While most cryptocurrency market place participants proceed to be tense with the red days, even the 2nd biggest asset holders by market place cap Ethereum (ETH) are failing with record revenue.

The fee of Ethereum portfolios with revenue plummeted

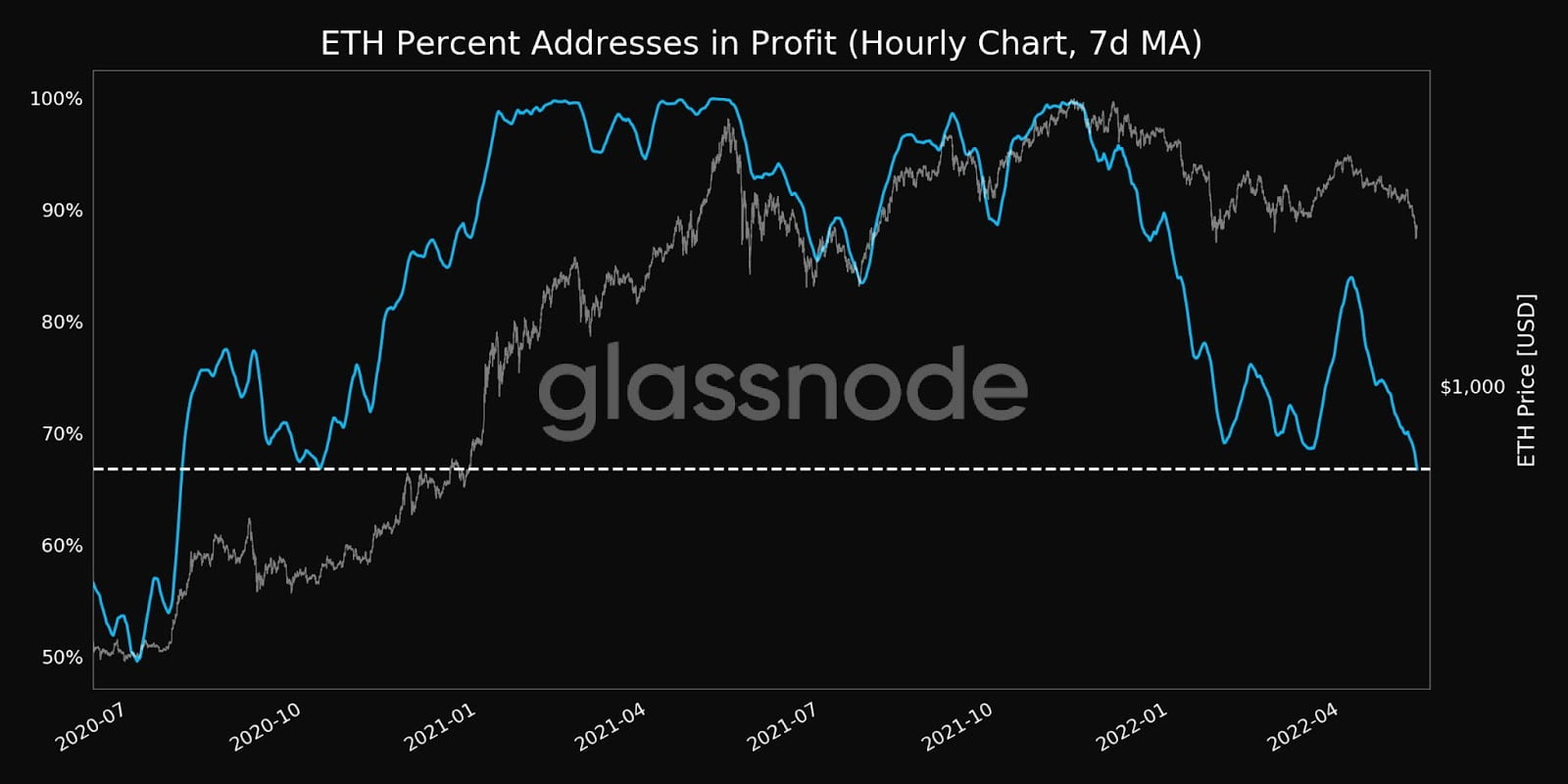

In reality, the percentage of rewarding Ethereum addresses is at a 21-month very low, as exposed in a Cointelegraph warning tweet. Glass knot yesterday (May ten).

At the very same time, the chart displays that in excess of 33% of wallet addresses that hold ETH are shedding income.

The final time these numbers have been recorded was extra than a 12 months and a half in the past, most notably on October eight, 2020, when the percentage dropped to a 21-month very low of 66.82%.

#Ethereum $ ETH Percentage addresses in revenue (7d MA) just hit a 21-month very low of 66.774%

The former 21-month very low of 66.818% was observed on October eight, 2020

View metrics:https://t.co/BUbkntqvVb pic.twitter.com/4g2WRx24YN

– glassnode alerts (@glassnodealerts) May 10, 2022

The revenue stress has greater

Before, Finbold reported on Ethereum’s offering stress, which resulted in in excess of $ 800 million (all over 330,000 ETH) flowing constantly into cryptocurrency exchanges to download coins.

According to information from CoinMarketCap, the rate of Ethereum at press time is $ two,348, down about one.one% on the day and sixteen% in the former 7 days. Market capitalization is at this time $ 287 billion.

Great expectations for “The Merge”

“The Merge” is a significant update that marks ETH’s significant transition to the Proof-of-Stake algorithm. A group of cryptocurrency authorities expressed their belief in a extra optimistic standpoint. They predicted that DeFi will quickly return to its all-time substantial of $ six,800 and then return to $ five,783 by the finish of the 12 months.

As announced, this update is anticipated to launch all over the 2nd half of 2022. However, a veteran Ethereum developer lately extinguished neighborhood believe in when he claimed The Merge occasion was nevertheless various months away, so “The Merge” will not get area in June as you would anticipate.

Synthetic currency 68

Maybe you are interested: