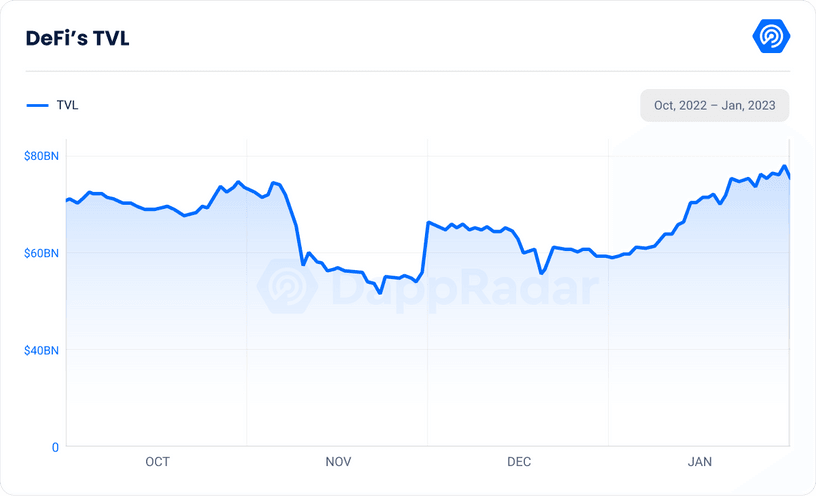

According to the regular monthly newspaper from DappRadarthe DeFi sector has proven indicators of recovery given that the starting of this 12 months, closing January 2023 with $74.six billion in frozen assets (TVL).

The volume of assets returned to DeFi protocols in January 2023 elevated by 26.82% in contrast to December final 12 months, to $74.five billion. According to the information of DappRadar, This is also the highest TVL degree in the final four months given that the minimal $50 billion in November.

Lido Finanza is The DeFi protocol has the greatest volume of TVL, dethroned MakerDAO earlier this 12 months. Currently Lido nevertheless holds up, the platform’s TVL has noticed an raise of 36.77% in the final month and has reached eight billion bucks.

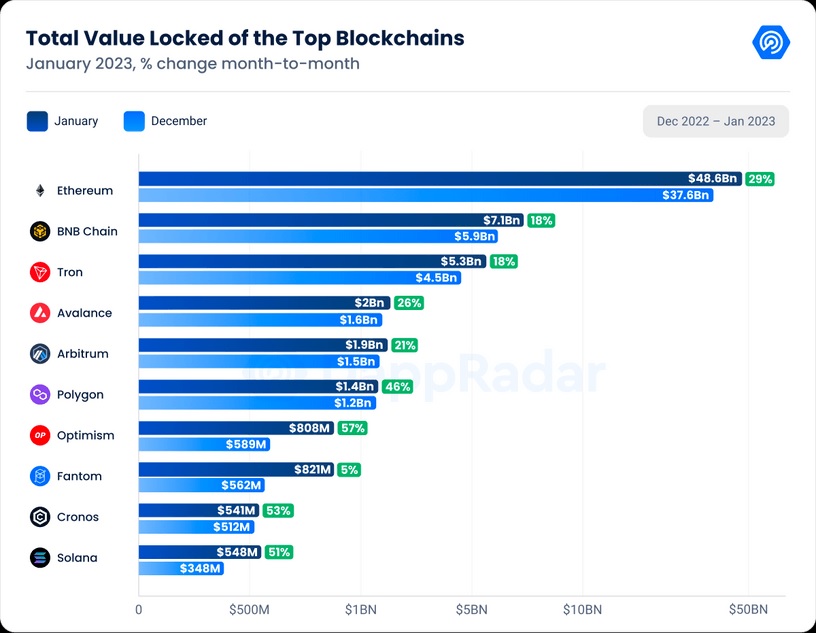

In terms of chain-broad TVL, Ethereum (ETH) prospects in TVL volume at $48.six billion, up 29% from $37.six billion in December 2022.

BNB Chain (BNB) and Tron (TRX) ranked 2nd and third respectively with $seven.one billion and $five.three billion TVL. Both of these blockchains have noticed an 18% raise in TVL given that December of final 12 months.

Notably, regardless of getting in seventh spot in the ranking, Optimism (OP) nevertheless stands out as it posted robust development for the month, jumping 57% from $589 million in December to $589 million in December and $821 million in January.

Cronos (CRO) and Solana (SOL) are the 2nd and third series to publish similarly robust development prices of 53% and 51% respectively.

Synthetic currency68

Maybe you are interested: