The Indian central financial institution (RBI) has the moment once more raised its company stance on the damaging effect cryptocurrencies will have on the nation.

Central Bank of India (RBI) Governor Shaktikanta Das stated for the duration of a press conference on February 9 that cryptocurrencies pose a severe risk to the country’s macroeconomic and fiscal stability. Coincidentally, the statement was manufactured at the very same time as Bitcoin fluctuated considerably due to inflation information and facts in the United States. Therefore, there is a substantial probability that it will place additional stress on BTC’s recovery momentum.

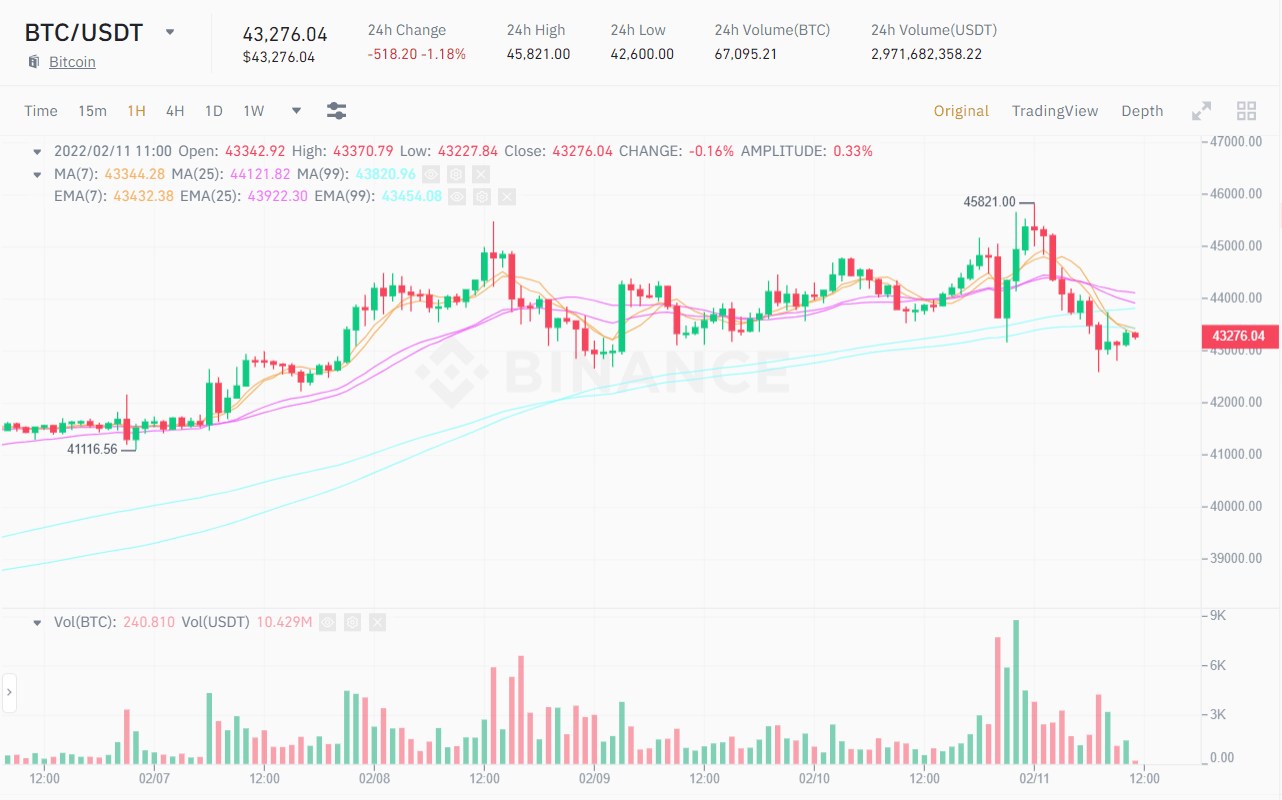

As of press time, BTC is trading at all around $ 43,276, down one.18% above the previous 24 hrs.

Returning to the principal subject, Shaktikanta Das also stated that any cryptocurrency not supported by a financial institution falls underneath the definition of “private cryptocurrency”, a notion that has sparked considerably controversy soon after the official government proposed the to start with CBDC and cryptocurrency building law. in November 2021.

“I don’t care if they are private cryptocurrencies or whatever you want to call them, they are all dangerous for the Indian financial system.”

The governor of the RBI went on to make clear that cryptocurrencies with qualities very similar to fiat currencies will weaken the purpose of the RBI. As a consequence, he has taken techniques to warn traders of the dangers of investing in cryptocurrencies. Special mention need to be manufactured of the 17th century “Dutch tulip” marketplace bubble.

“Cryptocurrency investors should remember that they bet a lot on the market because cryptocurrencies do not have fundamental intrinsic value.”

The leader stressed that the RBI’s place is extremely clear on cryptocurrencies and will not alter. In December final 12 months, the RBI urged the Indian government to comply with in China’s footsteps and absolutely ban cryptocurrencies. However, the government is nevertheless consulting with a variety of stakeholders to do the job out a additional proper policy.

Meanwhile, RBI has begun to participate in central financial institution digital currency (CBDC) investigation. Indian Finance Minister Nirmala Sitharaman announced final week that India will aim to launch CBDC as quickly as this 12 months and impose a thirty% tax on cryptocurrencies.

Synthetic currency 68

Maybe you are interested: