After 5 weeks on the run, the two co-founders of Three Arrows Capital (3AC) appeared to be telling the entire reality immediately after the collapse and the existing circumstance of the fund.

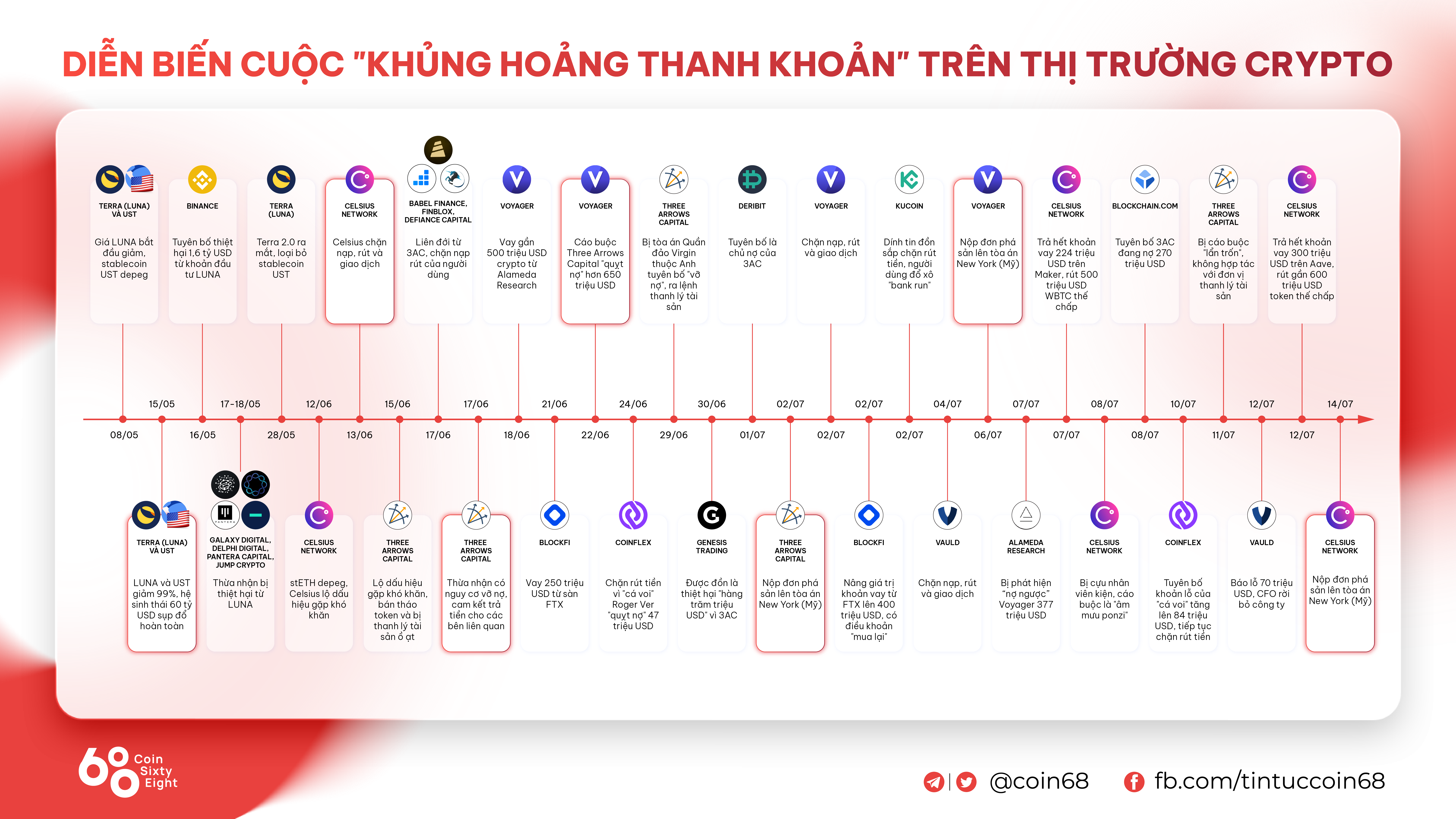

Like it Coinlive it has constantly up to date, considering that the liquidity crisis started to erupt on a huge scale triggered “Chain effect” stETH – Alameda – CelsiusOne of the most well-known investment money in the cryptocurrency marketplace, Three Arrows Capital (3AC), has been severely impacted. The liquidity dilemma is like the 2nd “pre-emptive blow” that 3AC has to endure, simply because the fund suffered hefty losses due to the collapse of LUNA-UST earlier.

On the other hand, due to the extreme use of leverage to invest and participate in the derivatives marketplace, when the marketplace fell, 3AC was constantly liquidated massively by lenders. However, it occurred as well speedily and 3AC progressively misplaced its repayment skill, foremost to a variety of lending platforms that have been both on the verge of bankruptcy or suffered significant losses.

Since then the two founders of 3AC, Zhu Su and Kyle Davis, have “disappeared”, there are numerous reviews that the two are not cooperating with the liquidator of the estate. It was not until finally July twelve that Zhu Su reappeared, but only by way of a number of lines of notices on his private web page to “unfairly claim” the over allegations immediately after filing for bankruptcy in a New York court.

As the situations are pretty difficult and numerous series of occasions come about for the duration of the 3AC incident, please study the a lot more comprehensive reference by way of the write-up and video beneath to get the highest overview:

Now, on July 22, the two Zhu Su and Kyle Davis have abruptly “revealed” and shared straight with Bloomberg the complete reality about the 3AC story.

Su Zhu and Kyle Davies, Disgraced Founders of Three Arrows Capital, Say Easy Credit Made Bad Bets Worse https://t.co/D8Rwkx9K2u

– Bloomberg Asia (@BloombergAsia) July 22, 2022

Zhu Su admitted that the crash brought about widespread “pain” in the cryptocurrency marketplace. He claimed that 3AC had suffered hefty losses and denied allegations of withdrawing income from 3AC just before anything went out of manage.

“People can contact us stupid or delusional. I admit. But you know, they would say I’ve in fact manufactured a lot more income back in the final 3AC time period. It is not genuine.”

Meanwhile, co-founder Kyle Davis shared:

“The entire factor is deplorable. I know a good deal of men and women have misplaced a good deal of income. “

3AC’s creditors lately filed with court in the British Virgin Islands to report that 3AC owes them a lot more than $ three.six billion in unsecured debt. Court information display that this variety is anticipated to raise drastically. To date, the liquidators have acquired manage of new assets for just $ forty million.

Discussing marketplace self-confidence, Zhu Su stated that for the duration of the crisis time period, 3AC nevertheless believed that the complete marketplace would develop yet again, but the outcomes have been towards the fund’s expectations.

“We were * told to ourselves * that the market would recover soon, but unfortunately it didn’t.”

Mr. Kyle Davis also additional:

“We have complete self-confidence in the marketplace. We all had, virtually all of our possessions. In the uptrend, we have finished the finest. And then in the tricky moments, we misplaced a lot more “.

Regarding the alleged act of borrowing income to purchase a yacht well worth $ 50 million from the creditors’ allegations, Zhu Su straight claimed that it was a defamation of the honor of organizations focusing on him personally. Zhu Su dismissed the argument that he favored a lavish life style as a substitute of cycling to and from operate every single day as his family members only has two properties in Singapore.

However, the two co-founders stated they will move to Dubai. Zhu Su’s principal hope is to finish the liquidation procedure in a calm and orderly method.

“There are so many crazy people in the crypto space using death threats against Kyle and me, so moving to Dubai temporarily will allow us to be physically safe and keep our lives safe. Give yourself a track record to avoid being tracked down. “.

Furthermore, Zhu Su exposed that considering that the two had planned to move their company to Dubai early, they will have to move right here quickly to assess regardless of whether or not they can tap into new probable. In the finish, she stated that anything is going extremely nicely and that 3AC’s principal purpose is to aid with the creditors’ recovery procedure.

Synthetic currency 68

Maybe you are interested: