begun their migration tactic to Polygon. Furthermore, the landing of the NFT wave also unintentionally elevated the volume of transactions to be processed.

The 2nd motive, a minor much more “conspiracy theory”, that is all Miners actively use bots to spam transactions, consequently expanding the fuel degree. As this fuel will ultimately be collected by miners, it is feasible that mining pools have teamed up to gather greater commissions from end users.

How to fix this trouble?

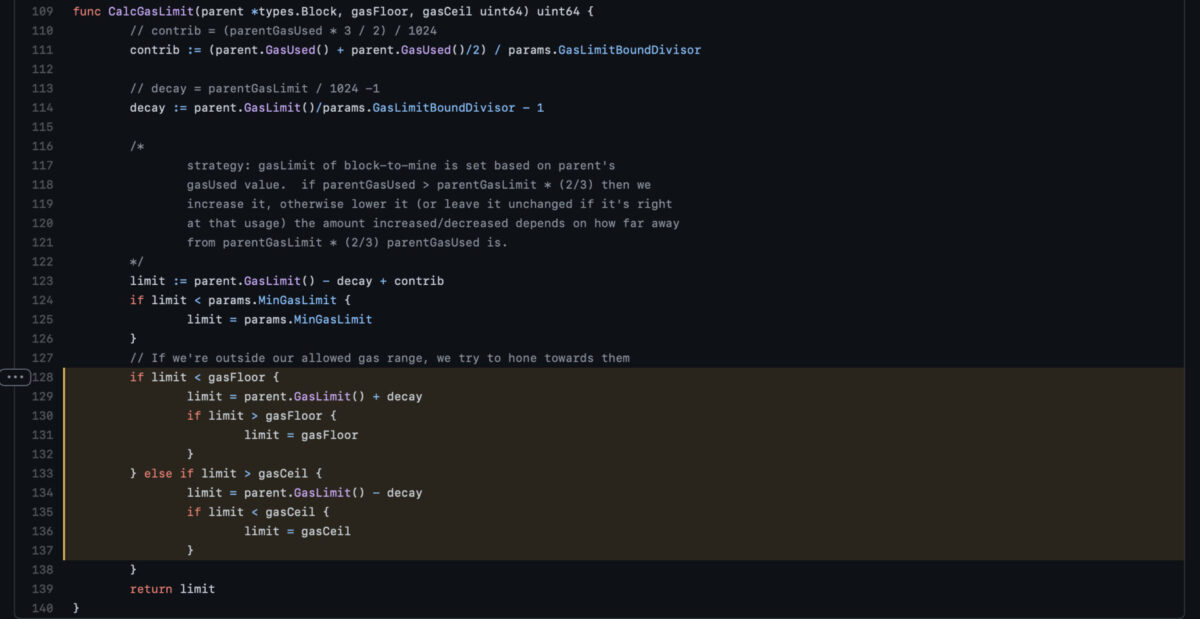

First, The Polygon local community proposed to enhance the Gas Limit dependent on the volume of fuel utilized in the prior block. If the prior block has a fuel utilized over two/three Gas Limit, this restrict will be elevated in the up coming block.

However, As previously outlined, if miners collude with each and every other to spam transactions and enhance fuel, the fuel charges on Polygon will encounter the identical trouble as Ethereum: floating without the need of figuring out a prevent.

A handful of much more strategies how to employ EIP-1559 for Polygon itself. With this model, the fuel from the transaction block will be burned. Therefore, miners will no longer have motive to perform transaction spam in purchase to increase fuel tariffs. Discover the EIP-1559 proposal, you can observe in the write-up under:

See much more: Is EIP-1559 the greatest option to all Ethereum issues?

So, we a short while ago looked at some info about Polygon’s stagnation and fuel tariffs. If you are interested and want to examine this ecosystem, you can examine it with the Coinlive administrators in the local community. Coinlive Chats.

Note: The over write-up is for informational functions only and need to not be viewed as investment guidance!

Synthetic currency 68

Maybe you are interested: