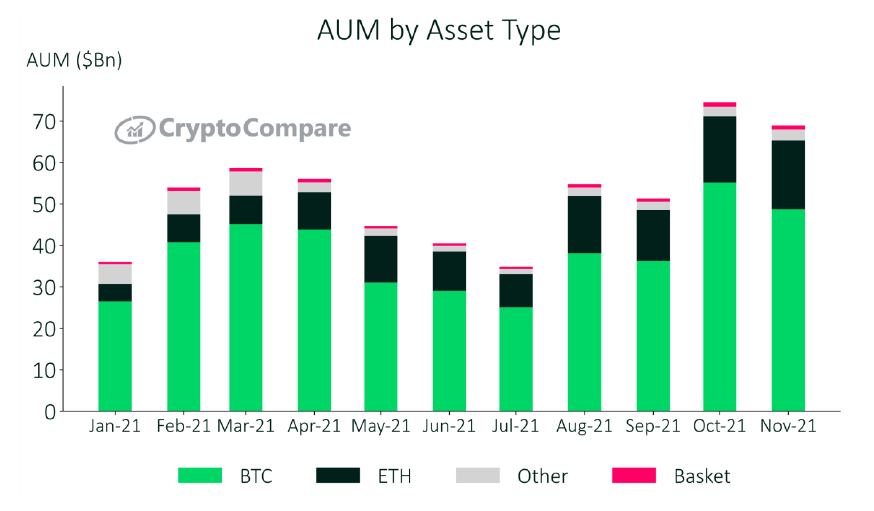

Total Bitcoin (BTC) Assets Under Management (AUM) fell 9.five% to $ 48.seven billion in November, although altcoin-based mostly crypto money this kind of as Ethereum (ETH) recorded a five.four raise in their AUM. % to $ sixteen.six billion.

While Bitcoin’s place as a viable inflation hedge continues to entice traders, the new information displays a shift in sentiment as Ethereum (ETH) and other altcoin solutions are moving in tandem.

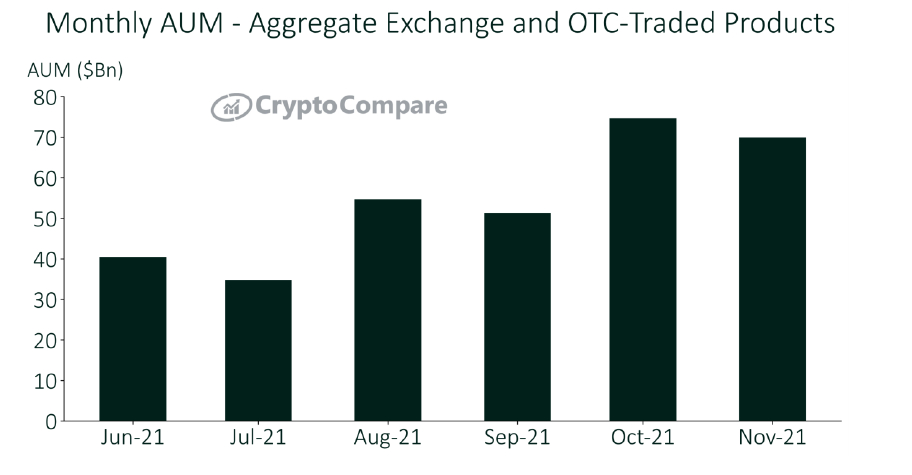

The complete AUM of all cryptocurrency investment solutions fell five.five% to $ 70. billion, coinciding with the ongoing bear marketplace because Bitcoin hit an all-time substantial of USD 69,000.

From the unsustainable assistance of $ 60,000 to the sudden volatility due to the information of the reconfirmed Fed chairman and lastly to the breakout of the $ fifty five,000 zone on the information about the COVID-19 mutation, it all exhibits that Bitcoin certainly has a good deal of prospective. for a great deal of November, which was remarkably anticipated by the investment neighborhood following a flurry of momentum from the SEC’s Bitcoin ETF series of occasions.

As a consequence, Bitcoin’s AUM marketplace fell 9.five% to $ 48.seven billion, marking the biggest month-to-month decline of the 12 months because July. On the other hand, altcoin-based mostly money this kind of as ETH have viewed a AUM surged appreciably to $ sixteen.six billion, or five.four%, although other crypto assets had been up $ two.six billion.

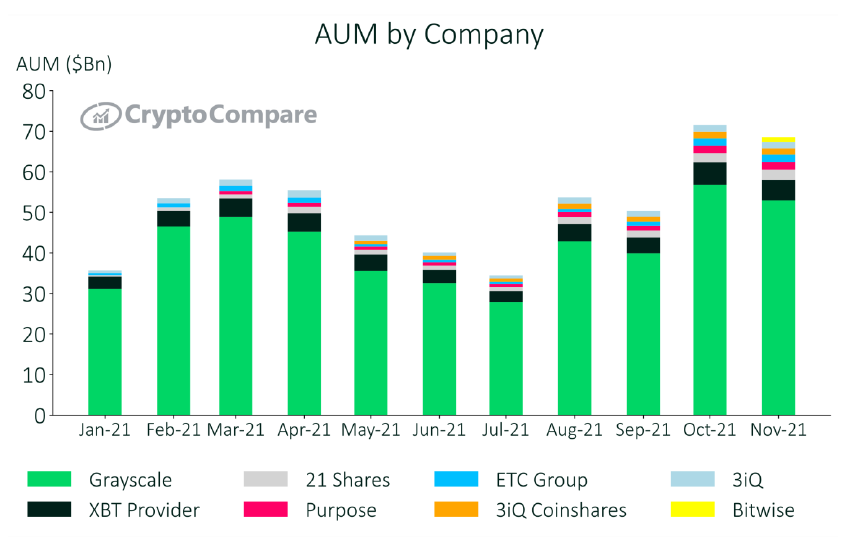

Of the complete AUM solutions made available by the world’s primary hedge money, grayscale solutions accounted for 76.eight% of AUM. However, grayscale dominance fell six.eight% to $ 54.five billion. Other important organizations involve XBT Provider ($ five billion, seven.two%) and 21Shares ($ two.five billion, three.six%), as evidenced by the graph under.

However, although Grayscale noticed a decline in the all round investment index, that did not halt primary US investment financial institution, Morgan Stanley, from raising its publicity to Bitcoin, holding in excess of $ 300 million in GBTC shares.

At the very same time, Bitcoin fishermen seem to be uninterested in the BTC correction, information from the chain exhibits that they have taken the uncommon chance to “pump” much more than $ three billion to rack up much more BTC in the encounter of worry. the marketplace in excess of the previous week, which incorporated a hundred BTC extra by El Salvador.

Synthetic Currency 68

Maybe you are interested: