Not just GBTC, quite a few other main merchandise in Grayscale’s investment issuance portfolio are in a “crisis” state.

According to the statistics of Y chartsSeven cryptocurrency merchandise made available by asset management company Grayscale Investments as shares are at present trading at spreads ranging from -34% to -69% relative to marketplace selling price (NAV).

Holdings tracked in the evaluation include things like Grayscale Bitcoin Trust, Ethereum Trust, Ethereum Classic Trust, Litecoin Trust, ZCash Trust, Horizen Trust, Stellar Lumens Trust, and Livepeer Trust. As a end result, Grayscale Stellar Lumens Trust has the lowest NAV at -34% and Grayscale Ethereum Classic Trust has the highest NAV at 69%.

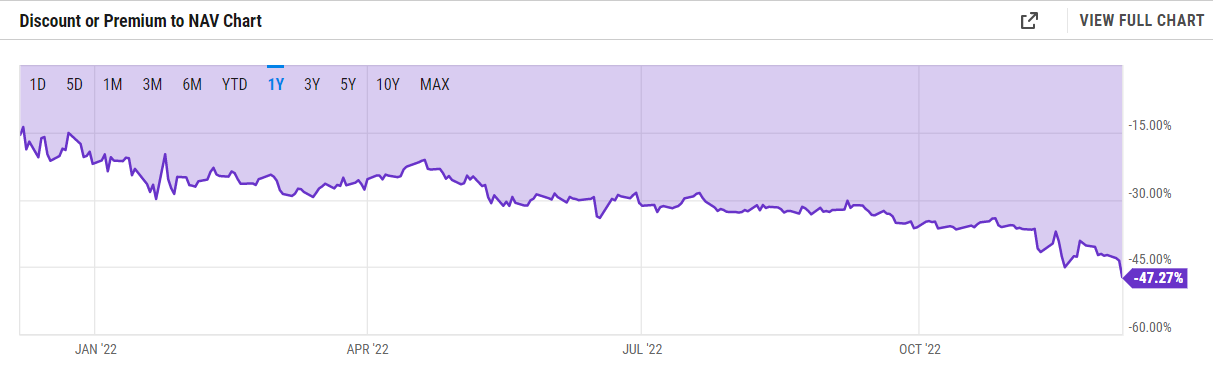

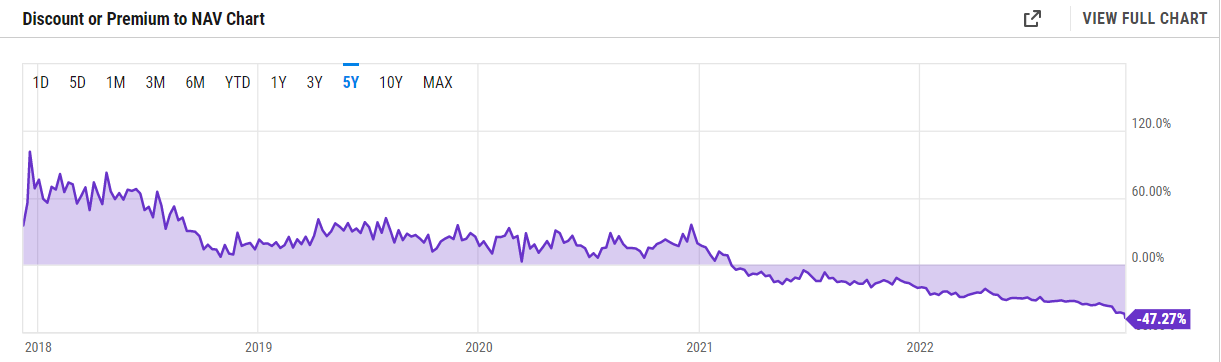

On the other hand, Grayscale Bitcoin Trust (GBTC) GBTC stock right after back-to-back NAV lows at -42.69% and -45.08% about two weeks in the past, as of this creating, GBTC continues to slump falling to – 47.27% .

What is regarding is that Grayscale Bitcoin Trust (GBTC) is taking part in the purpose of the greatest Bitcoin investment fund in the planet with a BTC worth of all over $ten.eight billion. Basically GBTC is witnessed as a stock representing Bitcoin, institutional and personal traders can acquire GBTC by means of a US stockbroker account. In other phrases, GBTC is the indicates of indirect publicity to Bitcoin.

The “unstoppable” devaluation of GBTC with the selling price of Bitcoin has proven that investor demand is now critically declining, no longer also salty to expose the sector. Because due to the fact the release of GBTC in 2013, the products has been extremely warmly acquired. At its peak in the course of 2018-2021, GBTC has constantly held over the selling price of Bitcoin, at occasions the NAV reached more than a hundred%.

The rising pessimism surrounding self confidence in merchandise issued by Grayscale is rooted in a series of failures by the firm in its strategies to launch a Bitcoin ETF.

First, the SEC rejected the company’s application for GBTC as an ETF on June 29, arguing that the proposal failed to show how the products was created to stop fraud and manipulation. Grayscale responded later on with a lawsuit towards the SEC, but the firm’s legal employees estimated that the litigation could get up to two many years and every little thing appeared to come to a standstill with no progress.

In November 2021, Grayscale’s mother or father firm, cryptocurrency hedge fund Digital Currency Group (DCG), faced insolvency rumors, primarily right after a further DCG subsidiary, Genesis Global Capital, halted withdrawals on Nov. sixteen, citing liquidity complications linked to the collapse of the FTX Exchange.

As a end result, the neighborhood urges Grayscale to swiftly generate evidence of its supporting crypto assets for the company’s merchandise. However, Grayscale did not approve, citing protection worries. Instead, the firm shared a letter from Coinbase Custody attesting to the quantity of assets it holds.

Synthetic currency68

Maybe you are interested: