The Real USD (USDR), a stablecoin whose worth is backed by true estate, fell to $.five due to significant consumer withdrawals.

The USDR stablecoin backed by true estate depegs 50% of worth

The USDR stablecoin backed by true estate depegs 50% of worth

On the evening of October eleven, 2023, the Real USD (USDR) stablecoin issued by TangibleDAO – a Real World Asset (RWA) task – misplaced practically 50% of its worth. According to the TangibleDAO web page, the asset is explained to be “a new currency backed and backed by real estate, offering returns of 8-15% per year.”

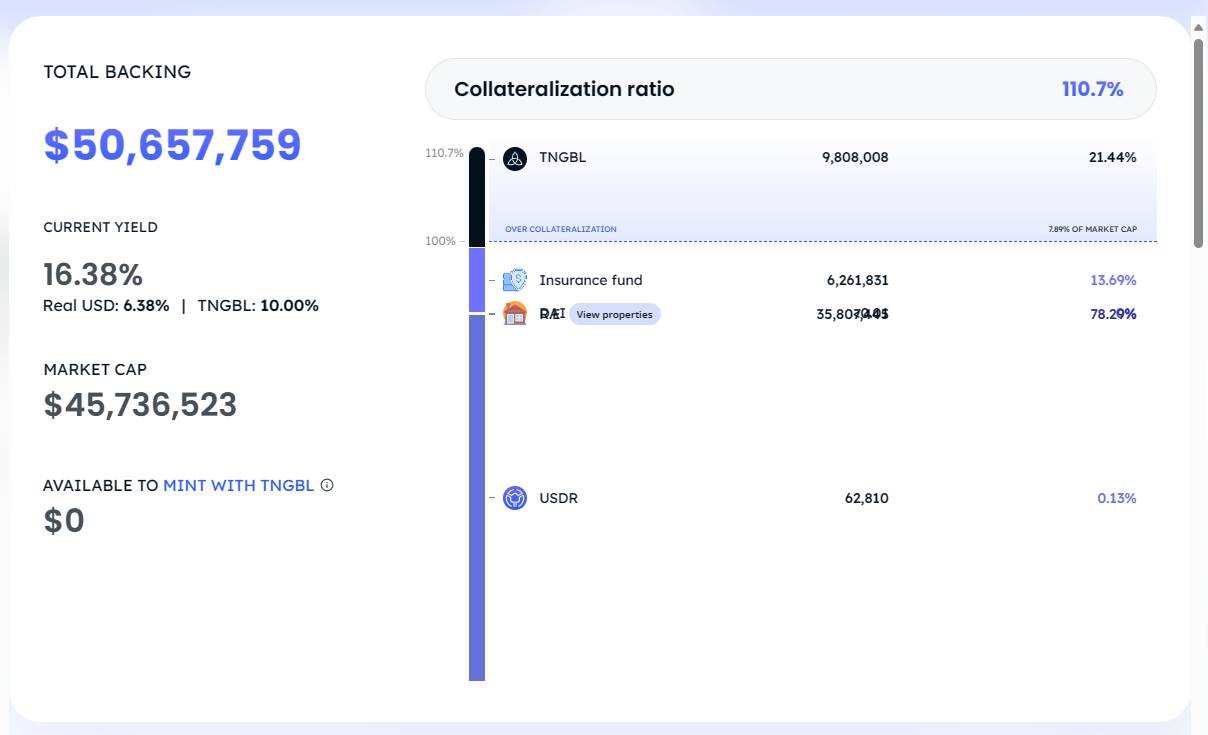

Before the depeg predicament occurred, Coingecko information showed that USDR had a market place capitalization of all around $45 million and was pegged at a price tag all around $one. Currently, the market place capitalization of this stablecoin only exceeds $41 million and has dropped to .5065.

The 24-hour chart on Coingecko displays the “dumping” worth of the USDR stablecoin. Photo taken at 00:05 on October twelve, 2023

The 24-hour chart on Coingecko displays the “dumping” worth of the USDR stablecoin. Photo taken at 00:05 on October twelve, 2023

Stablecoins (also recognized as steady coins) it is a digital currency pegged to a different steady asset, this kind of as gold or fiat currency (USD, EUR, British Pound). During intervals of intense volatility, they also deviate from the unique $one degree (also recognized as depeg) as traders eliminate self confidence in the collateral, leading to a shift in worth relative to the asset they signify.

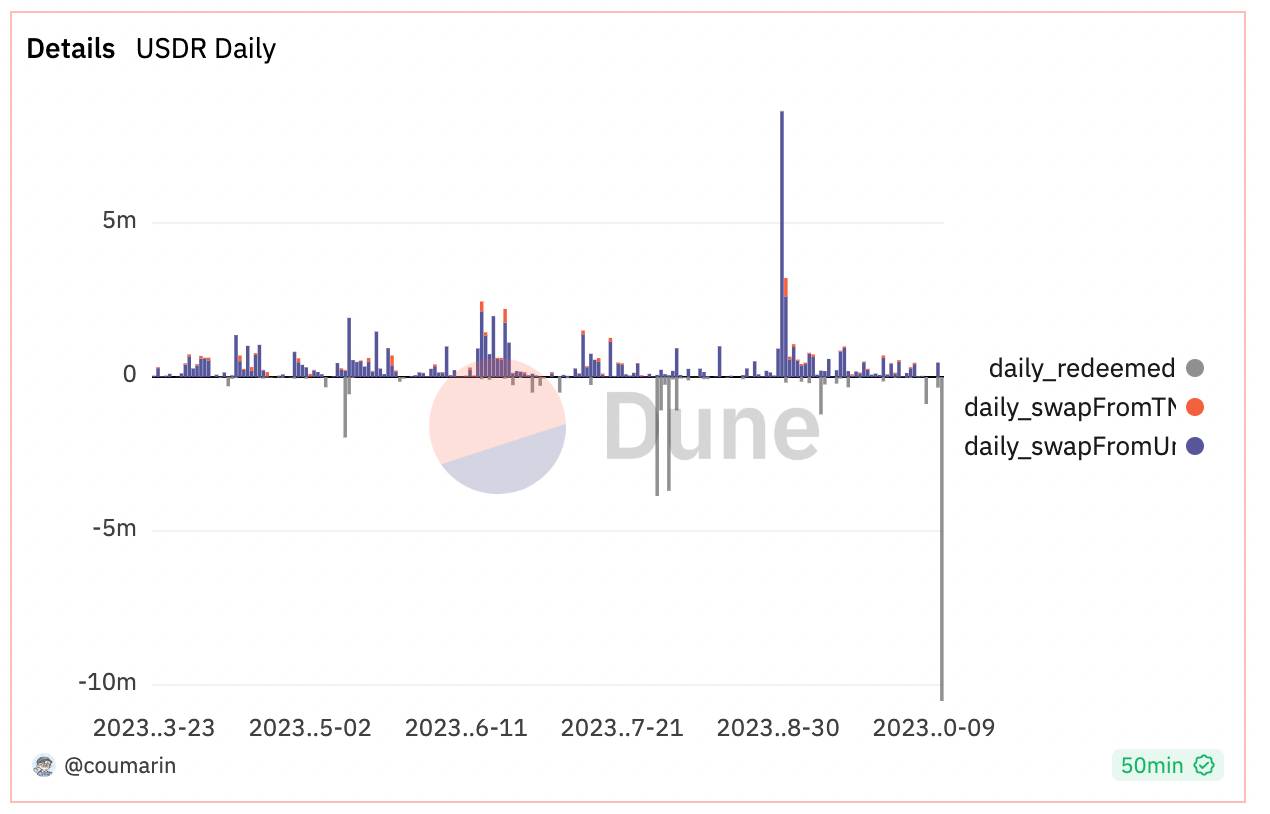

But in the situation of the USDR stablecoin, its virtually -50% reduce in worth is a unusual situation in the cryptocurrency area (with the exception of the LUNA-UST collapse). Data from on-chain analyst Dune displays that the USDR seems to have collapsed amid a wave of significant withdrawals.

Data from on-chain analyst Dune displays that the USDR has been topic to significant withdrawals

Data from on-chain analyst Dune displays that the USDR has been topic to significant withdrawals

This is understandable due to the fact most of this stablecoin’s collateral consists of illiquid assets this kind of as true estate and DAI liquid assets. It seems that the $eleven.eight million in collateralized DAI stablecoins as of October ten was fully “drained” all through the withdrawal approach, leaving only illiquid assets remaining.

$USDR flat development week/week and two new properties additional to treasury.

Let’s continue to keep creating 🏘️ pic.twitter.com/r8quXxgrbB

— Tangible 🏠💙 (@tangibleDAO) October 10, 2023

Information Even the collateralized assets on the task homepage plainly demonstrate that the USDR stablecoin is now underneath-collateralized if you exclude TangibleDAO’s native TNGBL token. The information also displays that some USDR stablecoins are collateralized by the USDR itself!

Other TangibleDAO-associated coins this kind of as TNGBL or CVR tokens are also falling significantly as of this creating.

TNGBL token price tag fluctuations in the final 24 hrs, screenshot by CoinGecko at 00:05 on October twelve, 2023

TNGBL token price tag fluctuations in the final 24 hrs, screenshot by CoinGecko at 00:05 on October twelve, 2023

CVR token price tag fluctuations in the final 24 hrs, screenshot by CoinGecko at 00:05 on October twelve, 2023

CVR token price tag fluctuations in the final 24 hrs, screenshot by CoinGecko at 00:05 on October twelve, 2023

This is not the initial time that “stablecoins” have been “destabilized”. The final time depeg occurred was in August and lasted until finally September 2023 for USDT, the cryptocurrency investment community’s favourite USDT stablecoin. In early 2023, mother or father firm Circle’s USDC stablecoin also suffered a sharp decline due to the effect of the Silicon Valley Bank collapse.

Coinlive compiled

Join the discussion on the hottest challenges in the DeFi market place in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!