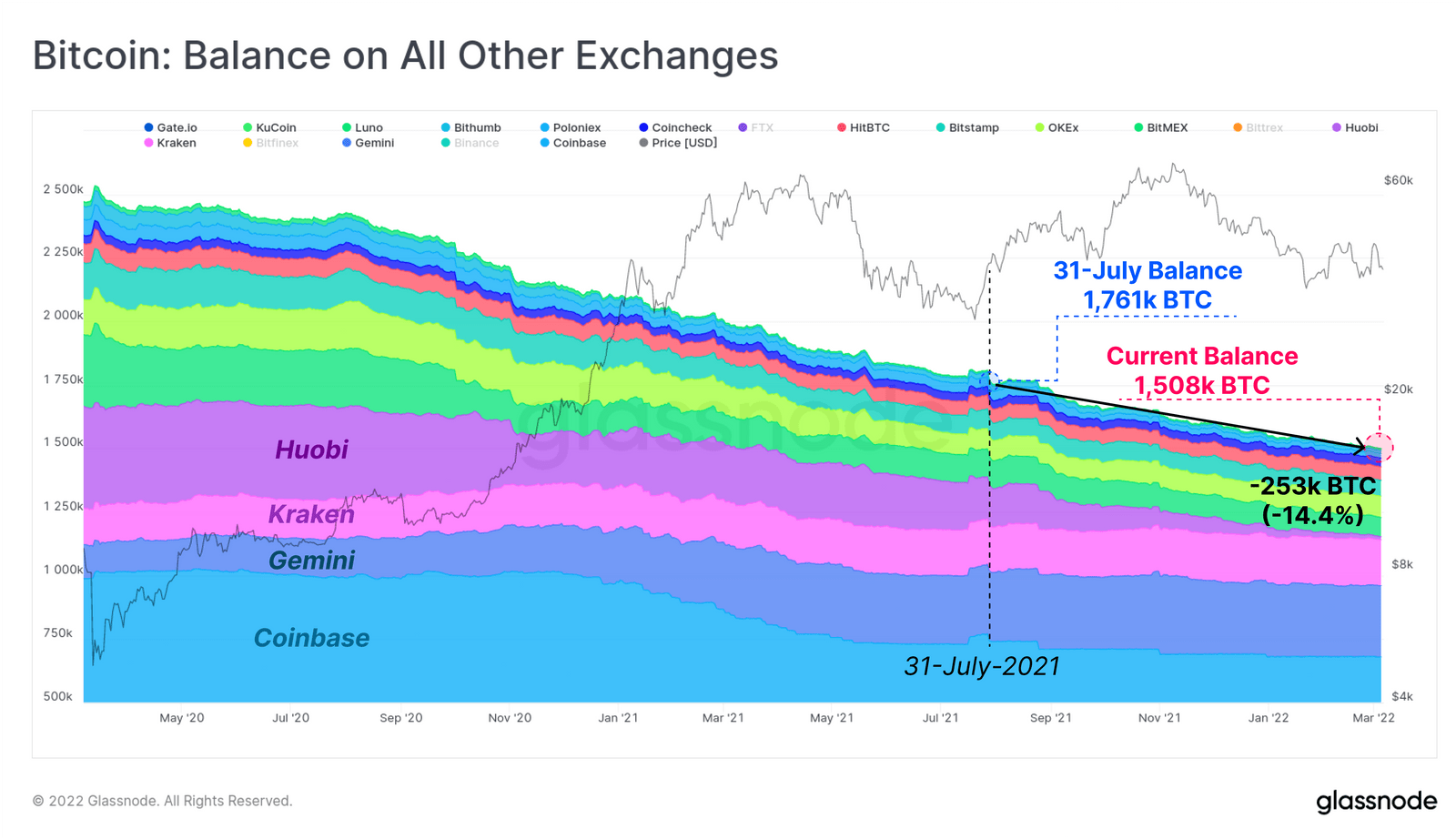

There have been additional Bitcoin withdrawals than deposits on most exchanges except Binance, FTX, Bittrex and Bitfinex given that final July, suggesting that sellers could be “burned” in the prolonged run.

Although the quantity of “dormant” Bitcoin offerings is reaching an all-time higher, it is relatively reassuring in the present market place correction. However, based mostly on the most recent information from Glassnode, the 4 greatest exchanges, Binance, Bittrex, Bitfinex and FTX have had a favourable (deposited) net inflow of 207,000 Bitcoins to date, up 24.three%.

Meanwhile, for other exchanges, up to 253,000 BTC has been withdrawn given that the finish of July 2021. Typically the situation of Huobi, which noticed the greatest all round decline, plummeting from 400,000 BTC in March 2020 to just twelve,300 BTC at press time. More than half of this drop in balances occurred just after the Chinese government’s Bitcoin mining ban in May and other restrictions imposed on widespread trading in September.

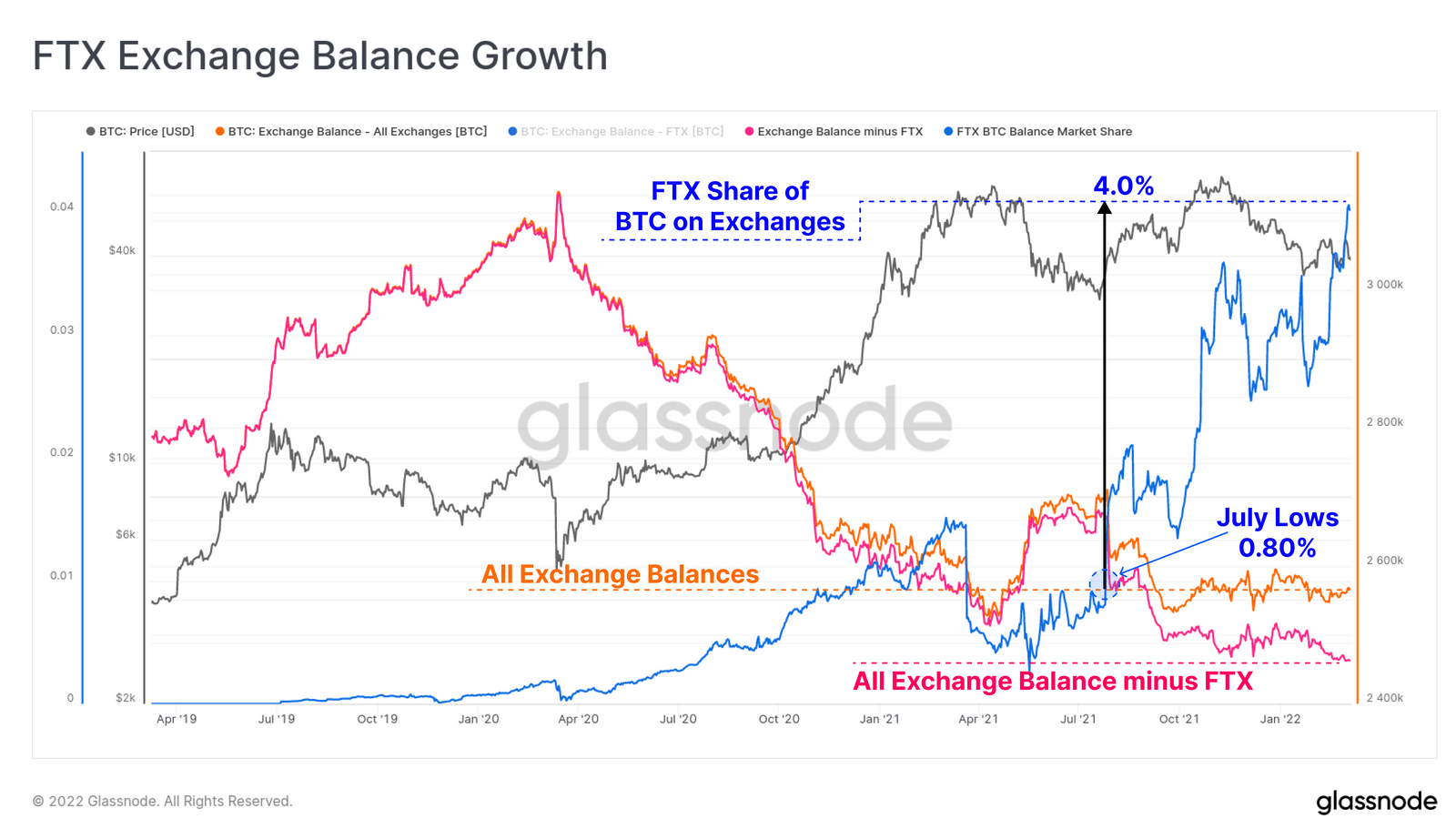

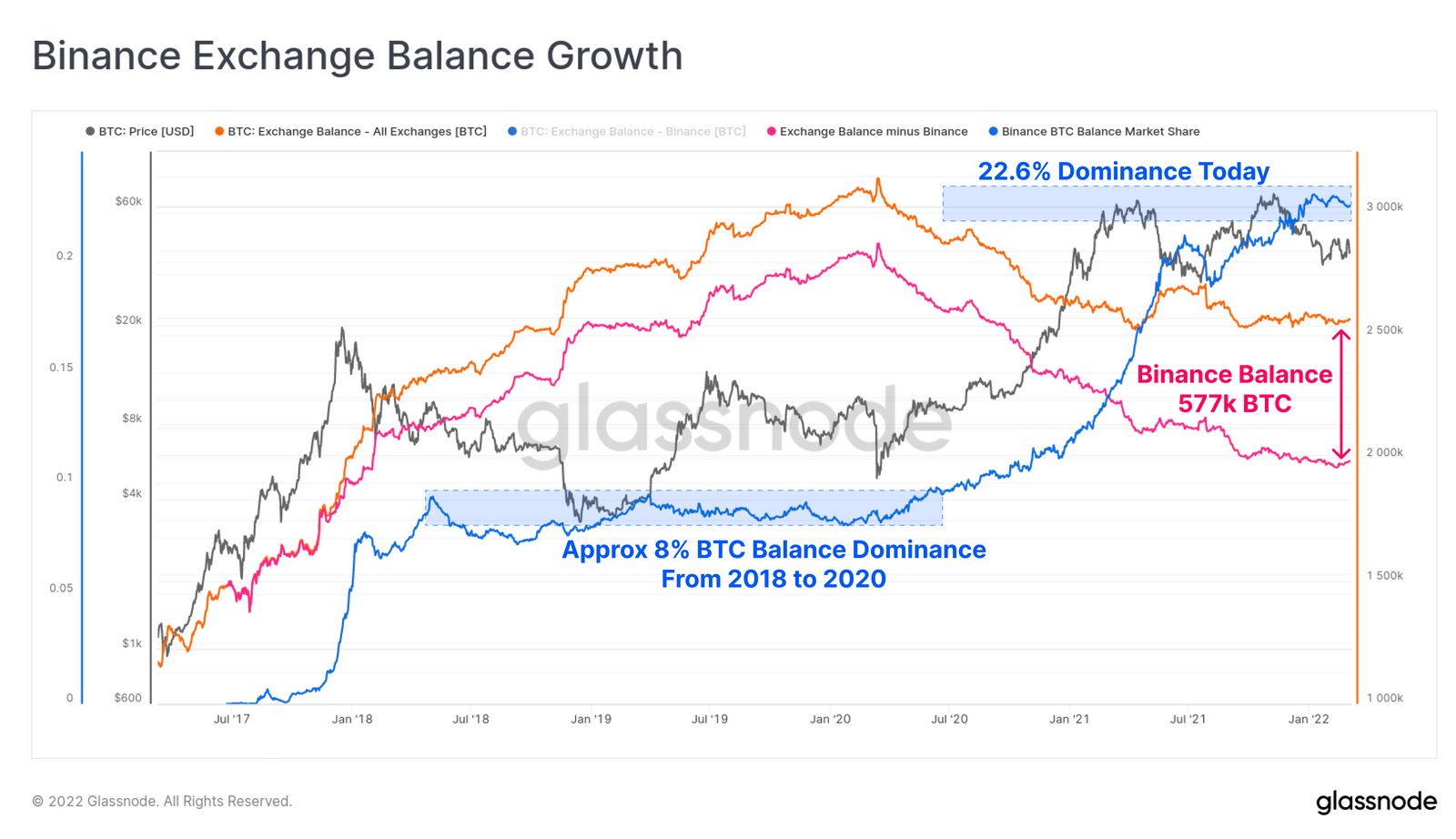

FTX and Binance in distinct actually stand out in terms of disruptive developments in the market place share domain (as measured by their BTC stability held). Note that the two Binance and FTX have a broad assortment of spot and derivative merchandise, so it is possible that the share of BTC on deposit from the two exchanges is largely allotted to collateral fund signing.

The complete volume of BTC held by FTX is at present estimated at 103,200 BTC, an extraordinary development from just three,000 BTC in March 2020. This represents a breakout of the stability of Bitcoin’s market place share in the planet growing from .eight% in July. 2021 at four% currently. If we take out holdings in BTC on FTX from the index of complete foreign exchange balances, we can see that this survey metric is at a new multi-12 months minimal, displaying the substantial footprint that FTX at present has.

Binance even now holds the crown of the most spectacular development in international market place share, growing from eight% in 2018-2020 to more than 22.six% now. The complete quantity of Bitcoins owned by Binance has greater by 315,000 BTC given that March 2020, an enhance of additional than 120% in just two many years.

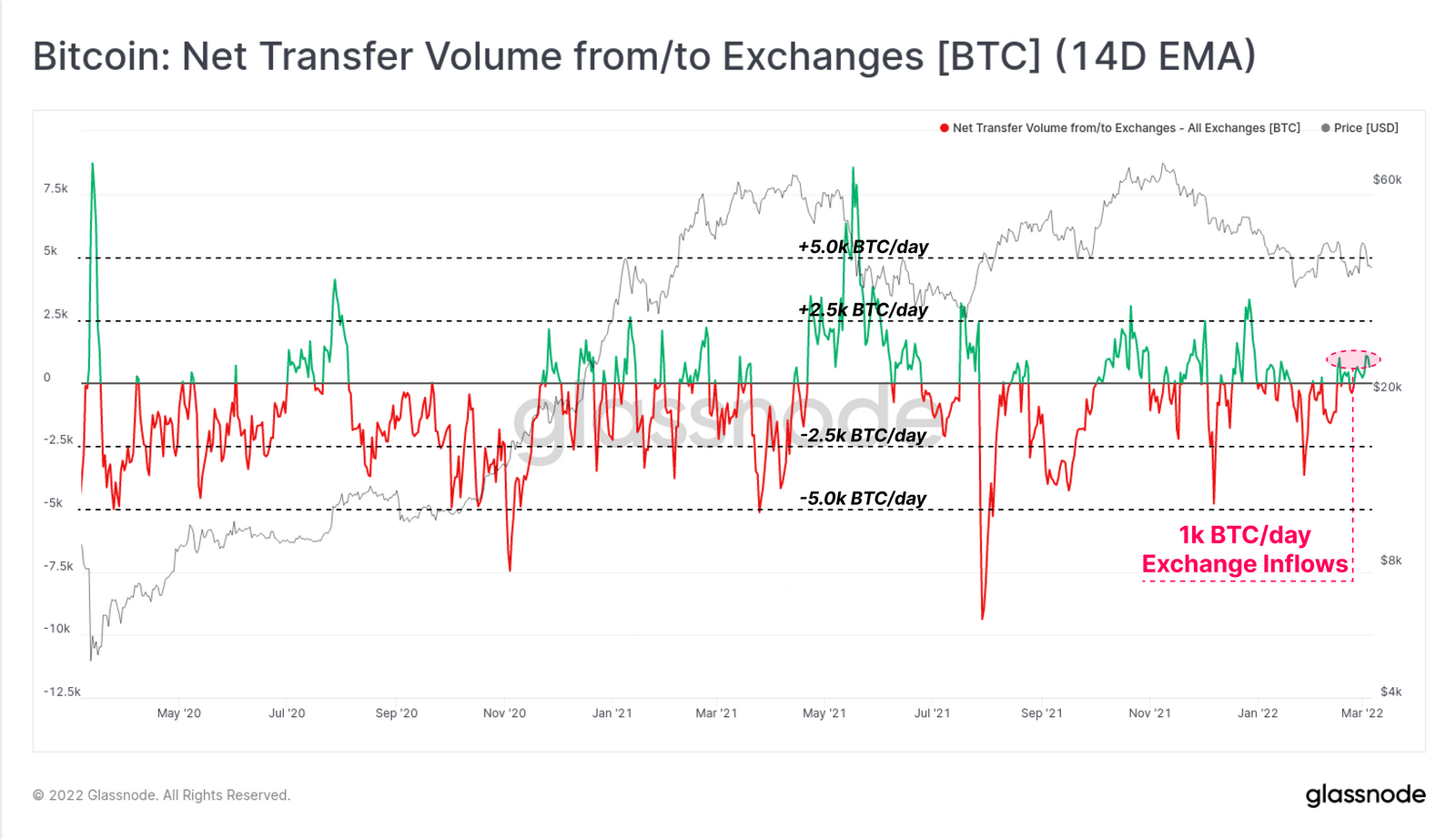

However, with the volatile geopolitical and macro occasions of the previous number of weeks, largely coming from the heart of the war among Russia and Ukraine, mixed with arguments from famed persons with terrific influence on the cryptocurrency sector, together with Ethereum founder Vitalik Buterin and co -founder Huobi Du Jun, the two declare that the market place has entered the phase of “crypto winter”, the stability of Bitcoin income flows on exchanges The epidemic has just been hit by the pandemic, remaining secure on a acceptable degree, whilst c ‘is a slight bias in direction of sellers this week.

Around one,000 BTC per day is pushed into the exchange, with Bitfinex and FTX dominating, a indicator that promote-side provide is even now pretty modest, specifically just after Bitcoin just continued plunging to $ 37,584, although Gold and commodity assets are even now pretty modest. greater, placing massive psychological strain on traders in the cryptocurrency market place.

Synthetic currency 68

Maybe you are interested: