The USDC depeg is producing traders nervous about asset shifts, even though also contributing to the spike in trading volume on DeFi platforms.

This previous weekend was certainly a really “busy” time for the cryptocurrency neighborhood. We see panic overwhelm as the USDC stablecoin heavily depegs due to the influence of Silicon Valley Bank and related hazards in other regions.

When consumers flee crypto assets to far more safe assets, it also suggests that on-chain exercise is far more extreme, contributing to the spike in transaction volume on a lot of DeFi platforms.

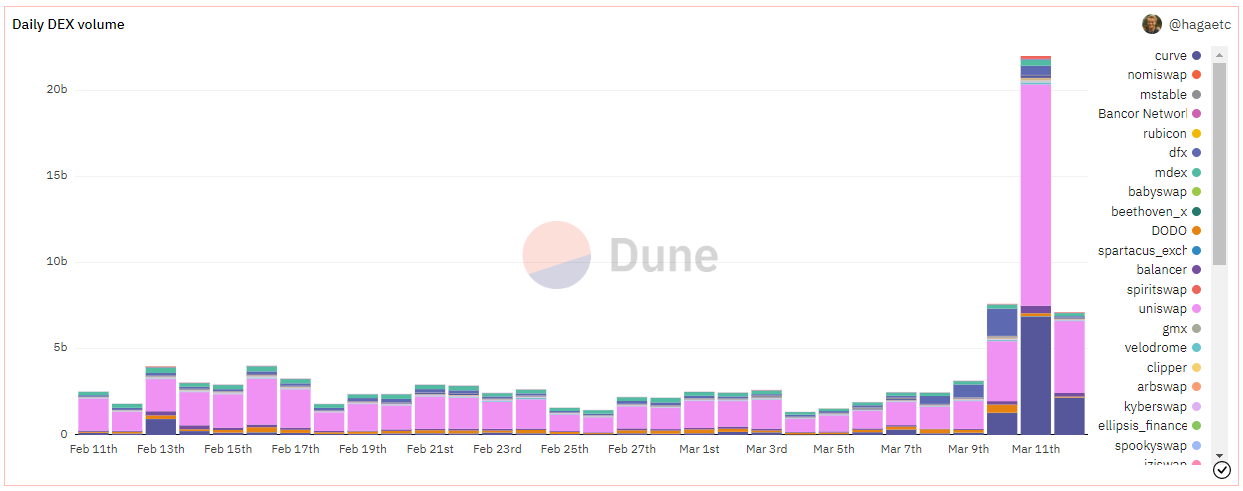

As of three/eleven/2023, the foremost DEX in the marketplace nowadays is uniswap recorded the highest each day trading volume in historical past, a $eleven.84 billion. This variety is even almost double the just lately broken record of $six.67 billion.

Yesterday, it recorded the highest each day USD volume on record @Uniswap Protocol!

$eleven.84 billion, almost double the day of 2nd spot.@DuneAnalytics: https://t.co/KMQxfmlIlo pic.twitter.com/pn9X9yBNHq

—Austin Adams (@AustinAdamsten) March 12, 2023

Curve it also noticed the peak in each day trading volume eight billion bucks. The project’s Twitter tweeted to congratulate the milestone:

eight https://t.co/moNX9E0O1Z

— Curve Finance (@CurveFinance) March 11, 2023

March eleven is also the day DEX exercise peaked, when complete volume greater “breakthrough,” as the chart under demonstrates:

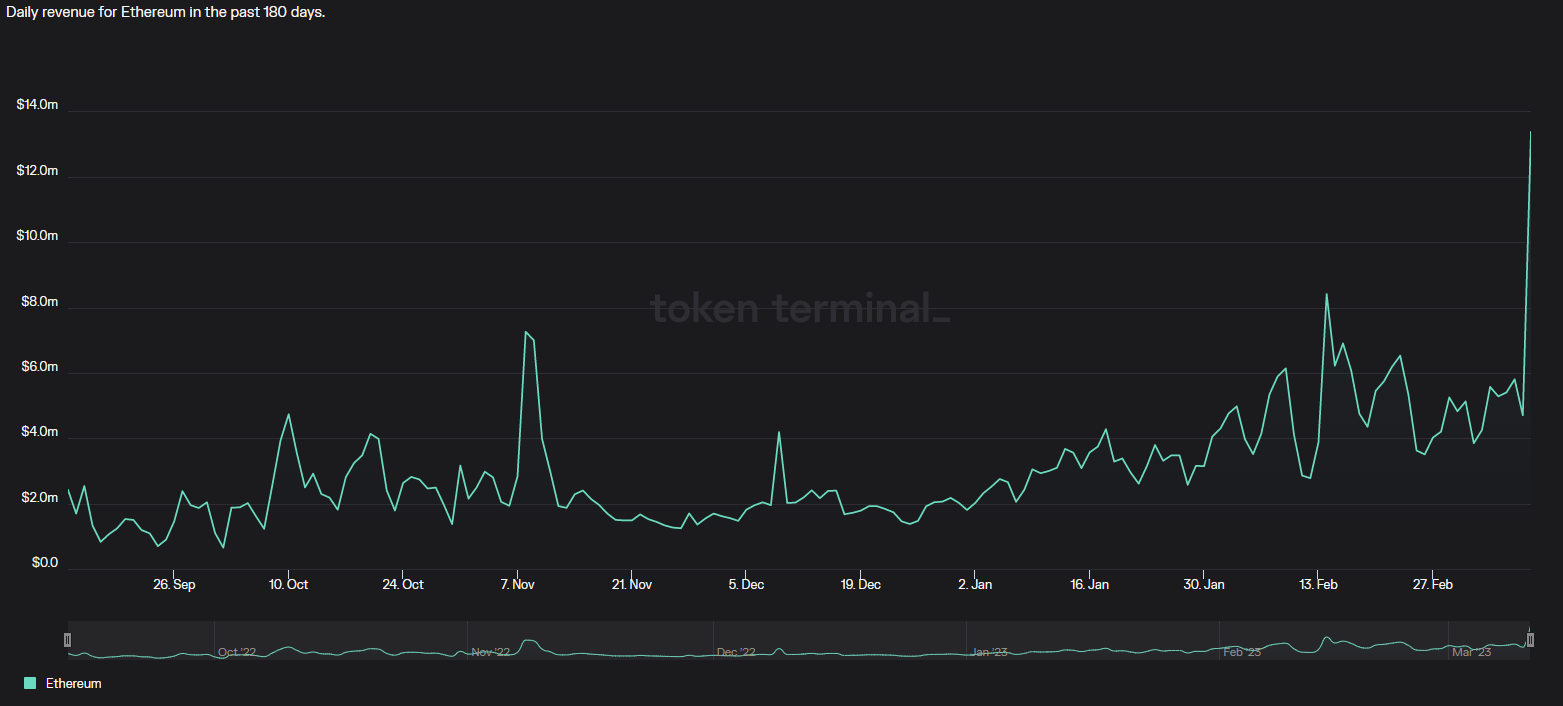

Volume development like this is right reflected in platform income. Since most DEXs earn based mostly on consumer transaction costs, an raise in volume suggests a massive raise in charge income.

Daily turnover of Ethereum record the peak $13.four million on March eleven, far more than doubled from the preceding day to just $four.seven million.

But on-chain asset transfers will not normally go “smoothly”. As it was Coinlive new, yes investors trade 2 million USDC but receive only 0.05 USDT because they are locked in the MEV. This was explained by KyberSwap and they uncovered a way to correct it.

Synthetic currency68

Maybe you are interested: