Three Arrows Capital (3AC) failed NFT StarryNight assortment was identified unexpectedly moved to a new Ethereum wallet.

Of the numerous queries that even now surround Three Arrows Capital (3AC) right after its default, one particular of the most vital worries the fate of the company’s lavish NFT StarryNight assortment. However, the response is getting clearer now as assets are now becoming moved to a new portfolio.

According to a report by the crypto analytics platform Nansen, NFTs belonging to Starry Night Capital, a fund founded by Three Arrows Capital and pseudonymous collector Vincent Van Dough in 2021, will be moved to a new wallet, particularly: quite possibly a Gnosis Safe wallet. .

Gnosis Safe is a well-known Ethereum wallet that involves several signatures to approve transactions. Nansen explained 383 NFTs had been transferred to the new wallet at press time, whilst the former wallet even now is made up of 80 NFTs. Most of the NFTs had been moved on the evening of three/ten.

NFTs previously collected by Starry Night Capital are moving to a safe handle in Gnosis.

These NFTs include things like:

– Pepe the Frog NFT Genesis, offered for one,000 ETH (~ $ three.five million) on five October 2021

– Fidenza # 718, offered for 240 ETH (~ $ one.1M) on November 13, 2021Some other noteworthy NFTs below👇 pic.twitter.com/8PU13CqMnn

– Nansen (@nansen_ai) October 4, 2022

In reality, Three Arrows Capital and Vincent Van Dough launched the $ one hundred million Starry Night Capital in August 2021 and carry on to invest heavily, obtaining a variety of higher-worth Ethereum NFT assets. The fund is announced to the globe right after the acquisition of NFT Art Blocks Ringers from artist Dmitri Cherniak for an ETH worth of around $ five.66 million.

Other notable NFTs collected by Starry Night Capital include things like NFT by artist Matt Furie Pepe the Frog Genesis well worth $ three.five million in ETH and a trio of NFT artists dubbed XCOPY with a cost tag ranging from one.four million to two million. , three million USD ETH. Additionally, Starry Night Capital also is made up of numerous CryptoPunks, Rare Pepes, and other big collectibles.

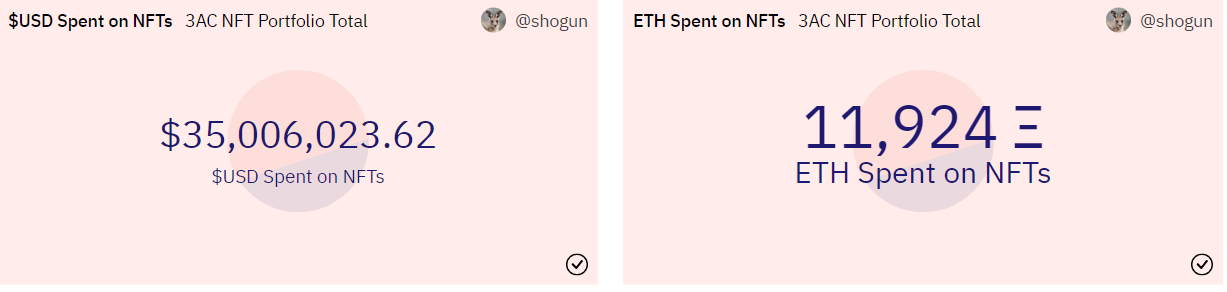

It is unclear no matter if the fund will eventually increase and invest the $ one hundred million planned for assortment functions. The dashboard on the Dune blockchain information platform exhibits that Starry Night Capital only invested close to $ 35 million on ETH.

Furthermore, it is tricky to decide the existing worth of several NFTs, as numerous NFTs are single-edition performs of artwork or aspect of collections with minor liquidity. As a consequence, Nansen sets the aggregate worth of the most liquid assets at 625 ETH, or close to $ 846,000, but notes that a lot more than 89% of NFTs are illiquid. Many properties seem to have been undervalued relative to their unique buy charges.

Because the NFT market place has considerably declined in worth considering the fact that the industry’s heyday in 2021. As the cryptocurrency business started to plummet in early 2022, the estimated charges of numerous “blue chip” NFT assets plummeted. . Likewise, trading volume at the NFT market place degree has also decreased considerably in current months, whilst a number of million NFTs are even now becoming offered just about every month but at a decrease cost.

However, this is pretty surprising information mainly because Three Arrows Capital is explained to have offered out NFT StarryNight well worth more than $ 21 million in June 2022 as one particular of the “final” answers for Three Arrows Capital to have a lot more dollars to repay in context. of a liquidity crisis.

two / Some background: 3AC launched Starry Night Capital final summer time beneath the pseudonym of NFT collector Vincent Van Dough with the aim of raising $ one hundred million and “assembling the world’s best NFT collection”https://t.co/sgXxSiQSJl

– Kyle Waters (@kylewaters_) June 15, 2022

Synthetic currency 68

Maybe you are interested: