Terra (LUNA) continues its extraordinary streak of footage, raising virtually forty% in worth in much less than three days to set a new worth record.

As reported by Coinlive, considering the fact that the announcement of a $ one billion Luna Foundation Guard fund to get Bitcoin as a reserve asset for the stablecoin TerraUSD (UST), Terra (LUNA) has had the power to rise and rebound in direction of new highs.

At close to 11pm on March 9, LUNA’s rate set a new ATH at $ 104.83, surpassing the prior record of $ 103/60 on December 27. Notably, the rate of LUNA was just lately corrected to USD 75.58 on March seven, which indicates that this altcoin has recovered up to 38% of its worth in much less than 72 hrs.

Part of LUNA’s determination stems from the common rebound of the complete cryptocurrency market place on March 9, soon after US President Joe Biden was reported to have issued an executive buy requiring government ministries to research the legal framework for cryptocurrencies.

In addition, there is a “special relationship” amongst LUNA and UST to retain the rate of the two currencies. Put simply just, UST is a stablecoin that holds close to USD one, but is governed by the creation / burning of LUNA. Specifically, if the rate of UST exceeds one USD (due to significant market place demand pushing the rate up), Terra will inspire customers in the ecosystem to burn up a specific volume of MOON to acquire UST of the identical worth back. . Such action would maximize UST’s provide to continue to keep the stablecoin rate close to $ one, when also building obtaining strain to drive LUNA’s rate up. Conversely, if the UST rate falls under USD one (due to powerful market place promoting), customers can trade UST for LUNA, minimizing the UST provide.

Furthermore, the continued development of Terra’s Locked Value (TVL) also generates substantial obtaining demand for the two LUNA and the UST stablecoin, the two major coins for worth transfer on this blockchain.

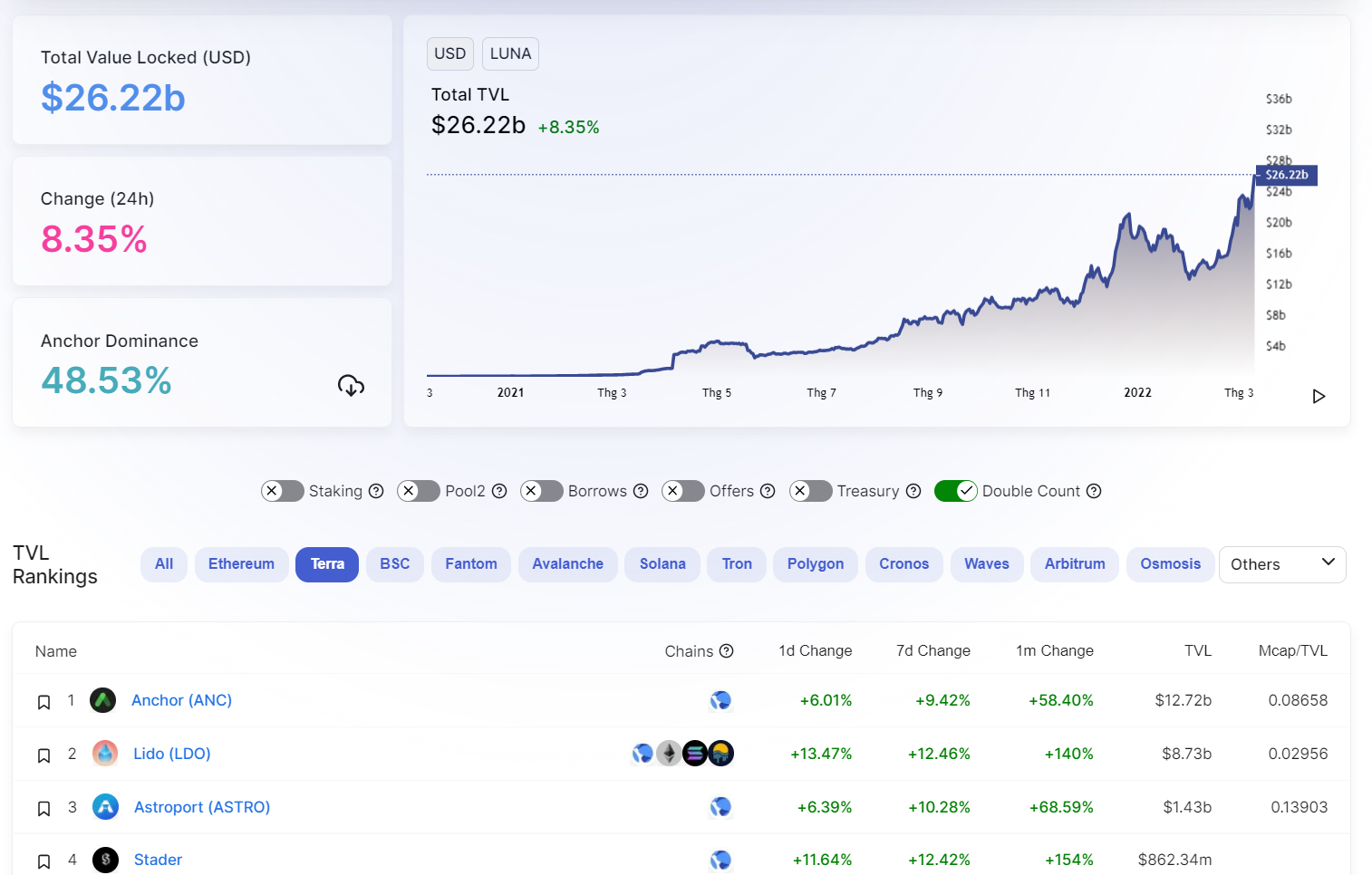

According to Defi Llama, Terra’s TVL on the morning of March ten hit $ 26.22 billion, the highest degree in background. Terra’s TVL has improved eight.35% in the previous 24 hrs and 73% in the previous month, solidifying Terra’s place as the latest 2nd-highest TVL blockchain soon after Ethereum, accounting for twelve.84% of the share. market place.

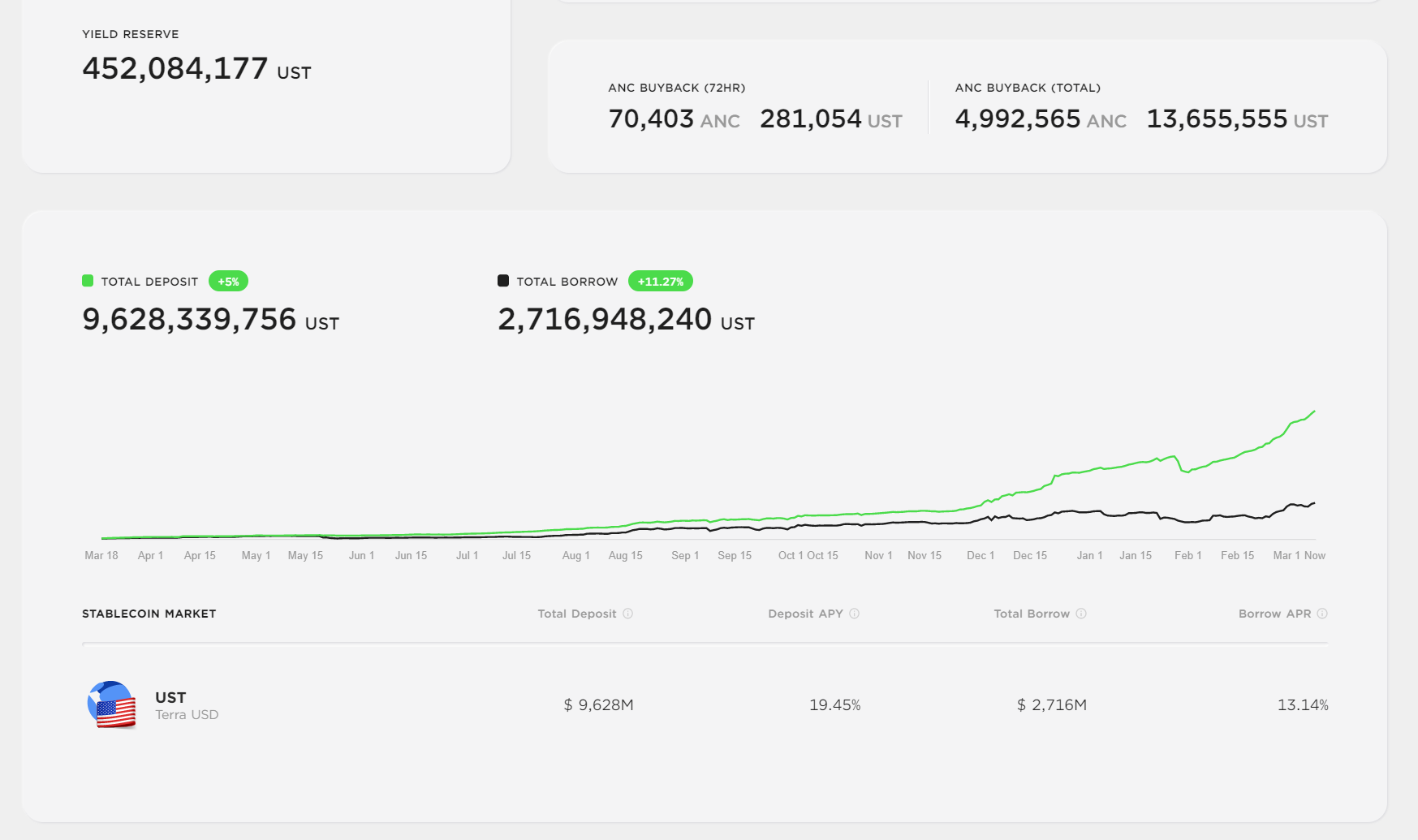

Taking up virtually half of TVL suitable now on Earth is Anchor Protocol (ANC), a extremely well known lending and lending protocol supplying loan curiosity charges up to twenty% / yr. This is explained to be the major motive why the volume of dollars is poured into Earth in common and Anchor in distinct, when most traders are wanting for a harmless revenue channel in the context of the ever-declining cryptocurrency market place. . months of 2022.

However, that also poses a significant dilemma for Anchor when most of the platform’s customers lend – with a complete volume of $ 9.six billion, when the loan volume is only $ two.seven billion. Anchor will then not be ready to use the loan curiosity to shell out the loan company, forcing the venture to shell out out of its personal pocket to make up for the variation. Anchor in February 2022 had to inquire Terra for a relief of UST 450 million just before the venture money had been drained.

However, there have been proposals to transform Anchor’s ANC token into a voting blocking token model comparable to Curve on Ethereum, encouraging customers to borrow and hold ANC to distribute the rewards for themselves. That proposal made the momentum for the ANC rate to peak ATH at USD six.19 on March 5th, just before becoming corrected to USD four.one at this time.

Synthetic currency 68

Maybe you are interested: