May and June 2022 witnessed a series of critical industry occasions. From the collapse of LUNA-UST to the reduction of stETH peg, a lot of cryptocurrency businesses have fallen into a liquidity shortage. The foremost investment fund on the industry, Three Arrows Capital, has also grow to be a terrifying title for traders.

May

May witnessed the surprising collapse of LUNA-UST, which triggered the industry to falter. The influence of the MTS collapse triggered 98% of the Earth ecosystem’s TVL to evaporate pretty much totally in 9 days.

Then there was the continued influence on a amount of other businesses on the industry, sending cryptocurrencies into a big crisis.

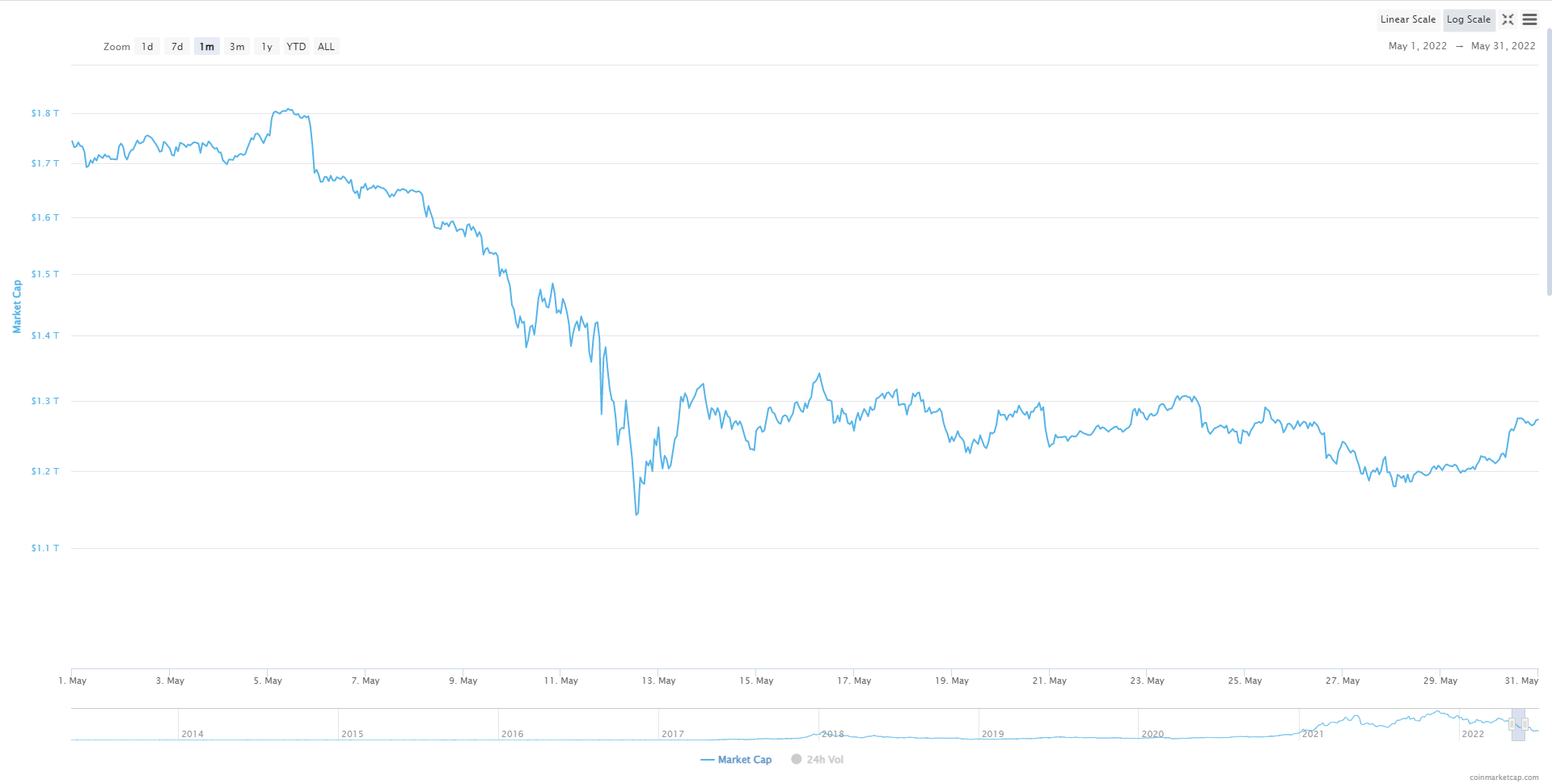

Market capitalization

Opening value: one.743 billion bucks

Closing value: one.272 billion bucks

Variation: 27% low cost

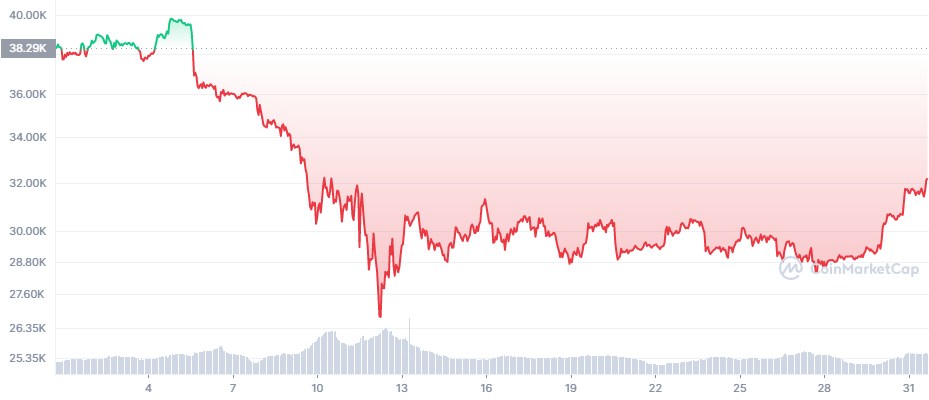

BTC value

Opening value: $ 37,630

Closing value: 31,801 bucks

Variation: 15.49% low cost

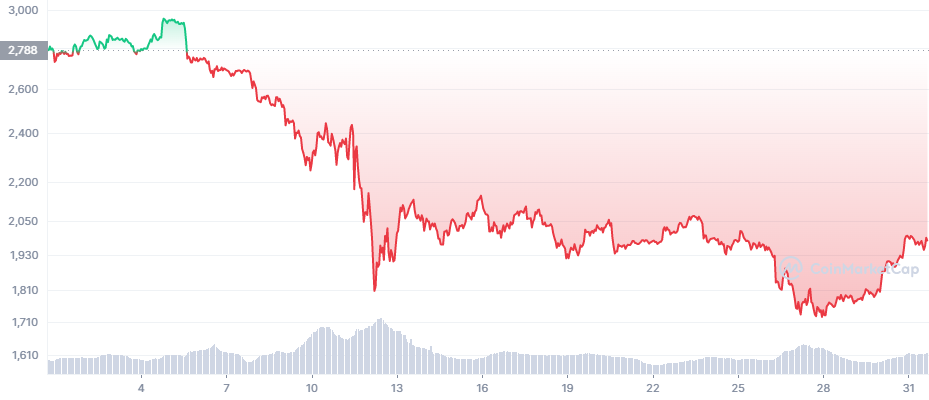

ETH value

Opening value: $ two,726

Closing value: $ one,942

Variation: 28.78% low cost

June

The LUNA-UST “ghost” continued to haunt the industry until finally June, and the stETH – Alameda – Celsius “Chain Effect” led to a broad-ranging liquidity crisis.

Starting with the Three Arrows Capital (3AC) investment fund, default, lack of dollars, … it has grow to be the obsession of a lot of foremost businesses in the cryptocurrency industry.

– Lending platform Centigrade: plagued by stETH devaluation, blocked withdrawals

– Investment platform Finblox: impacted by 3AC, impose withdrawal restrict

– Lending platform Finance of Babel: hit by 3AC, he stopped withdrawing dollars, massively abandoning the enterprise

– Investment money DeFiance Capital: rumored to be impacted by 3AC

– Investment money Genesis Trading: rumored to have misplaced “hundreds of millions of dollars” to 3AC’s involvement

– Lending platform BlockFi: 3AC collateral cleared, declared unchanged but borrowed USDC 250 million from FTX

– Investment application Digital travelerStruck by 3AC, claiming that 3AC owes itself much more than $ 662 million and has to borrow $ 485 million from Alameda to safe liquidity, has imposed a withdrawal restrict on customers.

– Blockchain platform Kyber network: influenced by 3AC, claim the amount of damage is not large.

– Exchanges Hoo: withdrawal block.

– Exchanges AEX: impose withdrawal restrict.

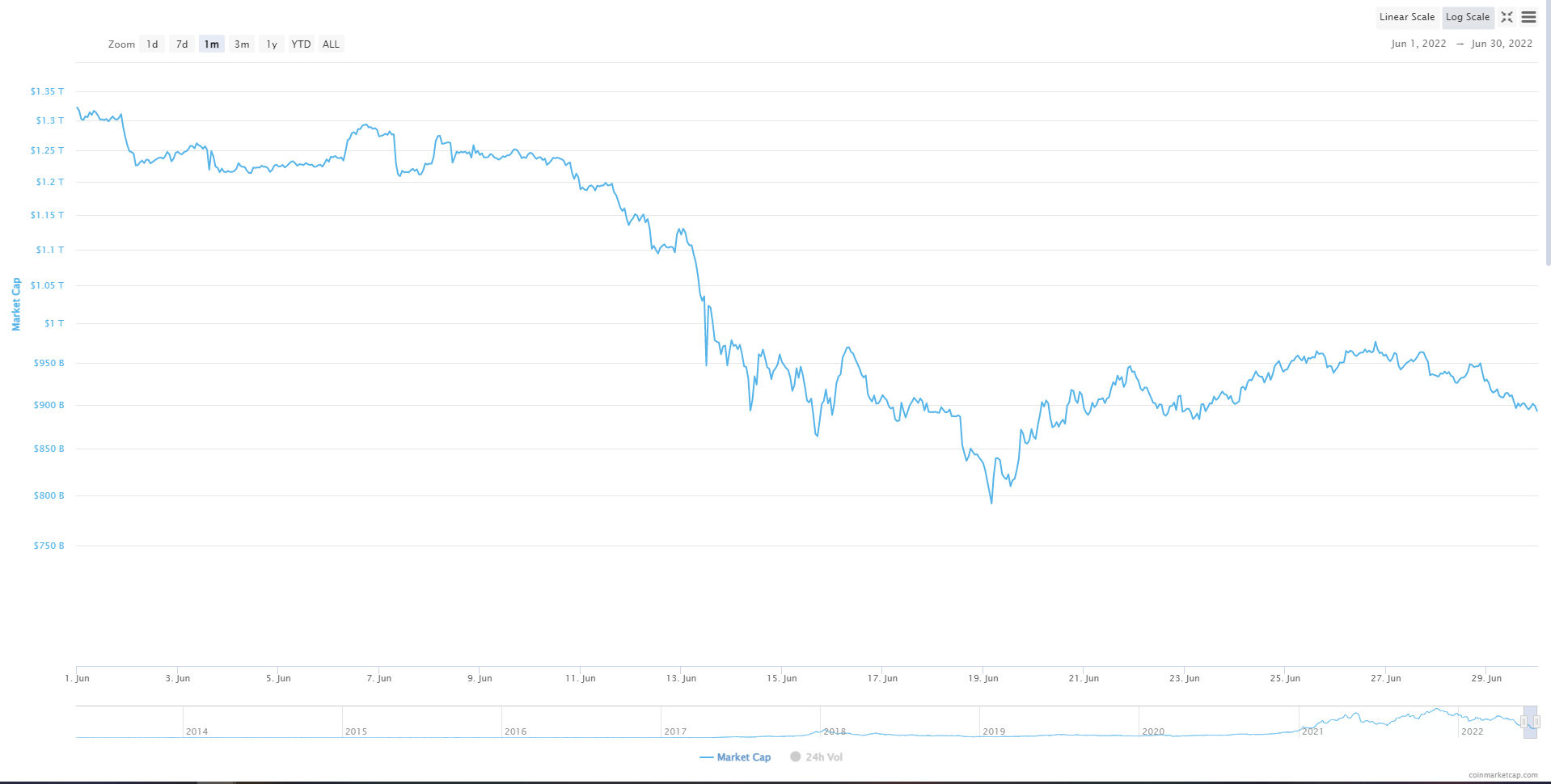

Capitalization

Opening value: one.272 billion bucks

Closing value: 892 billion bucks

Variation: thirty% low cost

Thus, the cryptocurrency industry for the to start with time considering the fact that January 2021 has misplaced a industry cap of $ one trillion.

BTC value

Opening value: 31,801 bucks

Closing value: 19,942 bucks

Variation: 37.29% low cost

A “memorable” milestone was June 18, 2022, when the industry professional a crash that pushed BTC and ETH rates to 18-month lows. The value of BTC has misplaced $ twenty,000, reduce than the peak of the final bull run. Meanwhile, ETH has returned to the “first 3 numbers”.

ETH value

Opening value: $ one,942

Closing value: $ one,071

Variation: 44.85% low cost

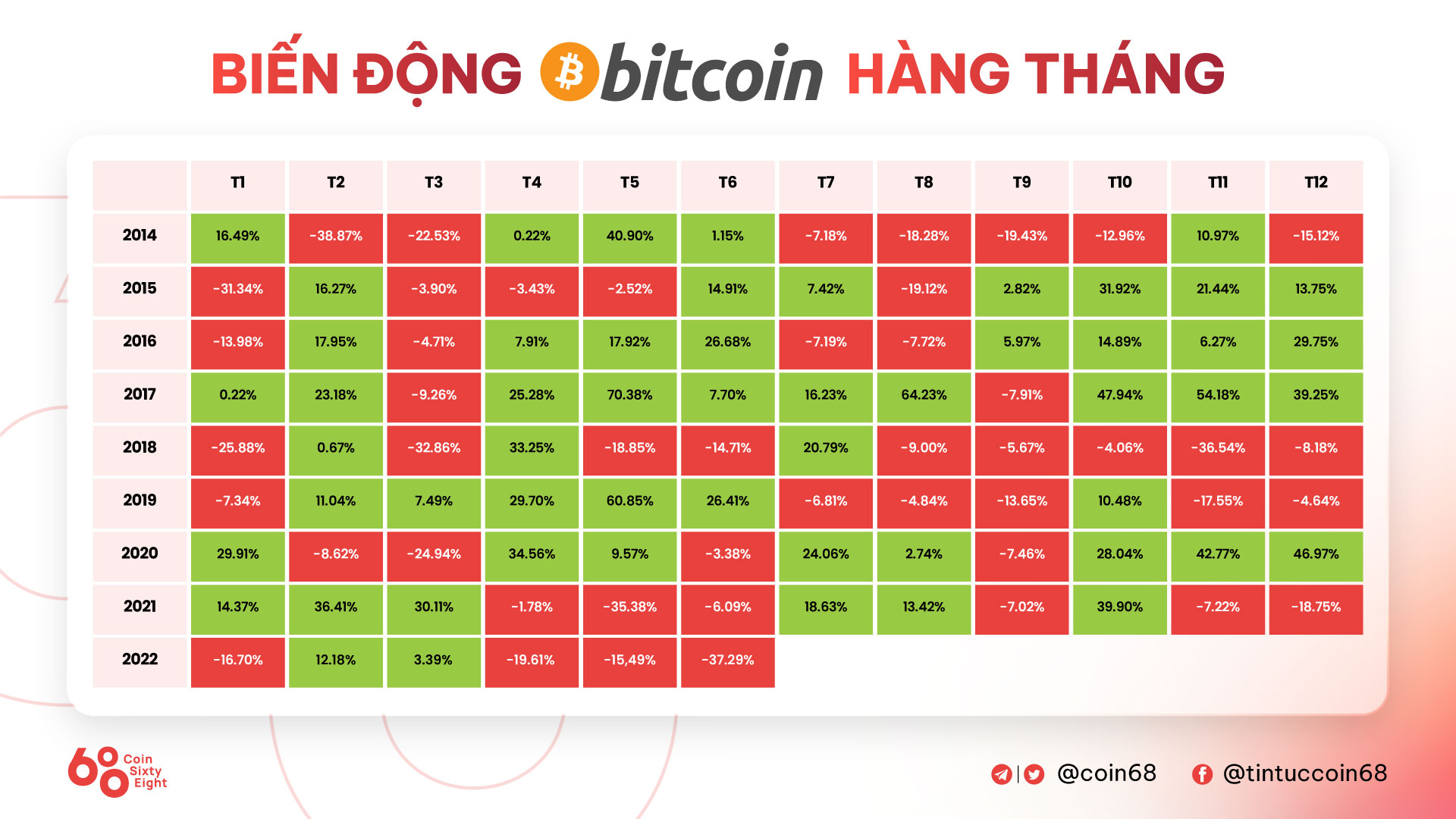

Thus, Bitcoin ended the 2nd quarter of 2022 on fire with a decline of up to 56.27%, the worst considering the fact that 2014.

#Bitcoin misplaced 56% of its worth in the 2nd quarter of 2022, the worst quarterly functionality in much more than a decade. pic.twitter.com/umD8MHQwmT

– unfolded. (@cryptounfolded) 1 July 2022

Synthetic currency 68

Maybe you are interested: