The long term of cryptocurrency in India continues to be hotly debated as the Nation’s Central Bank (RBI) has stressed that the government ought to wholly ban the sector to safeguard the country’s economic system.

With Indian authorities even now uncertain how to “deal with” the cryptocurrency industry in the previous couple of months, ranging from a bill to make a CBDC, to a slight regulatory modify. More modestly, the Central Bank of India (RBI) has expressed its see that it would like the nation to stick to China’s path by wholly banning all elements of the sector.

The RBI clarified the over subject at the 592 board meeting. An anonymous supply acquainted with the meeting mentioned the RBI highlighted the threats posed by cryptocurrencies that could influence macroeconomic policy, nation dimension and the instability that cryptocurrencies can bring about.

Furthermore, the financial institution also described the degree of concern in dealing with the exchanges working underneath their authority. The RBI maintains its company place that the ideal remedy to the trouble would be an outright ban. Notably, this is not the initial time the RBI has maintained a hugely “hostile” stance in the direction of cryptocurrencies.

In October, RBI Governor Shaktikanta Das mentioned the unregulated nature of cryptocurrencies would pose a really serious risk to any economic method in the planet. Additionally, the RBI effectively banned Indian banking institutions from carrying out company with cryptocurrency companies in 2018.

Indeed, cryptocurrency regulation in India might be delayed right up until 2022 as the government would like to hold broader and a lot more in-depth consultations. Prime Minister Narendra Modi, the most latest celebrity hacked into his Twitter account to submit fake Bitcoin (BTC) information, will make a ultimate appeal for a proposed legislative framework just before an official selection turns into obtainable.

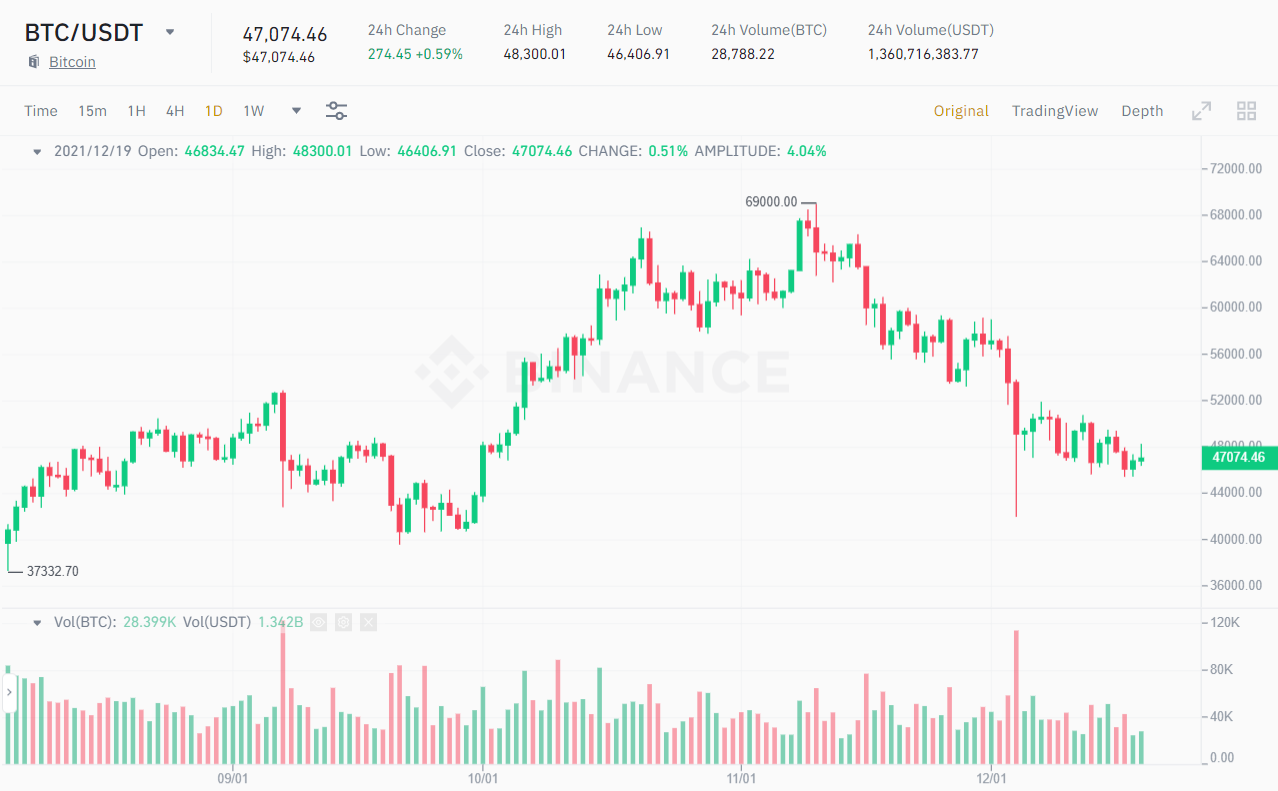

However, the hottest move by the RBI has unwittingly place a lot more and a lot more “pressure” on Bitcoin’s (BTC) value response, which has suffered some results from numerous “bans” inside the margins of other nations in the previous week.

These include things like United kingdom action to ban Coinbase advertisements and a amount of other big businesses, Chinese banking institutions have commenced educating people today about the dangers of cryptocurrencies, and the Russian central financial institution would like to ban cryptocurrencies. . Therefore, as of this creating, Bitcoin is even now struggling to trade all around $ 47074.

Synthetic Currency 68

Maybe you are interested: