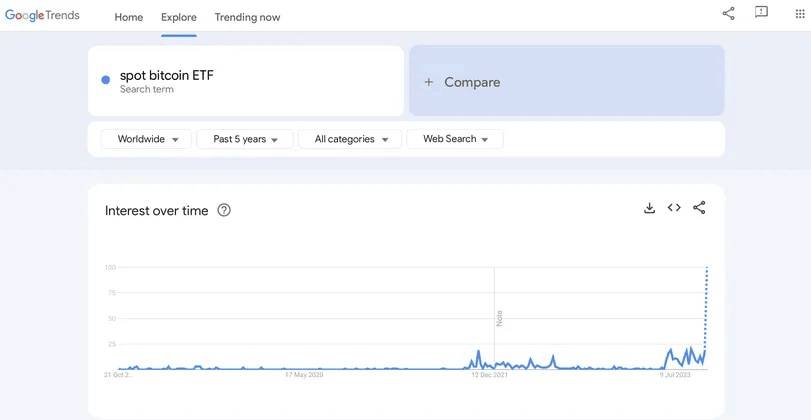

The FOMO for Bitcoin ETF has shifted from institutional traders to person traders and the mainstream public. The variety of Google searches for the key phrase “Bitcoin ETF spot” is about to peak.

The industry has modified for the superior, the variety of searches for the key phrase “spot Bitcoin ETF” on Google has peaked

The industry has modified for the superior, the variety of searches for the key phrase “spot Bitcoin ETF” on Google has peaked

The cryptocurrency industry is holding its breath in the fourth quarter of 2023 waiting for the SEC to approve the Bitcoin spot ETF. Despite the frequent postponements and shifts in determination deadlines, investor psychology nevertheless awaits with excellent nervousness the probability that the SEC “gives the green light”.

The feeling of hope is plainly demonstrated by the truth that the Google search worth for the phrase “spot Bitcoin ETF” globally is on track to attain the “maximum score” of a hundred.

Source: Google Trends

Source: Google Trends

According to the information Google Trendsthe key phrase “Bitcoin ETF” registered a hundred factors two many years in the past when the 1st Proshares Bitcoin ETF was listed on the New York Stock Exchange on October 19, 2021. After that this key phrase had a lengthy quiet time period in advance of exploding in the final months.

Both the search phrases “spot Bitcoin ETF” and “Bitcoin ETF” show public and retail investor curiosity in Bitcoin and the cryptocurrency industry in basic. This also exhibits that ETF money are no longer restricted to significant organisations, but have penetrated the globe of person traders.

Despite the SEC crackdown, most men and women think the SEC can approve a Bitcoin ETF in the up coming 12 months. Even the specialists of Bloomberg Expect an approval charge of up to 95%.

Cryptocurrency ETF proposals are below scrutiny by the SEC. Photo: Bloomberg

Cryptocurrency ETF proposals are below scrutiny by the SEC. Photo: Bloomberg

This trend is also understandable. When a variety of major guys and specialists flip to the media to share data about Bitcoin and ETFs, and even significant investment money like BlackRock inquire to register for a Bitcoin ETF, it is effortless to arouse public curiosity. And they will search for these search phrases on Google, escalating search volume.

The clearest proof of how “crazy” investor FOMO can be is Cointelegraph’s disastrous blunder on the evening of October 16th. Just 1 line of fake information posted on social networks that “SEC approves BlackRock’s Bitcoin spot ETF proposal” pushed the BTC rate to rise sharply to USD thirty,000 in just one hour.

Even if it is just fake information, this story demonstrates that “interest is repressed until the end” and is only waiting for a last “push” to explode.

BlackRock CEO Larry Fink shared with The block That:

“Investor interest pushed the price of BTC to rise far beyond the effect of fake news. Even after everything was cleared up, Bitcoin is still trading around the $29,000 mark, demonstrating positive investor sentiment.”

According to the support supplier Matrixport It is anticipated that the rate of BTC could improve to USD 42,000 – USD 56,000 if the BlackRock ETF is accredited. This prediction is as well favourable, but it partly represents the market’s see on the probability of a Bitcoin ETF appearing up coming 12 months.

Matrixport analysis factors out that if the BlackRock Bitcoin ETF is accredited, a conservative estimate is that the rate of Bitcoin will rise to $42,000 an optimistic estimate is that with a funds inflow of $50 billion, Bitcoin could rise to $56,000. https://t.co/Fr1zL6vHzO

— Wu Blockchain (@WuBlockchain) October 19, 2023

1H chart of the BTC/USDT pair on Binance as of four:twenty pm on October twenty, 2023

1H chart of the BTC/USDT pair on Binance as of four:twenty pm on October twenty, 2023

Coinlive compiled

Join the discussion on the hottest difficulties in the DeFi industry in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!