The previous week has been rough for crypto traders as the information from September 24-25 showed that the top rated one hundred altcoins misplaced up to 14.four% of their complete worth when Bitcoin (BTC) misplaced twelve.five. %.

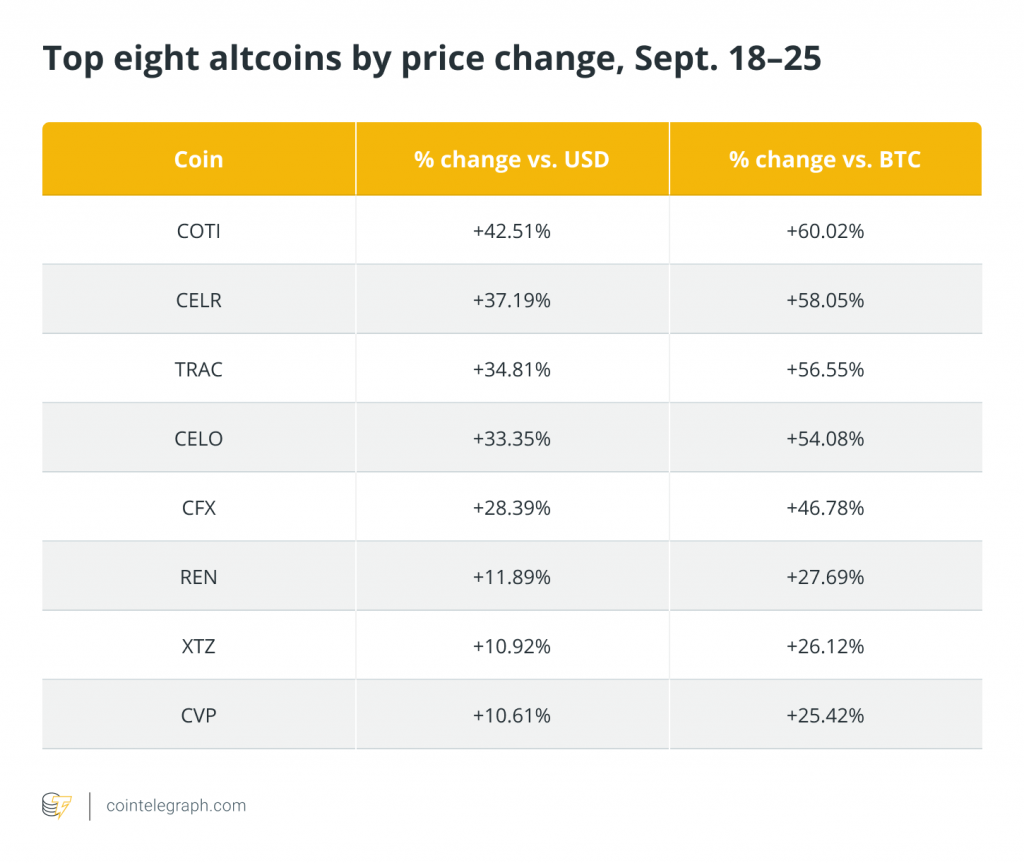

The quantity of altcoins with double-digit returns is also exceptionally very low. Data Markets Pro, Cointelegraph’s subscription-based mostly information intelligence platform, demonstrates that only eight of the hundreds of assets tracked are up a lot more than ten% towards the US dollar.

Since trading is a frequent stream of earnings and losses, how can traders spot coins that are very well positioned to climate the storm?

The finest men and women in a challenging week

The table under lists eight altcoins that have managed to make robust earnings even in the course of the Red Sea that swept the industry final week.

COTI continues a winning streak fueled by the current release of the Coti Treasury white paper, an asset listing on Crypto.com, and the anticipation of a new stablecoin partnership with Cardano.

CELR’s momentum accelerated following the introduction of Celer Network’s cBridge two. cross-chain, developed to facilitate the transfer of digital money amongst key blockchains.

The third finest asset of the week, Trace (TRAC), is the native token of OriginTrail, a blockchain ecosystem and protocol that aims to strengthen worldwide provide chains by giving an infrastructure for information sharing. trustworthy. The token’s valuation has elevated in current instances thanks to a quantity of constructive developments this kind of as: adoption OriginTrail based mostly SCAN Trusted Factory resolution.

TRAC and REN also announced pretty large VORTECS™ scores final week. VORTECS™ Score is a machine mastering algorithm that compares existing and historical industry situations close to crypto assets to assistance traders make a lot more informed choices.

The model examines a selection of quantitative indicators – which include industry outlook, selling price action, social sentiment, and trading action – to make a score that measures whether or not a coin is presently bullish. selling price, neutral or bearish.

Here’s how it worked for TRAC and REN final week.

VORTECS™ has found the to start with indicators of a breakthrough

The VORTECS™ model is optimized to recognize persistent industry and social action patterns that occurred more than the previous twelve to 72 hrs just before the coin rallied. A score of 80 or larger signifies that the situations observed have a historical past of robust uptrends.

TRAC selling price fluctuated in the course of the week from the most affordable VORTECS™ level – from the lows to the mid-70s. A large of 81 swiftly appeared late on September 21 (red circle on the chart), indicating dependence model’s developing dependence on the surrounding industry patterns and social action. This coin seems historically bullish.

Although the selling price drop began shortly following the highest VORTECS™ score, TRAC swiftly turned close to and initiated a two-day rally from $.37 to $.56.

REN prices decreased steadily in the course of the to start with two weeks amid a pretty large VORTECS™ series of scores.

REN sooner or later hit $.70 just before commencing to rally yet again, and shortly following that the 2nd set of VORTECS™ scores of 80 or larger appeared. Connoisseurs know that an asset with a VORTECS™ score that stays large for an extended time period of time – even if the selling price is flat – can present fantastic revenue options.

In reality, at the finish of September 23, the selling price of REN rose from $.81 to a large of $one.13 about 29 hrs later on.

Digital assets do not usually carry out as they have witnessed in the previous, primarily in the course of industry downturns.

After all, of the eight finest doing coins final week, only two produced well-known bullish patterns just before their costs skyrocketed. However, the more info that the VORTECS™ Score presents traders can be invaluable in a problem in which pretty handful of coins are anticipated to beat a struggling industry.

Cointelegraph is a monetary info publisher, not an investment advisor. We do not deliver individual or customized investment information. Cryptocurrencies are volatile investments and come with sizeable dangers, which include the danger of everlasting reduction and complete reduction. Past efficiency is no ensure of long term benefits. Figures and diagrams are appropriate at the time of planning or in accordance with other rules. Directly examined methods are not suggestions. Consult your monetary advisor just before producing any monetary choices.

.

.

.