While the cryptocurrency industry has been grim in excess of the final number of days of the 12 months, Twitter’s front has been filled with heated exchanges involving former FTX CEO Sam Bankman-Fried. This time, the two co-founders of Three Arrows Capital continued to declare that they have been “killed” by FTX.

Three capital arrows blame FTX and Alameda

Three Arrows Capital (3AC) co-founder Kyle Davies has not too long ago begun appearing and re-getting into mass media.

With this return, Kyle Davies plays the “victim,” blaming Sam Bankman-Fried (SBF) and the FTX exchange for the root bring about of 3AC’s downfall, not LUNA-UST.

This “message” was more highlighted by Kyle Davies in a podcast with hedge fund manager Hugh Hendry. In individual, the co-founder of 3AC explained that this investment fund is nonetheless standing just after the collapse of LUNA-UST, just after the sharp drop in the industry value, but “down” due to the liquidation of positions by the by FTX.

“We have been fine then. You know, we invested $200 million and produced a revenue of $600 million. But then that investment went to zero. But it did not seriously matter simply because the 3AC fund managed additional than $four billion.”

According to Kyle Davies, the circumstances of the 3AC fund are fine regardless of the credit score crunch and token investments have been hit by the sharp industry decline. Even when the lending platforms get started to repay the loans, the 3AC fund nonetheless has ample income to repay all individuals loans.

“For me, 3AC’s scenario was fine at the time. We have been injured, but we have been fine.”

But the blow that pushed the fund to “expiration” was the place liquidated by the exchange FTX.

“For us, the most recent ‘killer’ is the ‘hunt’ for FTX’s place. They see and share all of our areas with every single other. Here are the FTX exchange, the Alameda Research fund and the supporting trading businesses.

I was speaking to 1 of their insiders and this man boasted that he understands the liquidation value of our place incredibly nicely. He was absolutely sure his submit had been attacked and we have been out of action.”

Thus, the co-founder of Three Arrows Capital explained that the fund is entirely in secure issue and can climate the LUNA-UST shock, but sadly fell into the crosshairs of the “killer” FTX. Kyle Davies also accused FTX and Alameda of sharing consumer transaction facts with every single other, as the crypto neighborhood has lengthy speculated.

On Nov. sixteen, Kyle Davies publicly confirmed for the to start with time that FTX and Alameda Research had “taken down” the business on the air. CNBC – induced a wave of mixed public viewpoint at the time.

Some folks feel that 3AC is a “poor victim” who cannot escape the murderous hands of FTX. However, most in the neighborhood feel that Kyle Davies is attempting to “whitewash” and get benefit of the FTX crash to “normalize” the investment misconduct of the Three Arrows Capital fund.

SBF insists he is “innocent”

3AC’s other co-founder, Zhu Su, also not too long ago stepped up his Twitter exercise. Zhu Su frequently posted tweets unintentionally or intentionally alluding to SBF and FTX, equivalent to Kyle Davies’ allegations.

It would seem Sam could not stand individuals “rumors in and out” so he immediately tweeted to Zhu Su that:

I produced a good deal of significant blunders this 12 months.

But this was not 1 of them. There’s no proof why it did not transpire. Please please emphasis on your house. https://t.co/tlcQu9zFdf

— SBF (@SBF_FTX) December 9, 2022

“I produced a good deal of major blunders this 12 months.

But the story of 3AC is not 1 of them. No 1 can locate any proof, simply because which is not what took place. Friend, please emphasis on your actual challenge.

But Zhu Su was not to be outdone, replying that:

How would you know? Thought you have been claiming you have been unaware of what is going on in Alameda?

All correct, we can allow the DoJ make a decision https://t.co/vbALBqjOMF

— Zhu Su (@zhusu) December 9, 2022

“How dare you say that, Sam?

You explained you knew practically nothing about Alameda’s enterprise? So irrespective of whether Alameda “hunts” 3AC or not, cannot say?

Well then, allow the United States Department of Justice (DoJ) make a decision!”

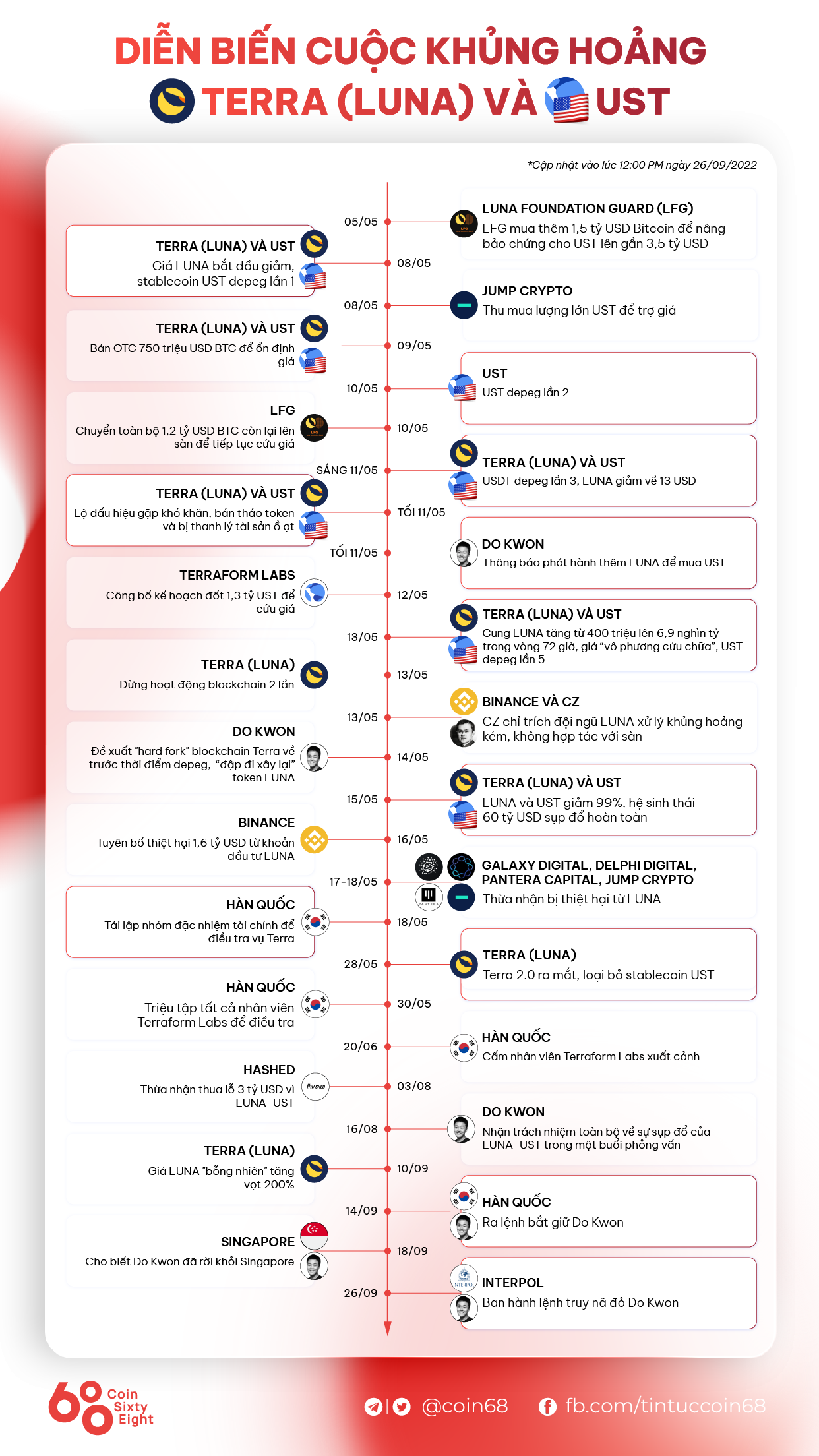

In this debate, Zhu Su has the upper hand. Due to the reality that US officials started investigating Sam for “staging” the collapse of LUNA-UST.

Of program, neither the former FTX CEO nor the Three Arrows Capital side are “innocent”. But on the media front the two sides are attempting to blame every single other.

Just yesterday, SBF and CZ continued to “discuss” the previous, building the Twitter neighborhood vibrate in the final days of the 12 months.

Synthetic currency68

Maybe you are interested: