The US government just additional a new stablecoin bill. According to this bill, issuers of stablecoins should have abundant and liquid collateral.

US authorities in latest many years have proven quite a few attempts to deliver cryptocurrencies into the legal framework. Of note is the “Responsible Financial Advancement Act” draft proposed by Senators Cynthia Lummis and Kirsten Gillibrand.

However, the scope of this draft is incredibly broad and entails quite a few departments, which include quite a few legal entities. Analysts realize that legalizing this kind of a regulatory framework typically will take a decade, going by quite a few procedures.

The “green door” for this draft was not broad, so other US officials rapidly proposed a further draft. More just lately, House Speaker Maxine Waters and Republican Patrick McHenry presented a particular draft law for stablecoins.

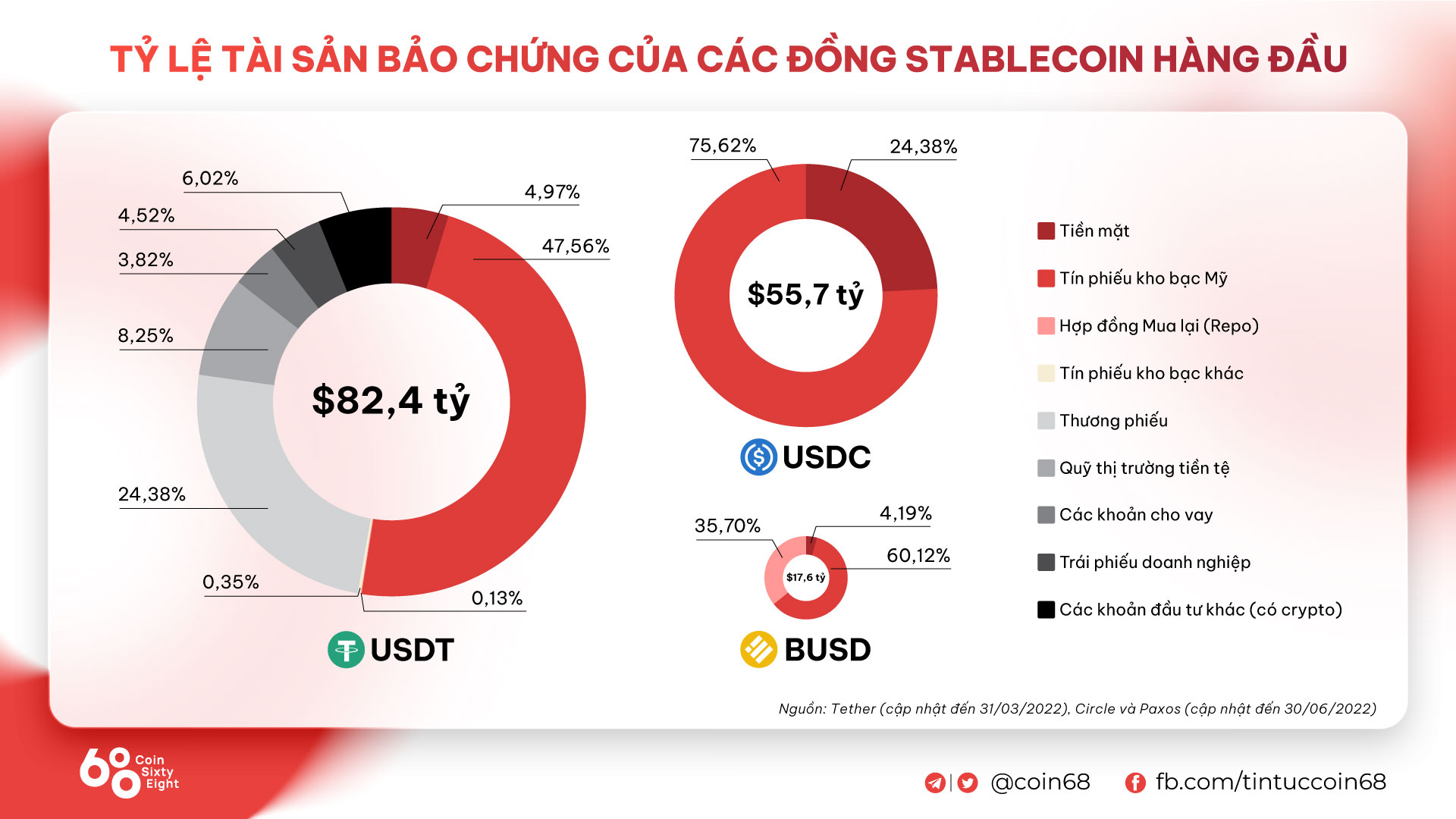

Although it has not been officially produced public, but in accordance to insiders, the new draft says that stablecoins should really be backed right by assets like US income and treasury expenses. Because this asset class will not be volatile in the occasion of a market place panic.

Therefore, stablecoin issuers also require to retain big capital, higher liquidity and companion with the watchdog.

If this supply is correct, it is possible that the new draft will have the “green light” from the House of Representatives. An even greater obstacle is the Senate, which should really be stricter on proposals coming from the House. To be authorized by the two chambers, the bill should be bipartisan and universal so that officials in the two chambers are significantly less possible to object.

Finally, if passed by the House of Representatives, this will be the 1st key cryptocurrency legislation in the United States. It will enable open the doors to extensively accepted and regulated cryptocurrencies, whilst it will produce some stricter laws for stablecoin corporations if they want to operate in the nation.

In unique, the new regulatory common will prohibit industrial corporations from issuing stablecoins. This implies that corporations like Meta (formerly Facebook), Amazon or Walmart will not be ready to concern their personal stablecoins.

The worries of the US government are not unfounded, specially just after the collapse of LUNA-UST. They rapidly stepped up exploration so that stablecoin legislation could be passed this yr.

Faced with a tougher regulatory scenario, Tether, the enterprise behind the world’s biggest USDT stablecoin, explained it will lower its holdings of industrial paper and carry out an audit with a key enterprise to demonstrate its abilities. Circle, the USDC issuer, also just lately launched a comprehensive report on the USDC underwriting.

The draft is anticipated to be talked about at the meeting on 27 July.

Synthetic currency 68

Maybe you are interested: