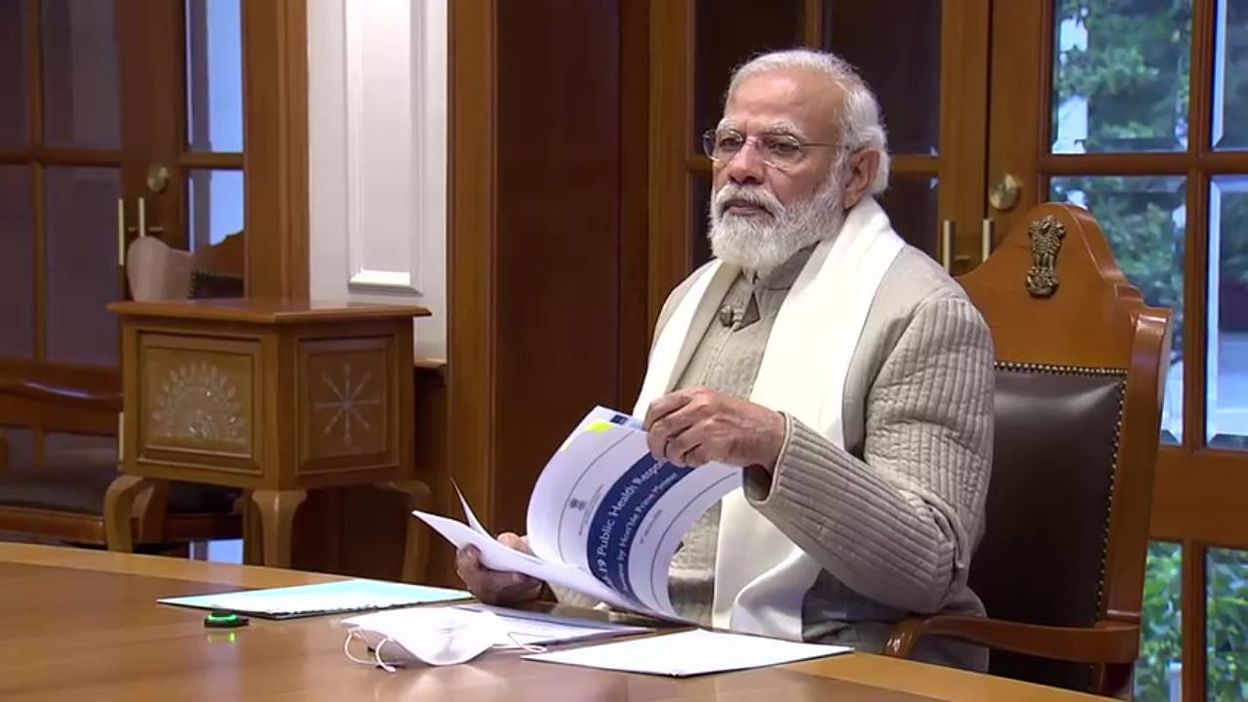

Indian Prime Minister Narendra Modi has just taken a stand in favor of the country’s central financial institution digital currency (CBDC).

During a virtual conference on the federal price range on February three, Indian Prime Minister Narendra Modi highlighted the likely positive aspects of a nationwide CBDC as a digital rupee in front of Party members and leaders. Bharatiya Janata (BJP).

In his see, the digital rupee will make on the internet payments more quickly and safer, underneath the supervision of the Central Bank of India (RBI). In addition, they could revolutionize the monetary technologies sector by building new options, strengthening the international economic system and easing the burden of managing, printing or managing income. Also, Indians can convert CBDC into fiat currency.

“The CBDC will help India’s sturdy economic system. This will be a technique that will make it possible for the exchange from fiat to cryptocurrencies.

Probably 1 of the factors why the Indian leader prefers CBDCs is that they will be strictly regulated and regulated. Not prolonged in the past, he referred to as for a international collaboration to be established to carry cryptocurrencies into a complete regulatory framework.

Modi’s curiosity is mostly targeted on Bitcoin. He advised that numerous criminals will proceed to use BTC in unlawful pursuits. Furthermore, the lack of principles can also “damage” the accessibility of younger generations to marketplace. Last month, the Prime Minister reiterated his place on the matter with the statement:

“Cryptocurrency is an example of the challenge we face as a global family. To protect themselves from risks, each country, each global agency must take collective and synchronized action ”.

The remarks from Prime Minister Narendra Modi come just days soon after Nirmala Sitharaman, India’s finance minister, mentioned the nation would launch a CBDC in the upcoming monetary yr (which runs from April one to April 31) in March, in addition to imposing a tax of the thirty% on cryptocurrencies. Similar to Modi, the politician expects the CBDC to give a “huge boost” to the nationwide financial technique.

In 2021, the RBI confirmed it will launch pilot applications to check how CBDCs interact with the country’s economic system. The company meant to get started testing late final yr, but sooner or later postponed it to 2022.

Synthetic currency 68

Maybe you are interested: