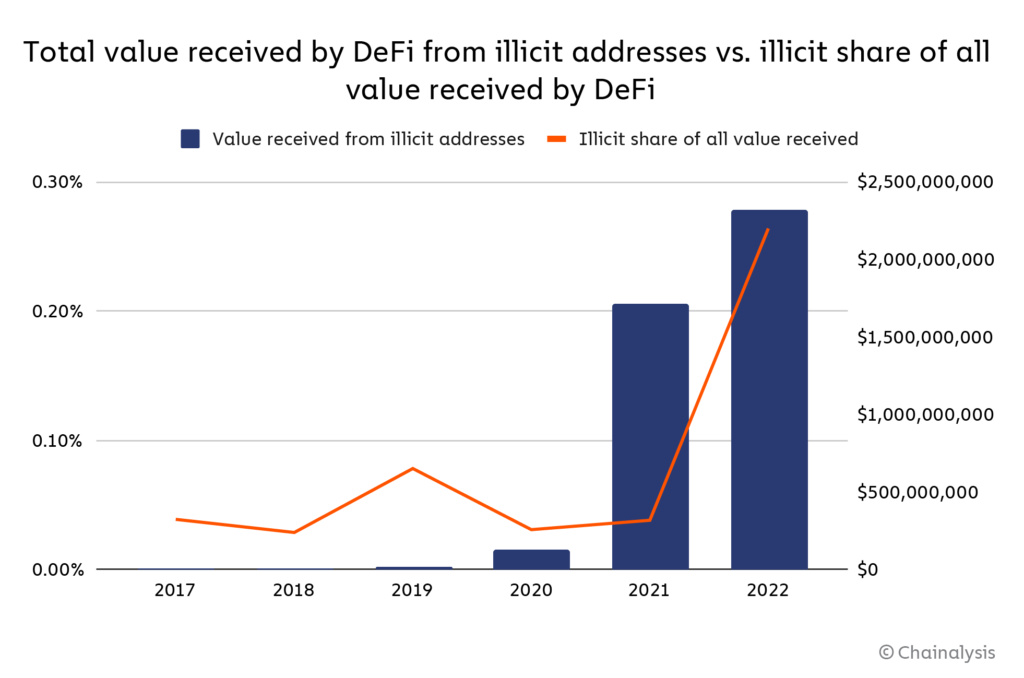

Since the DeFi wave broke out in the summer season of 2020, unlawful pursuits have also steadily improved in relation to this business.

After pouring in $ 170 million, bringing its complete valuation to $ eight.six billion, analytics company Chainalysis launched a new report focusing on unlawful pursuits taking place on the blockchain, noting that DeFi platforms have been the most widespread target that hackers have tended to assault as properly as carry out dollars laundering above the previous couple of many years.

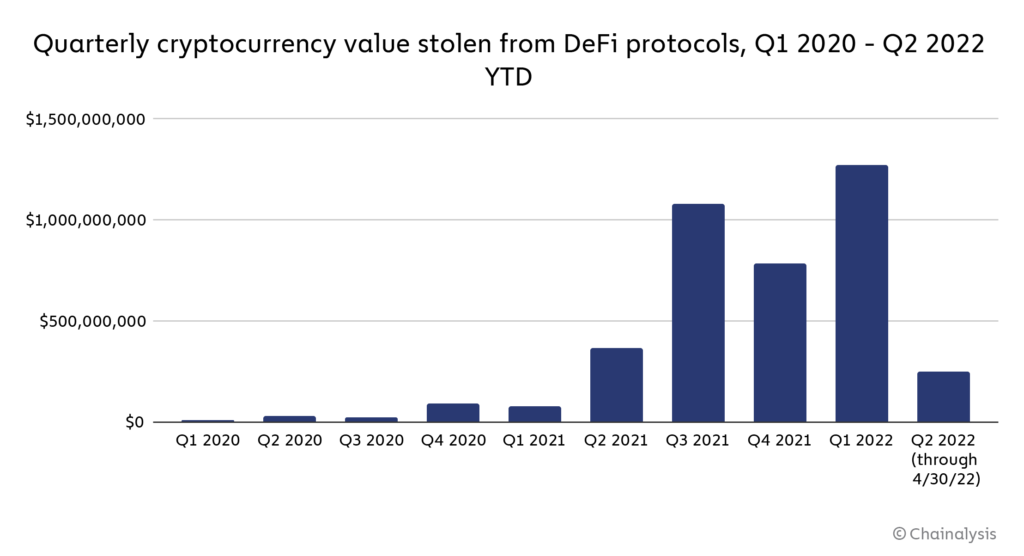

The worth stolen from DeFi has been on a quick upward trend given that the starting of 2021, reaching an all-time large in the initial quarter of 2022. A complete of $ one.seven billion in cryptocurrencies was stolen by the authors in 2022, such as the 97% came from DeFi platforms, primarily from two surprising hacks, Wormhole ($ 325 million) and Bridge, which linked Ronin ($ 622 million).

– See far more: The five most really serious attacks in the historical past of the cryptocurrency industry: the unhappy record of the Ronin Network

In truth, during 2021, DeFi has come to be the most coveted target by hackers on the lookout to steal cryptocurrency, outstripping centralized exchanges and quite a few far more in the area.

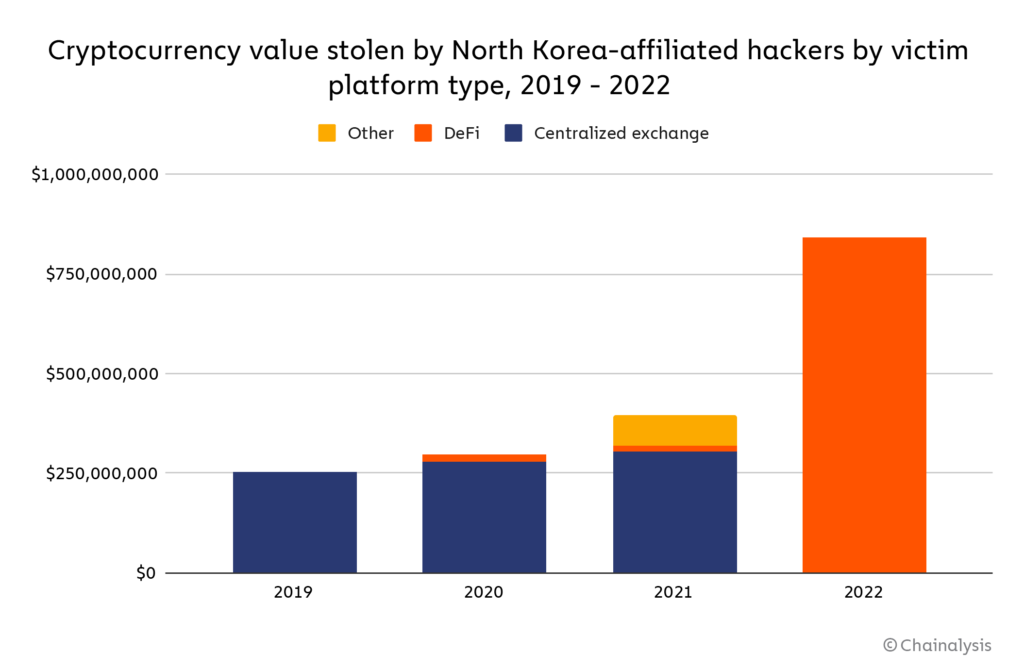

Furthermore, the report also exhibits that by 2022, most of the stolen money, amounting to far more than $ 840 million, went to hackers with near ties to North Korea.

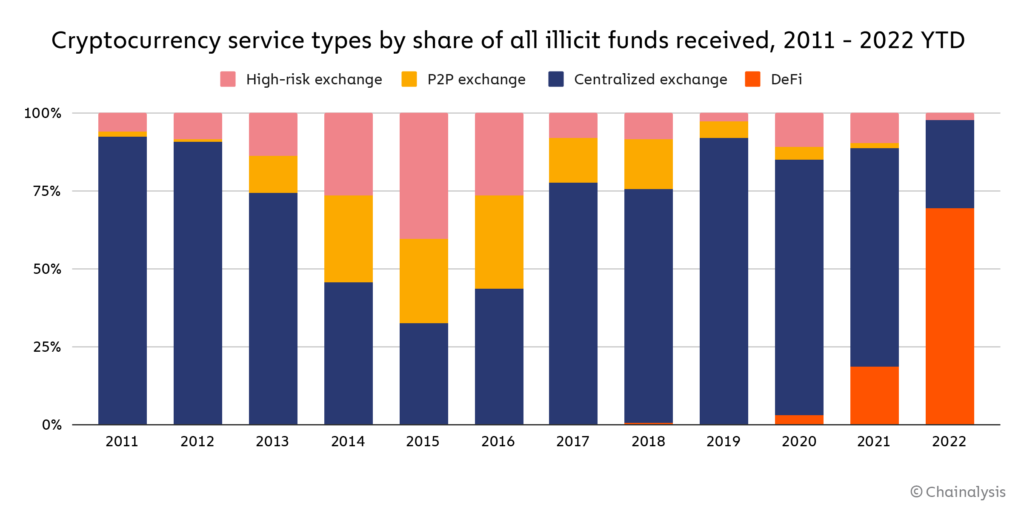

In addition to hacking, DeFi dollars laundering has also grown steadily above the many years, with quite a few DeFi protocols accounting for 69% of the crypto worth concerned in the crime in contrast to 19% in 2021..

One explanation is that DeFi platforms permit customers to exchange 1 token for a different, which can make monitoring their movements far more complex. However, contrary to centralized exchanges, most DeFi protocols provide this capability devoid of taking KYC information and facts from customers, producing them far more appealing to criminals.

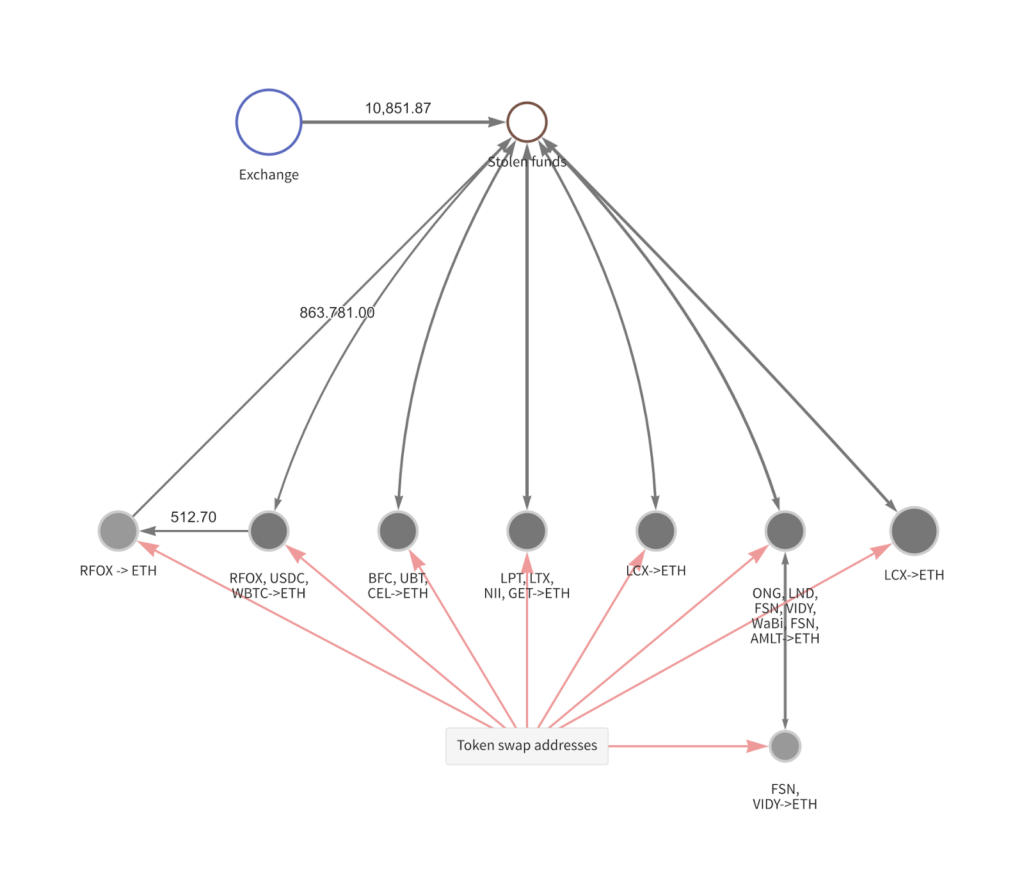

DeFi-based mostly dollars laundering is a different spot in which North Korean hackers are leaders. We noticed an illustration of this in 2021, when North Korean hacking group Lazarus Group (the mastermind behind Ronin’s hacking) made use of numerous DeFi protocols to launder dollars just after stealing above $ 91 million really worth of coins from a centralized exchange.

Initially, Lazarus stole numerous ERC-twenty tokens, then made use of numerous DeFi platforms to trade these tokens for Ethereum. Then they send that Ethereum to a mixer and trade with DeFi when once again, this time for Bitcoin, in advance of transferring that Bitcoin to some centralized exchange for settlement and money. . This is just 1 illustration of how hackers can abuse the DeFi protocol to launder dollars.

Synthetic currency 68

Maybe you are interested: