The most recent index displays Bitcoin savvy traders virtually no aggressive investing action in spite of BTC hitting an all-time substantial this 12 months at $ 69,000.

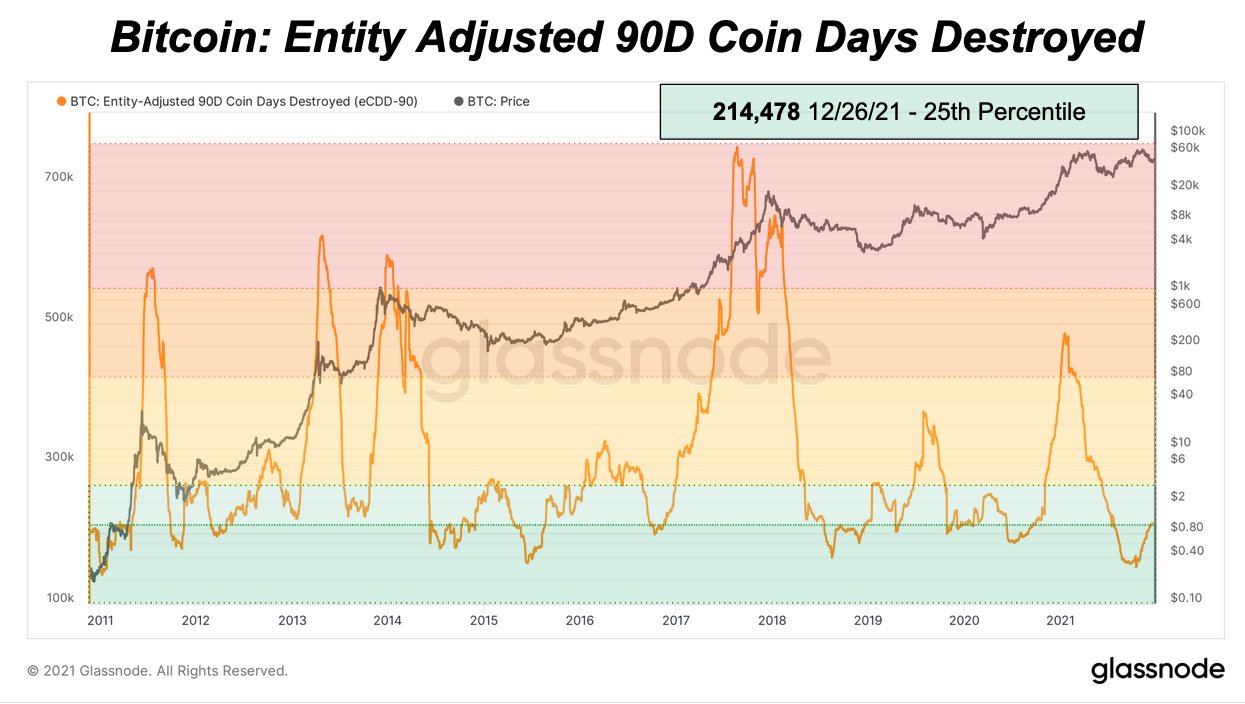

According to information from Glassnode’s 90-day Coin Destruction Days (CDD), the percentage of Bitcoin invested by former soldiers stays shut to an all-time minimal, confirming investor and proprietor self confidence. “.

CDD refers to the time just about every BTC was inactive prior to the get started of the move. This supplies an different to straightforward volume measurements to determine marketplace trends. As a consequence, older Bitcoins are “more important” than younger BTCs with an energetic background.

Ever considering that the sale of previous bargains surged soon after BTC broke 2017’s all-time substantial of $ twenty,000 final 12 months, longtime traders have remained steadfast. Bitcoin’s continuation to hit $ 69,000 this 12 months also failed to break the trend, main to marketing stress that even now seems to be coming from newcomers to the marketplace.

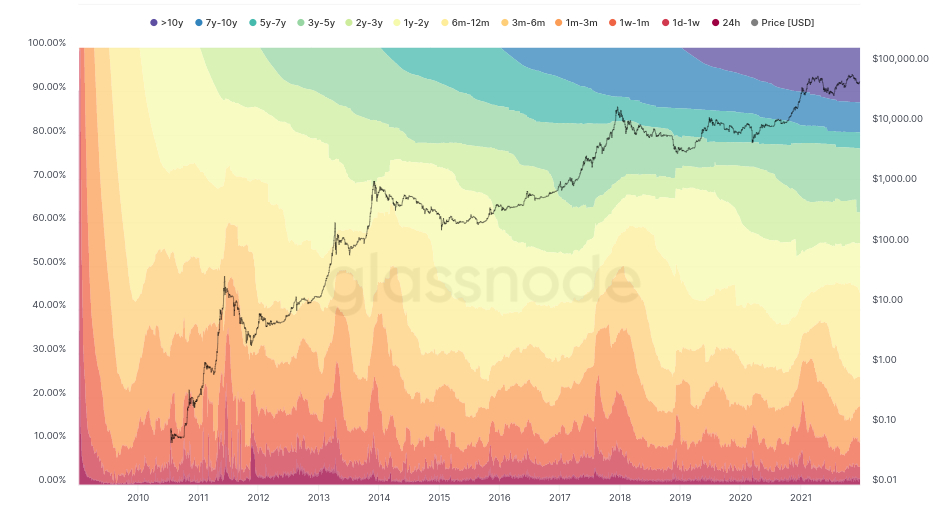

Another histogram is HODL Waves which also confirms the over signal. The volume of Bitcoin bought 3 to 6 months in the past is now encountering the biggest drop in complete provide. As of now, 90% of the BTC provide has been mined. This implies that sellers purchased back their BTC among June and September in the time period that BTC dropped as significantly as $ thirty,000 just before China’s mining crackdown.

However, the distinction among prolonged-phrase and youthful traders is now becoming proven pretty plainly. Market participants at $ twenty,000 per BTC are also doubling, as BTC appears set to finish 2021 about the $ 45,000 – $ 50,000 array.

Meanwhile, UTXO Management senior analyst Dylan LeClair mentioned that, all round, miners are including “aggressively” to their positions for the duration of the Bitcoin accumulation phase, in addition to the origin occasion. set an ATH earlier this week.

#Bitcoin is back in accumulation mode. pic.twitter.com/BezC2AUewO

– Dylan LeClair 🟠 (@DylanLeClair_) December 23, 2021

Synthetic Currency 68

Maybe you are interested: