Pyth Network, a decentralized, cross-chain orcal information platform developed on the Solana blockchain, will be officially launched on August 26.

Pyth Network is about to be launched on Solana’s mainnet. So far, Pyth Network has been accessible on the Solana devnet as a spot to check the efficiency of the platform. The mainnet launch will let developers to integrate Pyth Network industry information into decentralized finance (DeFi) applications.

The venture was incubated by Jump Trading and has also obtained contributions from other nicely-acknowledged trading corporations, such as GTS, Virtu Financial, Chicago Trading Company, IEX, Akuna Capital, DRW Cumberland, XR Trading, and Hudson River Trading.

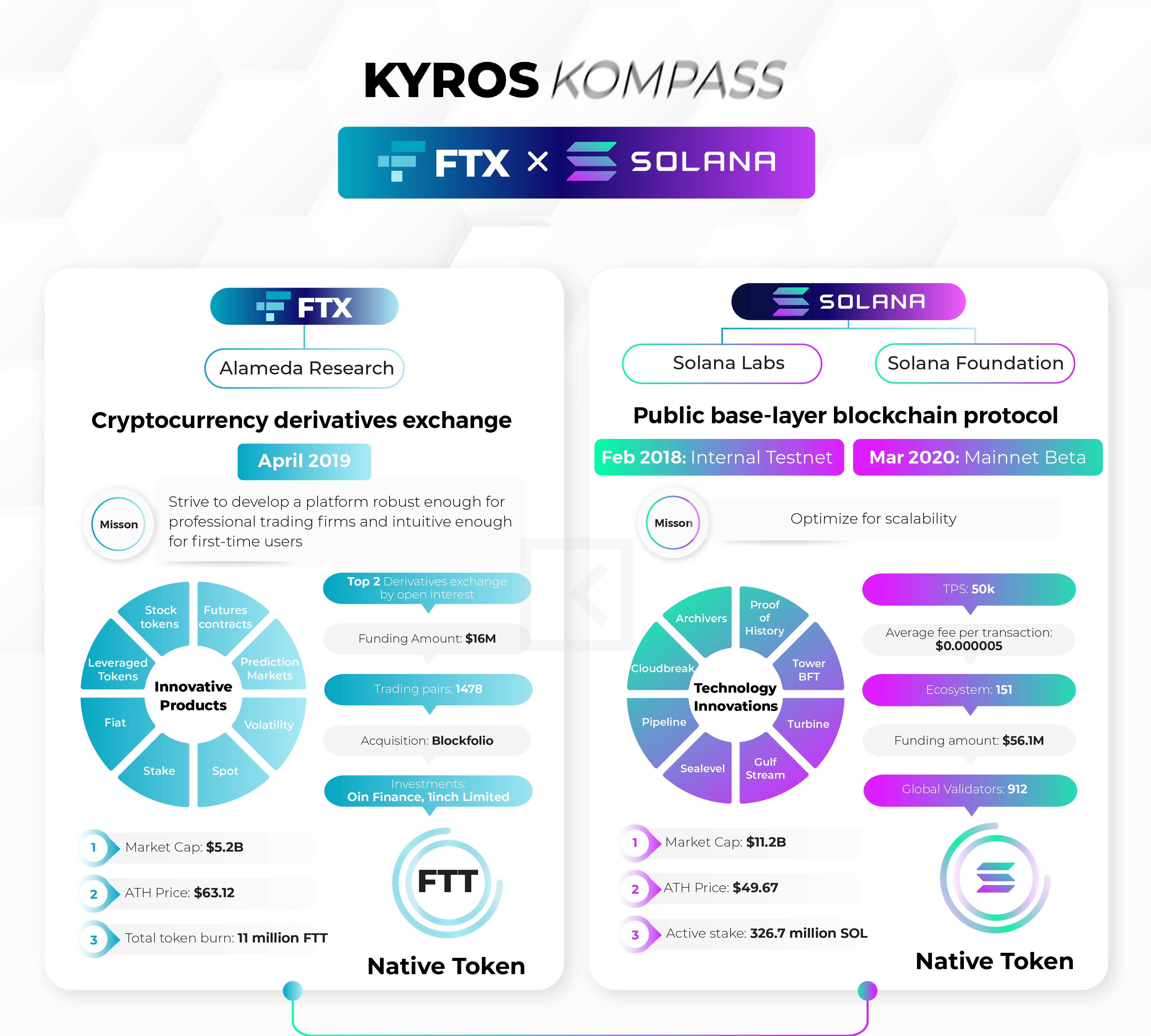

Other notable faces contributing to the venture incorporate LMAX, MIAX / BSX, Genesis Global Trading, FTX, CMS, CoinShares, and Bitso. Mostly KGI Securities, a wholly owned subsidiary of China Development Finance Corporation.

Pyth Network will hyperlink the industry information of these trading and trading corporations to any good contract by way of the Solana blockchain. The decentralized nature of the Pyth network lets the platform not to depend on any single information supply that can be manipulated.

Some of the tasks at present set to use Pyth Network incorporate decentralized Solana-primarily based exchanges this kind of as Saber Labs, Mango Markets, and Bonfida. The impending launch of the Pyth Network will more fuel Solana in the oracular sphere. Most just lately, on August 25, Solana integrated with giant Chainlink to broaden making DeFi applications on the platform.

While Pyth is at present supporting Solana-primarily based tasks, the venture also programs to integrate with the Wormhole interaction protocol in the coming weeks to assistance 3 other well-known blockchains, Ethereum, Binance Smart Chain (BSC) and Terra.

Synthetic currency 68

Maybe you are interested:

- Morgan Stanley holds more than one million shares of Grayscale GBTC

- FCA United kingdom Confirms Binance Fully Compliant: CZ is “Claimed”

The Solana-primarily based Oracle Pyth Network submit “Dark Horse” officially initial appeared on Coinlive.