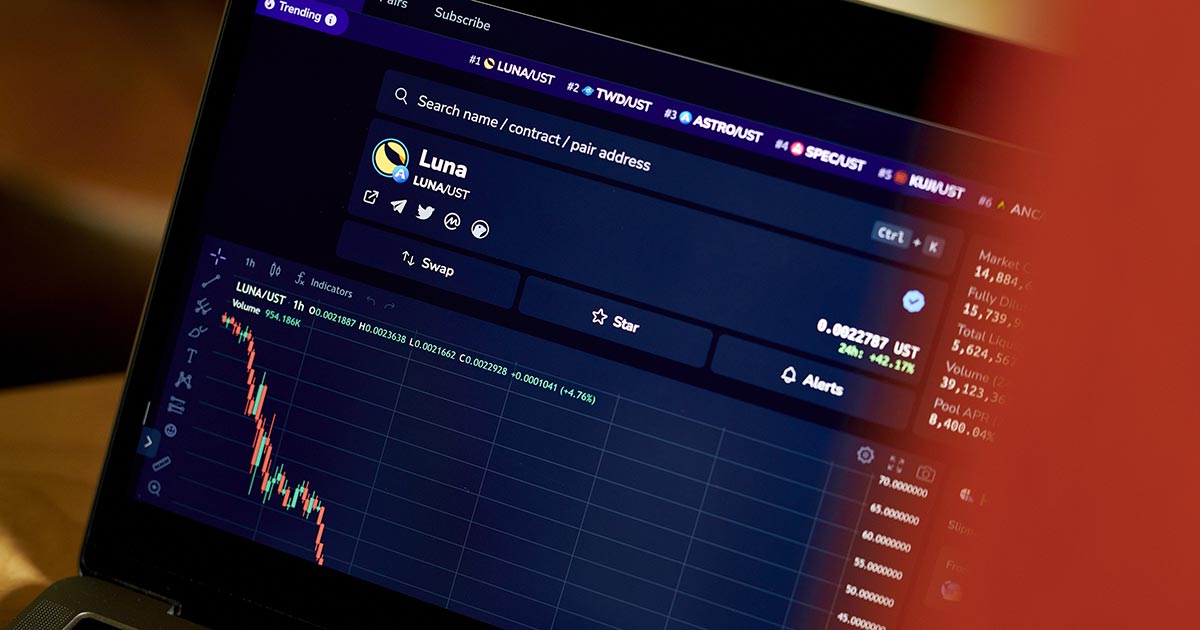

After the SEC, it is the US Department of Justice’s flip to even further investigate the lead to of the collapse of the LUNA-UST venture pair in May 2022.

According to sources of Wall Street JournalThe US Department of Justice has opened an investigation into cryptocurrency venture Terra (LUNA) and stablecoin TerraUSD (UST), raising the chance of criminal fees towards founder Do Kwon.

—db (@tier10k) March 13, 2023

Notably, the US Federal Bureau of Investigation (FBI) and the Southern District Attorney’s Office in New York have begun interviewing former staff of Terraform Labs, the firm behind the two cryptocurrencies, as properly as seeking into their extra in-depth investigations .

The prosecutor is explained to be recounting discussions concerning the industry’s top rated investment money, which include Jump Trading, Jane Street and Alameda Research, with regards to the strategy to “save” LUNA-UST in May 2022.

While no bailout has been announced for the $60 billion cryptocurrency ecosystem, authorities seem to be figuring out regardless of whether or not this kind of investment money are manipulating the market place.

Earlier, in February 2023, the US Securities and Exchange Commission (SEC) charged Do Kwon with billions of bucks of fraud by the LUNA-UST venture pair and explained the two coins are stocks.

Additionally, the SEC indictment also mentions an unnamed “American investment fund” that engaged in off-chain transactions with Terraform Labs to subsidize UST throughout the May 2021 depeg. That investment fund manufactured massive earnings from the agreement with Terraform Labs and designed the false impression that the stablecoin’s UST working model is steady in accordance to the predetermined algorithm, offering traders the self-assurance to preserve depositing revenue.

There are quite a few speculations that the investment fund is Jump Crypto, the subsidiary that participates in the cryptocurrency market place of Jump Trading.

Since the collapse of LUNA-UST, Kwon has deliberately evaded authorities in Singapore and South Korea, with rumors that he would stay in Serbia. South Korean authorities, who ordered Do Kwon’s arrest and canceled his passport, sent representatives to Serbia to proceed the search for Do Kwon. It was lately reported that the CEO of Terraform Labs is getting ready to return to the cryptocurrency market place with a amount of new tasks.

Synthetic currency68

Maybe you are interested: