The Curve Finance founder has not long ago manufactured notable strides all-around CRV, crvUSD stablecoin, and USDT on Silo Finance’s product or service platform.

The founder of Curve Finance has “switched debt” from Aave to Silo Finance

The founder of Curve Finance has “switched debt” from Aave to Silo Finance

After a series of loan positions with CRV as collateral and a series of rumored OTC income specials, Curve Finance founder Michael Egorov has not long ago manufactured new moves with his debt positions.

After the cost of CRV recovered strongly in the final 48 hrs thanks to the return of various “whale” staking, as reported by Coinlive, Mr. Egorov deposited a big sum of CRV on the Silo Finance lending protocol.

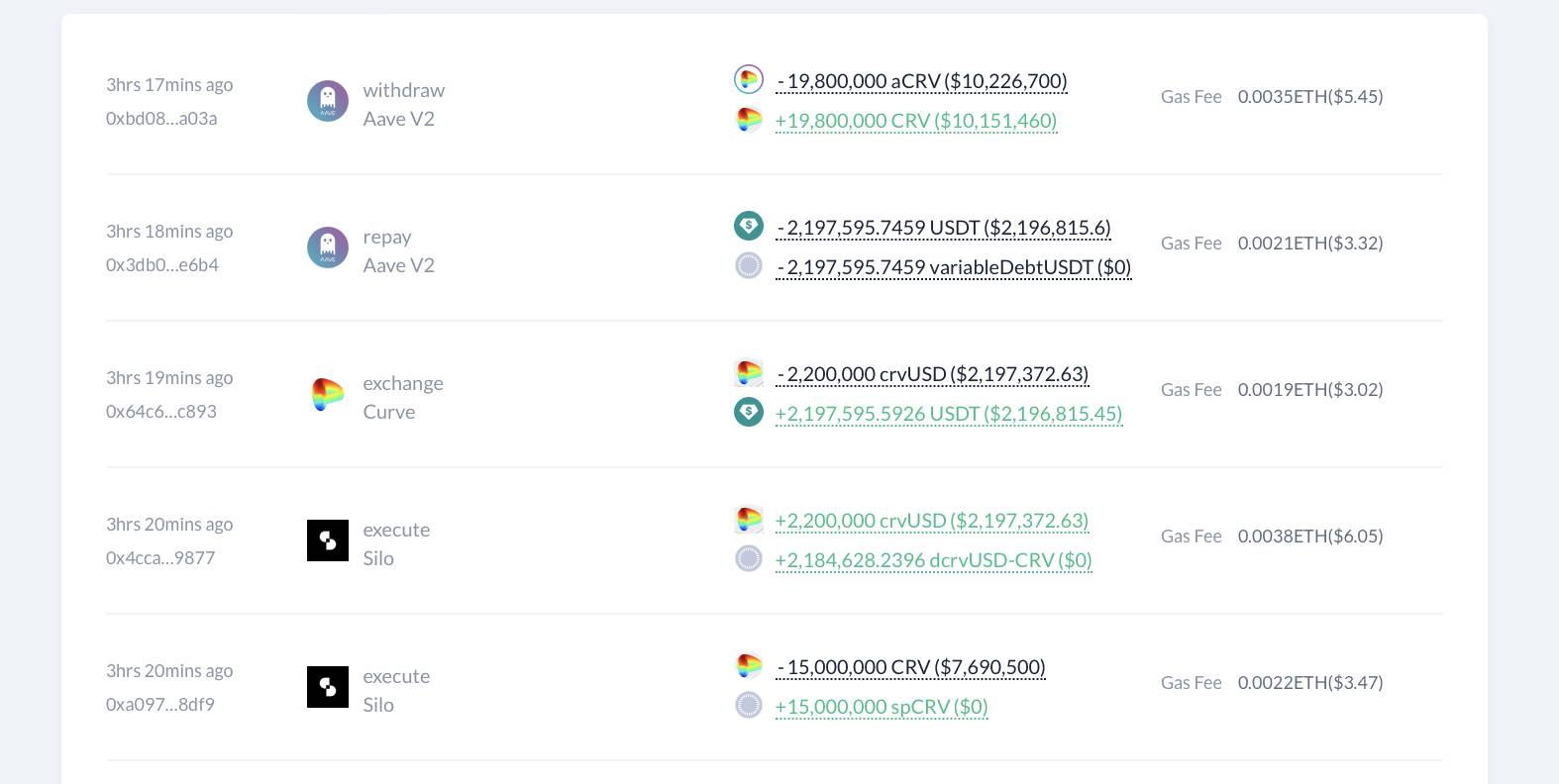

After the cost of $CRV enhanced, Michael Egorov deposited a complete of 23.26 million $CRV ($twelve.three million) in #Silo and borrowed three.75 million $crvUSD in the final one hour.

So trade three.75 million $crvUSD For $USDT and repaid the debt #Aave.https://t.co/bedCXcs8Rj pic.twitter.com/1j5DBStJVv

—Lookonchain (@lookonchain) September 25, 2023

Specifically, the founder of Curve Finance pledged 23.26 million CRV to borrow three.75 million CRVUSD utilizing the wallet deal with “0x425…6c5a.” This wallet then transferred the aforementioned three.75 million crvUSD to the wallet deal with “0x7a1…5428” – the deal with that at this time has big loan positions of Michael Egorov.

After acquiring the over stablecoins, Michael exchanged crvUSD for USDT and repaid the loans on Aave.

Immediately afterwards, 22.five million CRV had been withdrawn to Aave and from right here 15 million CRV had been deposited as collateral on the Silo platform.

This cycle nonetheless continues with these ways:

- Deposit CRV in Silo to home loan and borrow crvUSD

- Exchange crvUSD to USDT to repay loan on Aave

- Collect the CRV promise on Aave to transfer it to storage in Silo.

Therefore, it is simple to see that Michael Egorov’s target is to “move debt” from Aave to Silo, a lending platform that supports collateral this kind of as CRV and crvUSD loans. The cause for this move could be to decrease the unfavorable influence on Michael Egorov’s place from the governance and voting phases of Aave.

At the exact same time, this founder can also assistance a small much more volume and trading action for the “homemade stablecoin” crvUSD.

Michael Egorov’s CRV-backed loan positions have develop into the emphasis of criticism from the local community. Credit units have also acquired significantly criticism for setting debt ceilings that are also higher and for not owning the required chance assessments for very volatile asset kinds.

Coinlive compiled

Join the discussion on the hottest difficulties in the DeFi marketplace in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!