The cryptocurrency market place continues to keep its stagnant trend, down three.seven% in the previous 24 hrs, but the metaverse sector has responded positively.

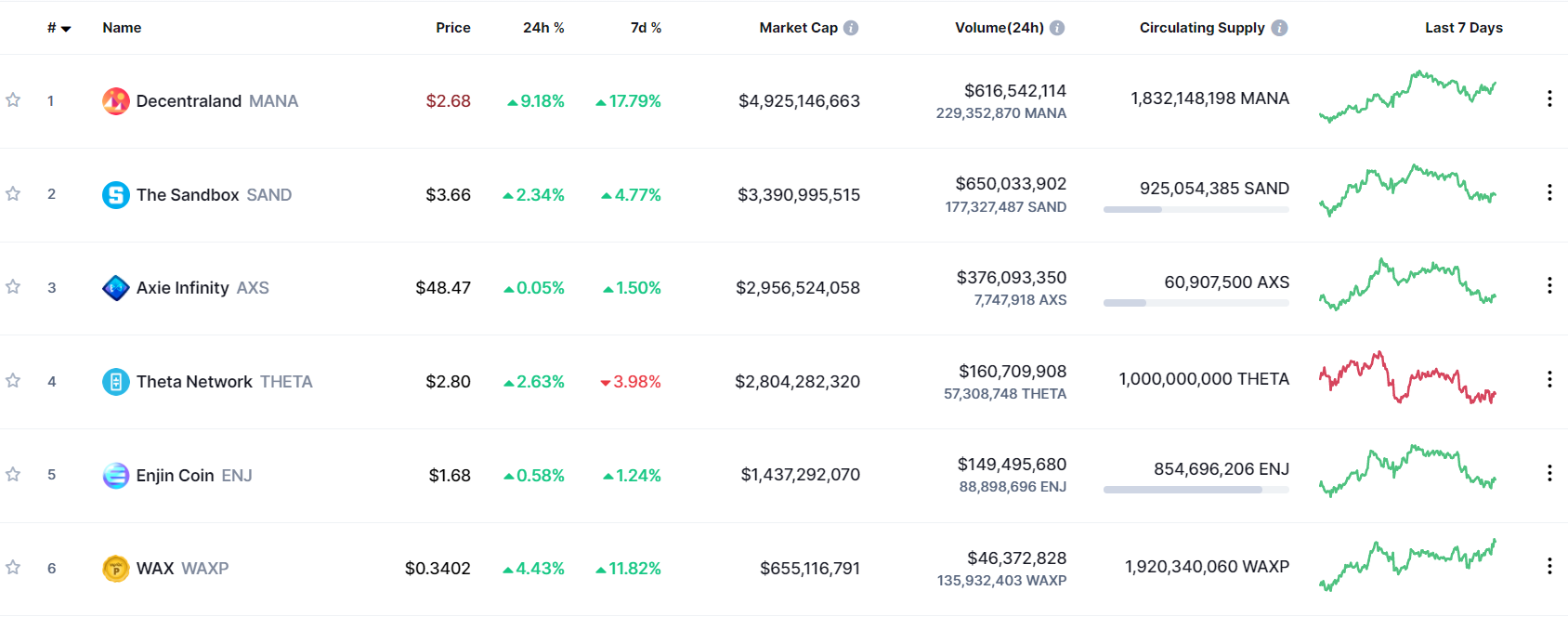

Most of the market place-foremost metaverse tokens recovered impressively and reacted rapidly to the $ two,000 + drop in Bitcoin (BTC) on February three. Typically Decentraland (MANA), The Sandbox (SAND) and WAX (WAXP), the blockchain of selection for the giant Amazon, has elevated additional than double from final week.

Another standout situation is Seems to be, the LooksRare NFT market place token, which was up 25.one% in excess of the week. LooksRare is one particular of the most anticipated accomplishment stories in 2022. The platform reached $ 325 million in NFT trading volume thanks to the Seems to be token airdrop, but there are nonetheless some considerations that several transactions are coming from traders connected to the manipulation of rewards of the undertaking.

However, contrary to developments in the cryptocurrency market place, the primary representative of the trend, Meta (formerly Facebook), had to encounter a steep drop in the company’s share selling price, dropping up to 21% in the previous 24 hrs, right after the corporation has warned traders that its to start with quarter earnings for 2022 are probable to fall quick of expectations due to elevated competitors in the metaverse area.

Because, in the fourth quarter of 2021 earnings report launched earlier this week, Meta has misplaced $ ten.two billion in earnings on metaverse improvement in excess of the previous 12 months. On the other hand, with the official collapse of the company’s stablecoin Diem undertaking, Meta announced that it had offered all undertaking assets and intellectual residence rights to California-primarily based financial institution Silvergate.

However, it would seem that Meta’s setback is completely due to the truth that the corporation is focusing as well a lot and dedicating several assets to the improvement of the metaverse regardless of the powerful stage to be exploited is the products of the social platform. Therefore, Meta nonetheless has several issues that ought to be conquer to regain investor self confidence, otherwise the “bleeding” of talent will return to Microsoft and Apple, direct rivals of the corporation.

Synthetic currency 68

Maybe you are interested: