Ethereum staking has been a extremely sought-right after trend given that its introduction on Beacon Chain and temporarily “dominates” the present cryptocurrency industry.

The quantity of ETH deposited in decentralized liquid staking goods has enhanced steadily more than the previous week. Second Dune examination, there are sixteen.47 million ETH staked in the Beacon contract, really worth about $26 billion. In specific, this token are not able to be withdrawn till The approaching Shanghai tricky fork in March.

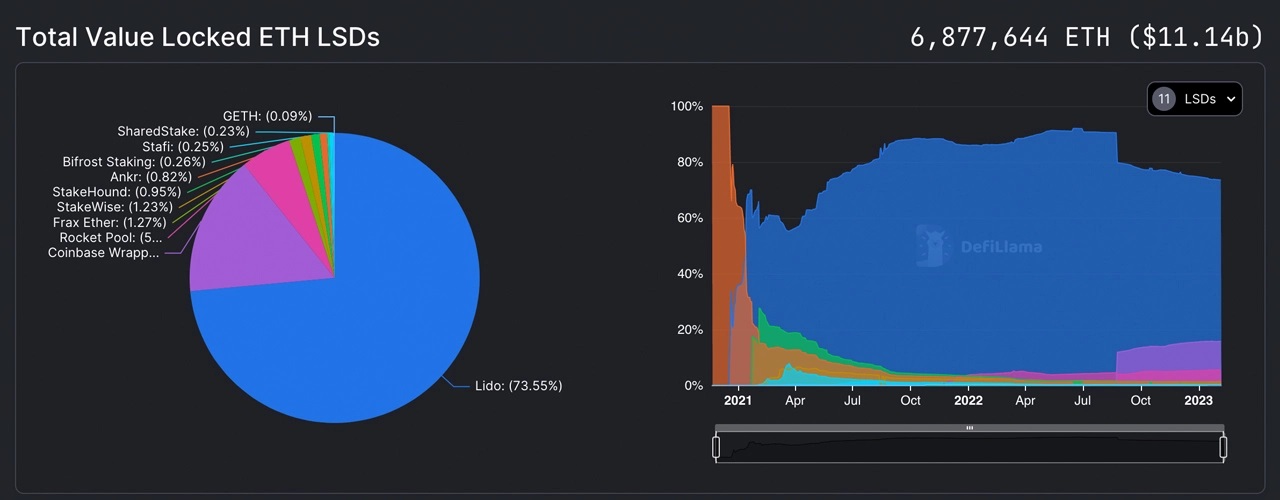

A sizeable portion of Ethereum locked down is on liquid staking protocols. As of Feb. seven, the leading eleven liquid staking protocols hold $eleven billion in TVL. Lido, Coinbase, and Rocket Pool have all noticed four-ten% development more than the previous month.

Notably, the biggest liquid staking answer in the cryptocurrency field at this time Lido Finance contributes more than 73% of the complete worth locked (TVL) with five.05 million Ethereum stakings and accounts for all around thirty% of the industry share.

📈 Lido Analytics: thirty January – 06 February 2023

TLDR:

– Lido surpassed five.05 million ETH staked on Beacon Chain.

– February incentives of LDO one.95 million are lively.

– New Ethereum lending pools are exploding, incl @MakerDAO steCRV: 33,599 (seven days: +636%) e @AaveAave V3 wstETH: 29,480 (seven days: +140%). pic.twitter.com/w6CJXIrXcc— Lido (@LidoFinance) February 6, 2023

More than 15% of the staking pie is “occupied” by Coinbase, which is genuine pooling level of all around one.08 million ETH locked. Rocket Pool’s TVL enhanced by ten.71% more than the thirty-day time period, and Frax Ether’s TVL also enhanced by 76.73% more than the similar time period. Rocket Pool has around 387,016 ETH staked and 87,134 Ethereum belong to Frax Ether (one.27% industry share).

On the other hand, the fifth biggest liquid staking unit, Stakewise, has 84,481 ETH (really worth $136 million) on Feb. seven, or one.23%. The other 6 liquid staking platforms hold only a modest two.six% of the complete worth.

As reported by CoinliveLiquid staking refers to the protocols for end users who participate in staking to obtain rewards, but will not be barred from coins but will obtain a representative token (this kind of as stETH) at a ratio of one:one to carry on DeFi actions on other platforms.

The purpose Liquid Staking has been sizzling yet again in latest days is for the reason that the Shanghai Update, which lets individuals who have staked ETH in Ethereum two. contracts to withdraw money and staking rewards, is close to. As not too long ago as the evening of February seven, Ethereum developers confirmed efficiently examined the Shanghai tricky fork on the Zhejiang testnet. But we’re nevertheless waiting for far more time for this characteristic to operate properly on two testnets Sepholia and Goerli in advance of moving to the mainnet in mid-March.

Ethereum has opened ETH two. staking contract given that November 2020 to serve The Merge. At the time of creating, the quantity locked up right here is more than sixteen.47 million ETH, really worth $26 billion.

Responding to the argument “without Lido, Ethereum will lose its momentum,” one particular local community member stated that Lido Finance is the strongest wall to assist decentralize the Ethereum network. If Lido did not exist, the Ethereum pie would go to bigwigs Coinbase, Kraken, and Binance.

Without Lido

Coinbase, Kraken and Binance reportedly captured Ethereum.

Lido was and is the only reputable bulwark towards the centralization of Ethereum. All speak of decentralization would have been a joke. https://t.co/LZWb75fHq1 pic.twitter.com/Lptbx9CTCV

—frontalpha.eth | Lido (@frontalpha_eth) February 7, 2023

Synthetic currency68

Maybe you are interested: