The International Monetary Fund (IMF) says the “crypto winter” is unlikely to have also considerably effect on worldwide monetary stability.

In its “New World Economic Outlook Update” launched on July 26, the IMF acknowledged that the cryptocurrency marketplace has skilled a “stressful” promote-off. However, this does not seem to have sufficient traction to injury the worldwide monetary procedure.

After a timid recovery in 2021, the financial outlook has turned gloomy and uncertain, with the probability of a worldwide economic downturn. The final one particular #WEO explains the motive for the downgrade to our development projections. https://t.co/ldMsaieJUU pic.twitter.com/PbpvScahsN

– IMF (@IMFNews) July 26, 2022

As traders encounter uncertainty about Russia’s war in Ukraine and provide chain difficulties amid other macroeconomic variables, they are shifting their riskier assets to safer asset lessons. Bitcoin and altcoin are deemed risky along with stocks.

The IMF stated:

“Cryptocurrencies suffered a huge sell-off that resulted in huge losses in dangerous investment vehicles and caused the failure of many algorithmic stablecoins and hedge funds, but it poured into the system. So far, broader funding has been limited.”

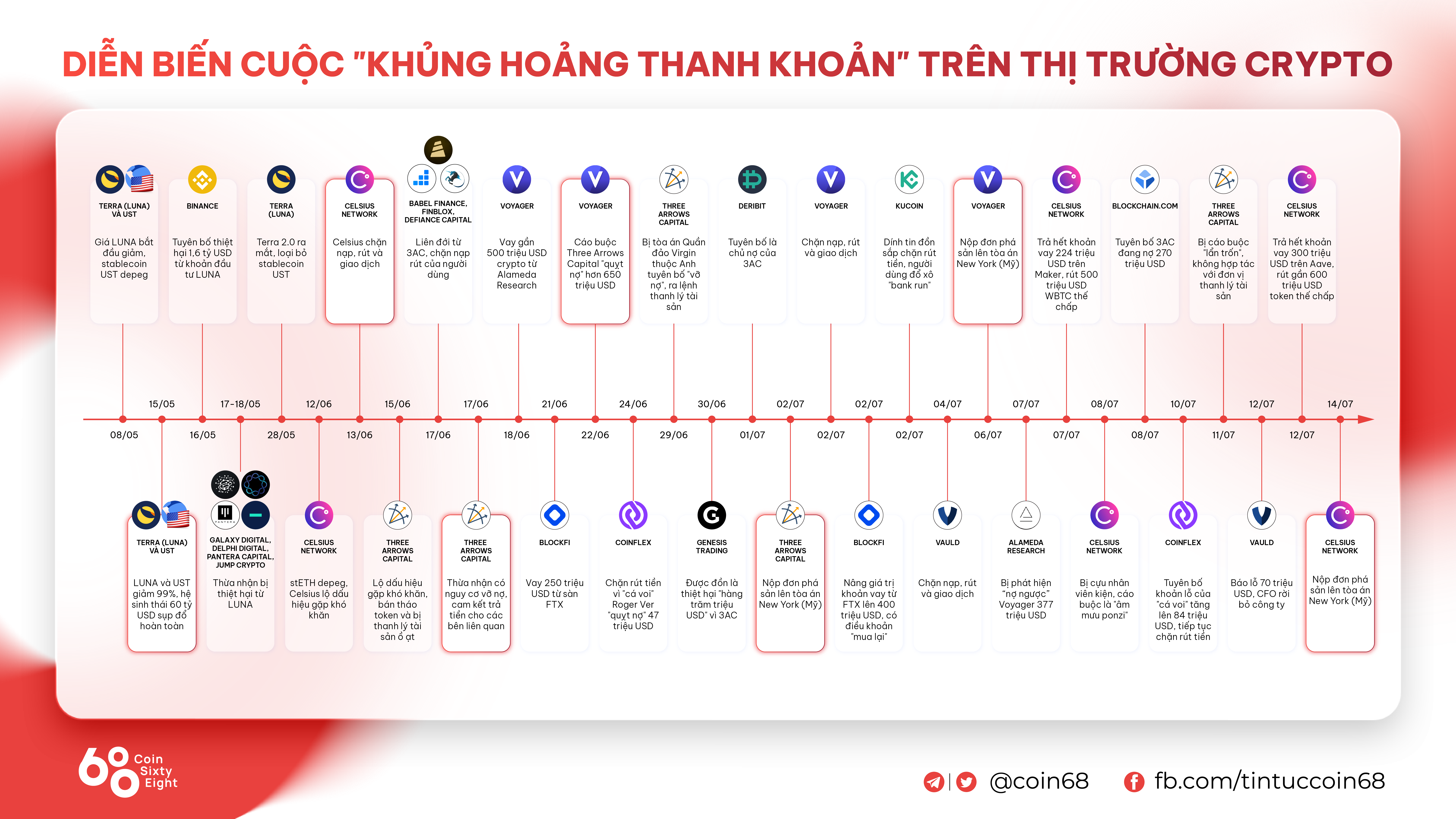

The company addressed the demise of the Terra blockchain with a harsh commentary on the UST platform’s algorithmic stablecoin. Also emphasize on the resulting liquidity crisis “Chain effect” stETH – Alameda – Celsiusleading to the Three Arrows Capital (3AC) investment fund and lending platforms this kind of as Celsius Network and Voyager to fail, resulting in a lot of other crypto providers this kind of as Babel Finance, CoinFLEX Exchange, BlockFi, Vauld, Zipmex, and CoinLoan getting also impacted . slander”.

Additionally, in a June 2022 report, the European Financial System Risk Committee stated the expanding recognition of cryptocurrencies could indicate threats in monetary markets emerge swiftly and all of a sudden. The IMF itself has referred to as for better regulation of the sector and has repeatedly warned El Salvador to abandon the use of Bitcoin as fiat currency.

But requirements regulators all around the planet are also doing work to figure out specifically how banking institutions must start out acquiring concerned in the cryptocurrency marketplace. The incumbent Basel Committee on Banking Supervision has proposed a restrict on holdings in Bitcoin, which, collectively with the excessive capital necessities, will restrict the lending capability of banking institutions with publicity to cryptocurrency.

Synthetic currency 68

Maybe you are interested: