Bitcoin (BTC) cost has plummeted all through 2022 and is trading at $sixteen,877.39 at press time — down additional than 66% from its all-time substantial of more than $68,000 in November 2018. 2021.

Most traders contemplate cost the most vital development metric. While the cost of Bitcoin has small purpose to rise, the evaluation of other development metrics can make a powerful situation for BTC development in the coming many years.

Long-phrase holders hit all-time highs

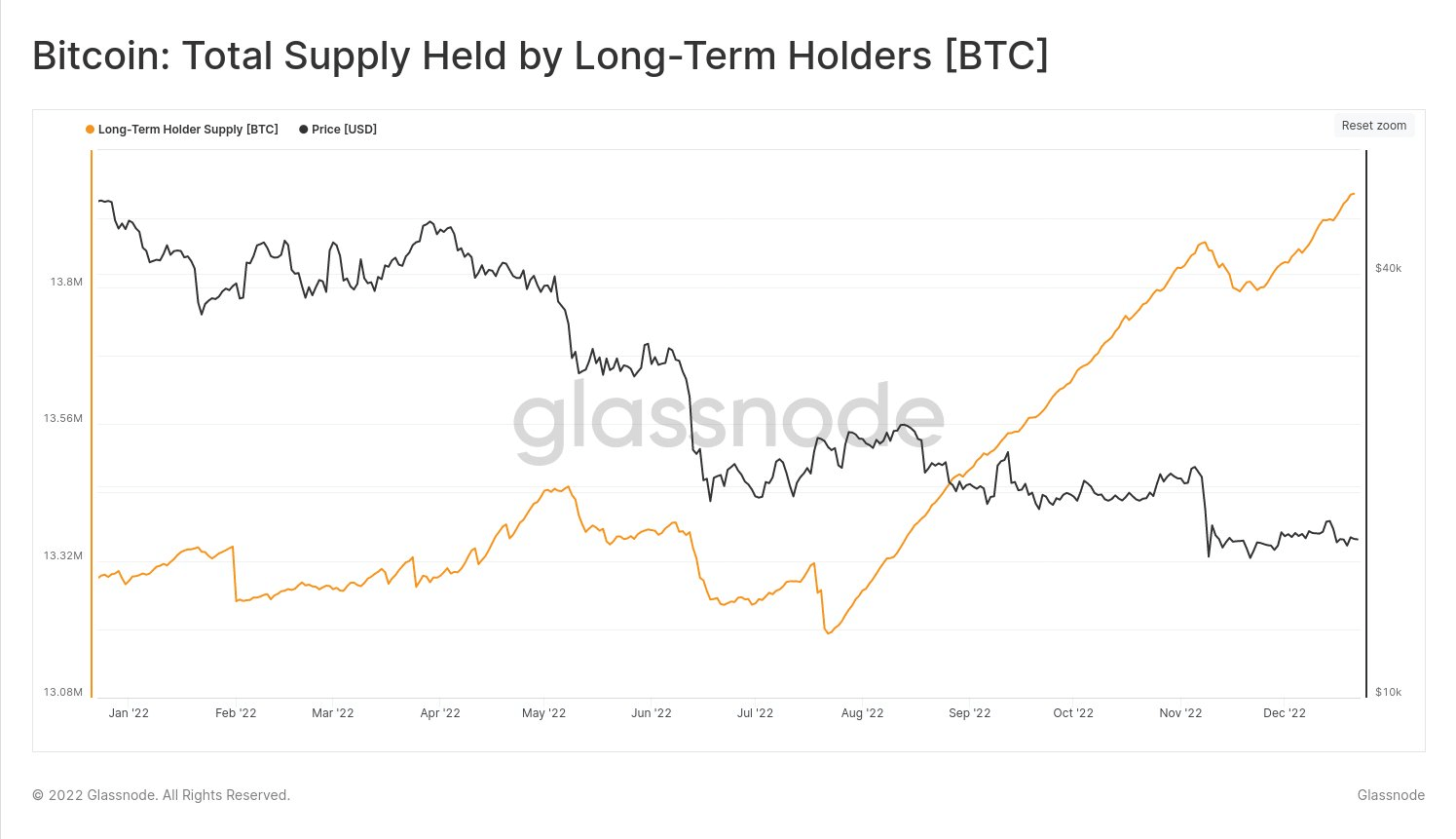

The complete provide of Bitcoin held by lengthy-phrase consumers has greater all through 2022. But it is really worth noting that it has wobbled for the duration of key occasions this kind of as the Terra-LUNA failure in May, the bankruptcy of the area fund. Three Arrows Capital (3AC) in June and crypto loan company Celsius in July and the collapse of FTX in November. These occasions developed a brief-phrase panic that sent holders lengthy-phrase have to lower their BTC holdings.

However, regardless of the drop, the complete provide of lengthy-phrase holders has reached an all-time substantial of additional than 13.9 million BTC, in accordance to Glassnode. data analyzed by CryptoSlate. This displays that lengthy-phrase traders hold about 72.seven% of the circulating Bitcoin provide of 19.24 million coins – the highest ever. Long-phrase holders are individuals who have held Bitcoin for 155 days or additional.

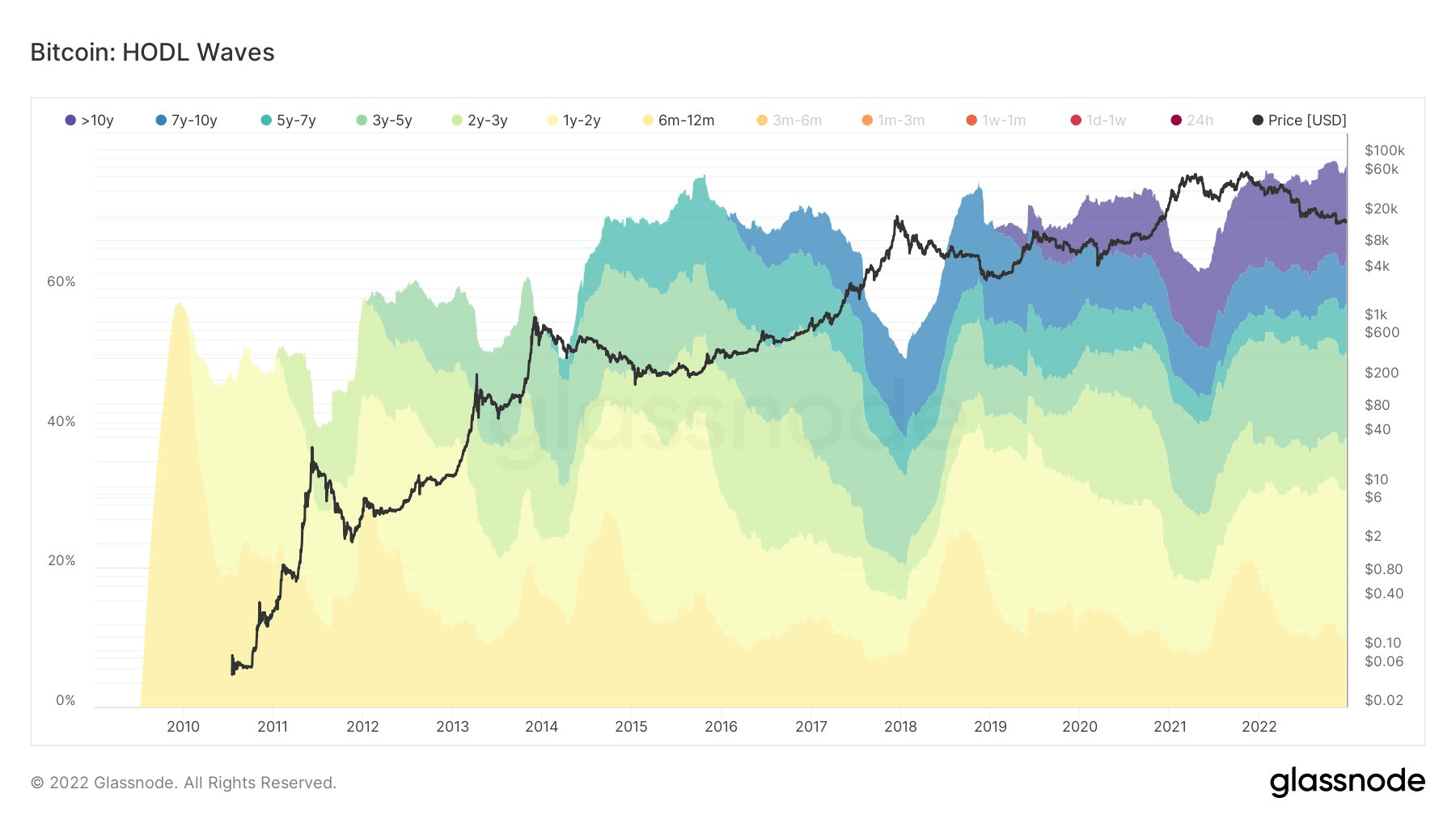

Additionally, the BTC HODL Waves chart signifies that the variety of unique BTC fans who have been holding their coins for additional than ten many years (purple) is substantial, though decreased right after the FTX crash. HODL Waves chart exhibiting BTC holdings for diverse age groups.

The percentage of traders holding their BTC for seven many years to ten many years has barely transformed regardless of marketplace fluctuations all through 2022, which suggests that lengthy-phrase holders are retaining preserve their faith in BTC.

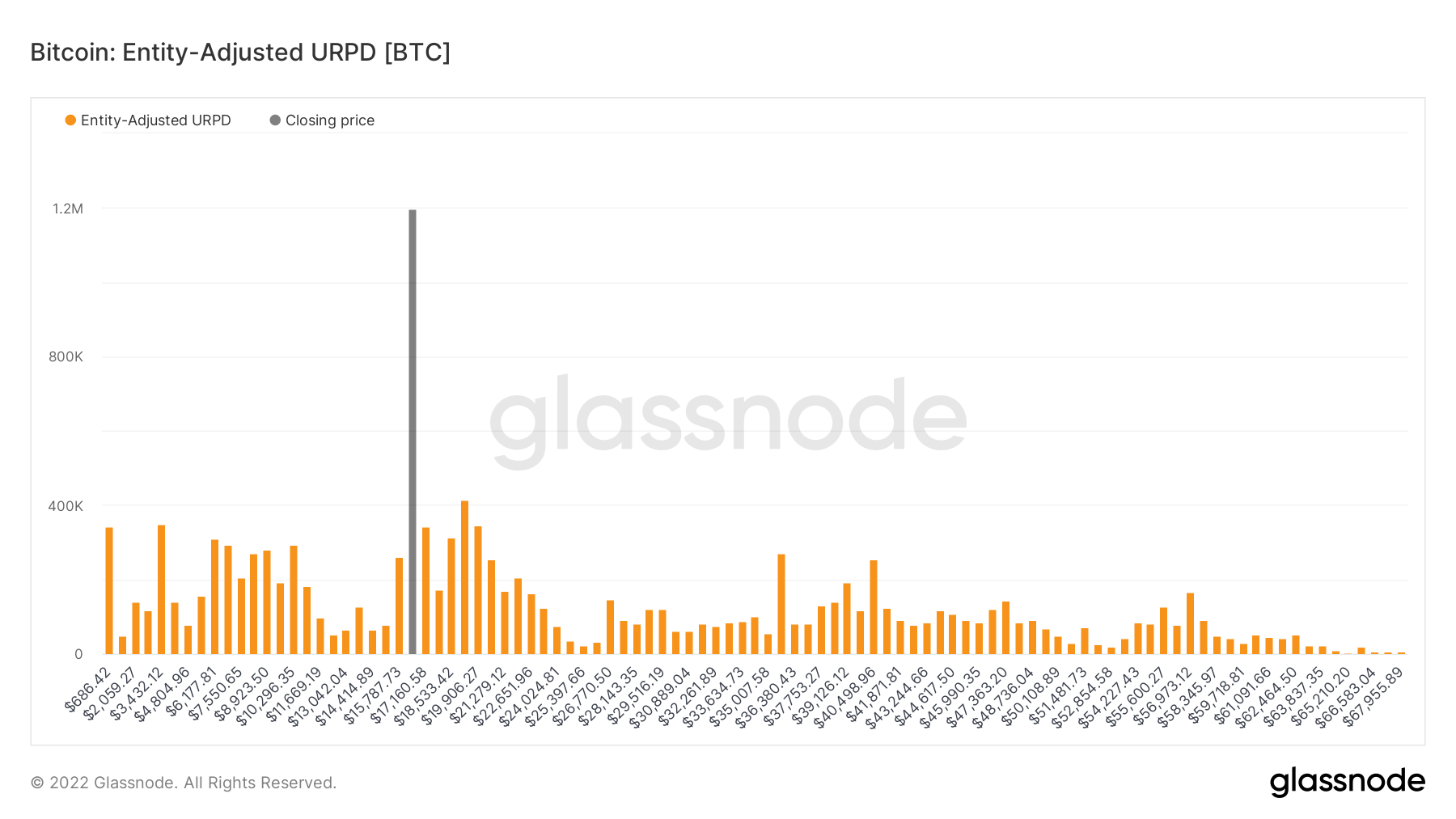

Nearly one.eight million BTC have been purchased among $15,700 and $17,one hundred

According to Glassnode information, virtually one.eight million BTC — or additional than 9% of the circulating provide — was bought among the $15,787.73 and $17,160.58 cost ranges. BTC has only been trading in this cost assortment in November 2020 and this 12 months, as of November 2022.

While 9% volume suggests additional redistribution, Bitcoin consolidation displays that lengthy-phrase holders are in handle.

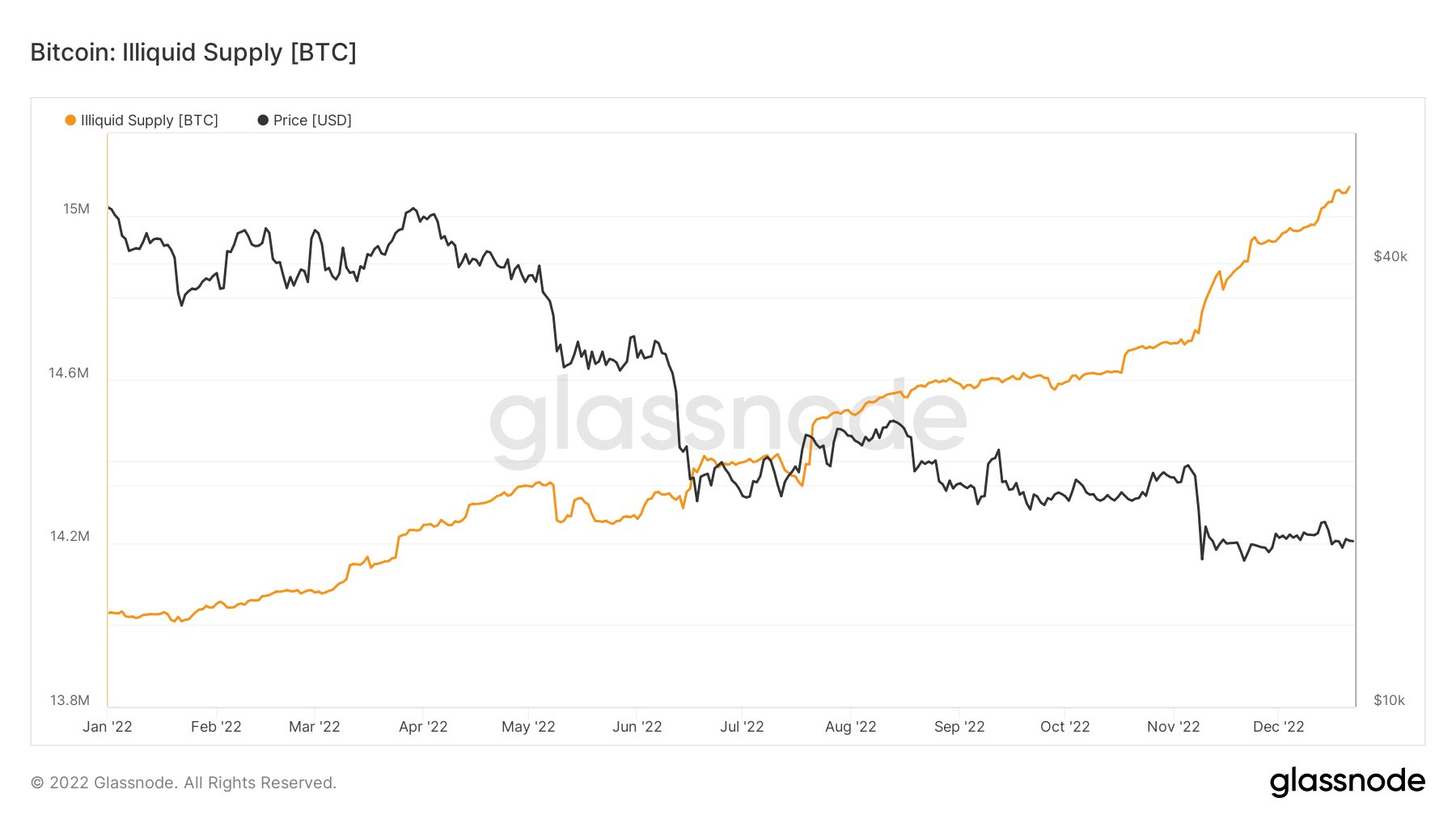

78% of Bitcoin’s circulating provide is self-governing

A series of famed bankruptcies by cryptocurrency lenders and centralized exchanges, which includes Celsius and FTX, have taught traders an vital lesson — not your keys, not your income. Although the phrase has been all over for many years, with hundreds of thousands of traders collectively dropping tens of billions of bucks by 2022, the message has ultimately come to light.

Throughout the 12 months, a good deal of traders continued to consider handle of their assets amid a decline in self-confidence in centralized exchanges. As of December 27, more than 15 million coins or about 78% of BTC’s circulating provide of 19.24 million is illiquid. The illiquid provide signifies that BTC stored in hardware cold storage wallets or planet broad net and mobile primarily based non-custodial wallets is not obtainable for trading.

The provide of illiquid BTC has greater from all over 14.eight million coins or 76% of the circulating provide in August. Additionally, Bitcoin’s illiquid provide has greater by about seven.four% from just more than 14 million. currency at the starting of the 12 months.