Friday: Cryptocurrency options expiration date. Nearly $3 billion in Bitcoin (BTC) and Ethereum (ETH) contracts are set to be paid or extended today. The Cryptocurrency market has been on an upward trend thanks to the “Trump rally” effect over the past few weeks, but will this momentum continue?

Expiry of Cryptocurrency options often results in significant price movements, causing traders and investors to closely monitor today’s developments.

$2.72 Billion Bitcoin and Ethereum Options Expire

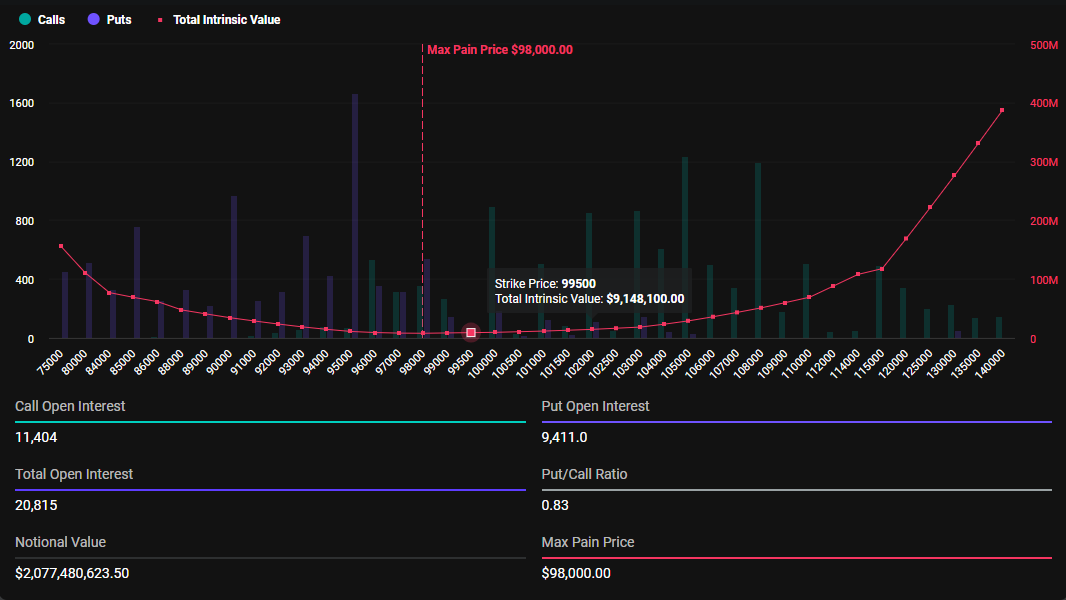

According to Deribit, 20,815 Bitcoin contracts with a nominal value of $2.077 billion will expire today. The put-to-call ratio is at 0.83, showing that traders continue to sell more call options (long-term contracts) than put options (short-term contracts).

The maximum pain point (the price at which the asset causes the greatest financial loss to the majority of Holders) is $98,000. Notably, this level is slightly lower than the current market price of 99,758 USD.

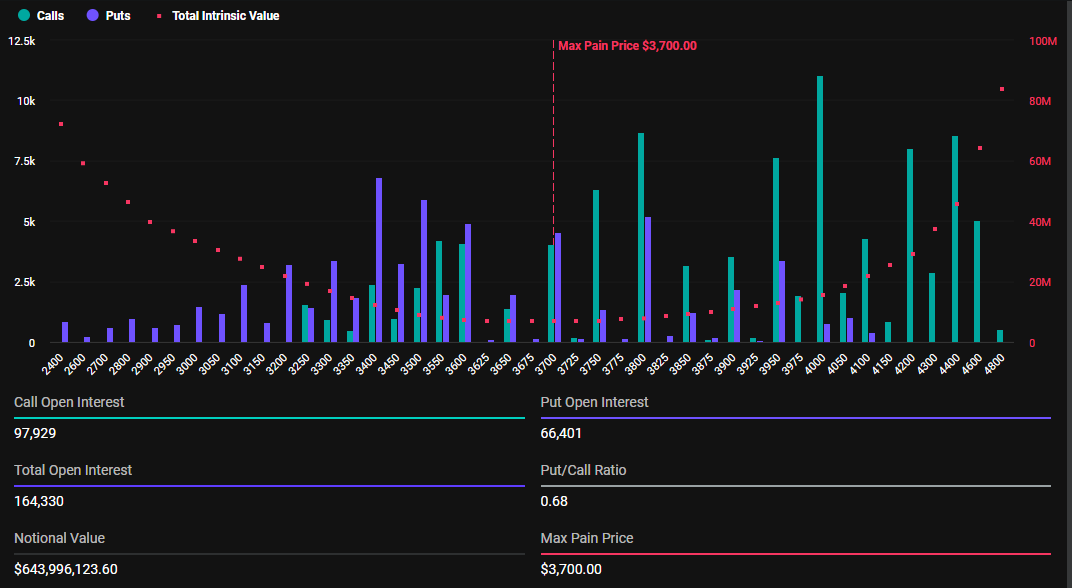

Meanwhile, 164,330 Ethereum options contracts with a nominal value of nearly 644 million USD will also expire today. The put-to-call ratio is 0.68, indicating that, similar to Bitcoin, traders are selling more long-term contracts than short-term.

Greeks Live commented that this week’s market is dominated by corrections, unlike last week, when there was a slight correction for Bitcoin and a stronger correction for altcoins. However, with Christmas and annual deliveries approaching, market makers are starting to adjust positions.

“Recent Block call options transactions account for a higher percentage, with a daily average of more than 30%. In previous years, Christmas trading temperatures in Europe and the US would drop sharply. This year, the influence of US stocks on Cryptocurrency increased, and this phenomenon may be more obvious,” Greeks Live speak.

This raises the question of whether there will be a Christmas rally this month, as the market once again confronts more obvious divergences. Currently, BTC fluctuates below 100,000 USD, while ETH is just a little short of reaching the 4,000 USD threshold.

Options market data over the last two weeks indicates that market makers are increasingly cautious. Amid strong market fluctuations, there were slight increases in implied volatility (IV) of the primary term. In this context, analysts at Greeks.live believe that options are currently very suitable for short-term play.

“…the cost-effective way of buying options remains very high,” they added.

Meanwhile, these options expirations come after a volatile week from a US economic data perspective. Inflation in the US increased to 2.7% in November, while core CPI remained at 0.3%. While an interest rate cut by the Federal Reserve is widely expected, persistent inflation complicates the path to sustained monetary easing.