After a time period of silence, MicroStrategy and CEO Michael Saylor have returned to their aggressive Bitcoin (BTC) obtaining technique.

On the evening of March 29, MicroStrategy CEO Michael Saylor announced that his subsidiary MacroStrategy had finished a $ 205 million loan from the Silverbank banking group and would use the complete volume to proceed investing in Bitcoin.

Specifically, MacroStrategy claims that the over loan will be secured in BTC.

MacroStrategy, a subsidiary of @MicroStrategyclosed a $ 205 million bitcoin-backed loan with Silvergate Bank for invest in #bitcoin. $ STR $ YEShttps://t.co/QYw2ZgeE3U

– Michael Saylor⚡️ (@saylor) March 29, 2022

However, it is nonetheless unclear when the enterprise will make this Bitcoin invest in.

This is MicroStrategy’s newest move soon after a prolonged time period of “sleeping”. The final time the investment company awarded additional funds to Bitcoin was a $ 25 million invest in in early February 2022.

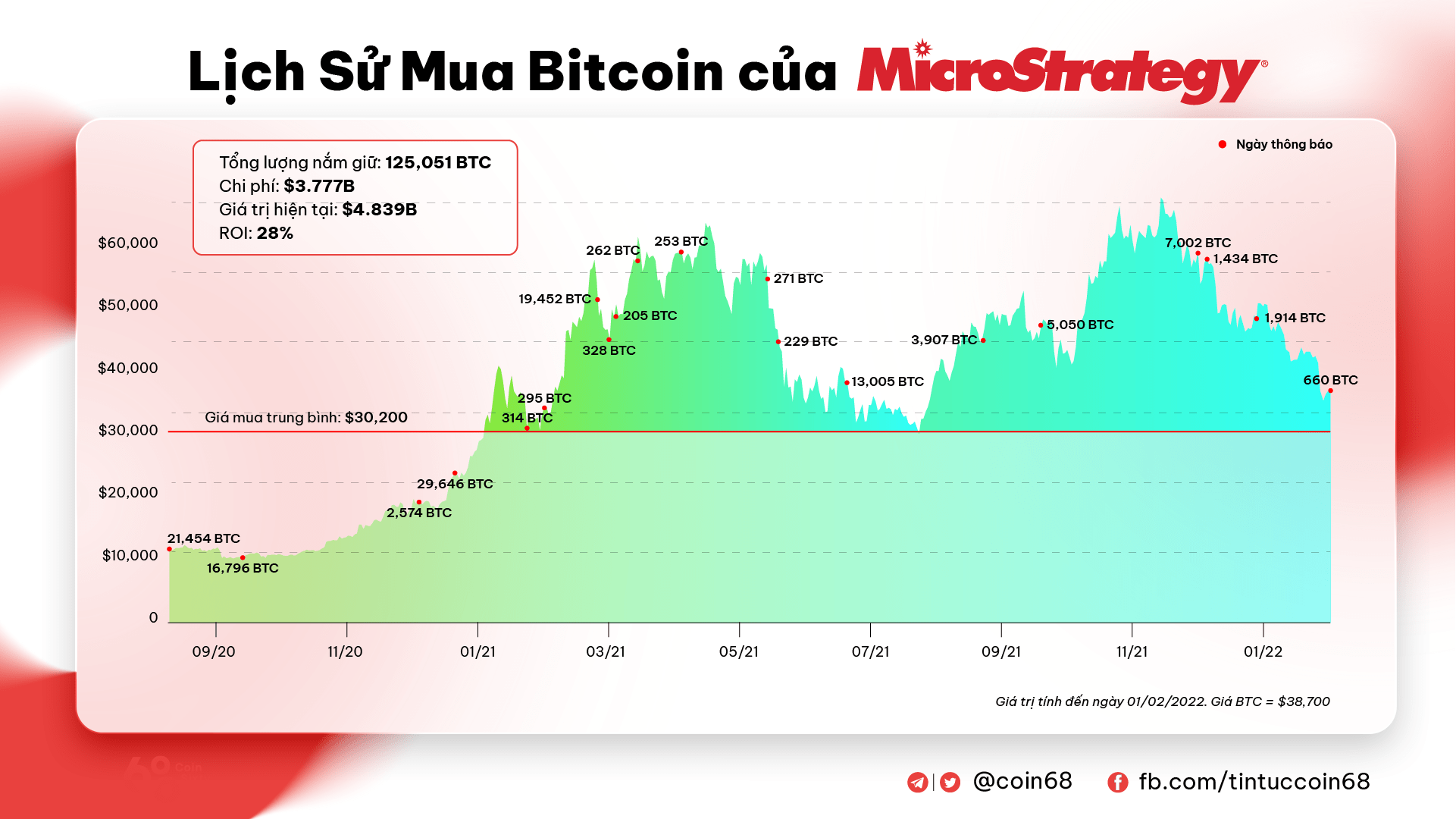

As of now, MicroStrategy holds 125,051 Bitcoins, well worth practically $ six billion at present BTC rates. The company’s investment price is $ three.seven billion, which signifies the enterprise is nonetheless rewarding at practically 60%.

Earlier, in late January, MicroStrategy’s Chief Financial Officer stated the company’s technique is to proceed obtaining additional Bitcoin in spite of the industry downturn.

Likewise, CEO Michael Saylor confirmed that his enterprise will not promote Bitcoin, but will as a substitute discover a way to use this “dormant” fund, this kind of as the loan.

Over the previous seven days, the cost of Bitcoin has strongly recovered thanks to the momentum of the Moon Foundation Guard, which has invested in excess of $ one.three billion to purchase BTC as a reserve fund for the UST stablecoin. Bitcoin hit a new substantial of 2022 this morning at $ 48,189 and is exhibiting no indicator of stopping.

The @LFG_org now #hodl 27,784.97 #Bitcoin with a complete stability of $ one,320,983,863.84 USD in the Bit Side of the Moon reserve.

– Reserve_LFG (@Reserva_LFG) March 29, 2022

This afternoon’s LUNA cost also set a new ATH, as reported by Coinlive.

Synthetic currency 68

Maybe you are interested: