Despite the bearish surroundings for the broader marketplace, stablecoin provide has risen to a new all-time higher of $ 180 billion.

The development of stablecoins continues to outperform other individuals, gaining six% more than the previous thirty days or $ 9.five billion to set up a new ATH at $ 180 billion.

📈Total stablecoin provide exceeded $ 180 billion in February 2022, in accordance to information collected by https://t.co/OiMrtD9yod

Despite the latest volatile surroundings, stablecoin provide has grown by $ 9.five billion more than the previous thirty days.

👉 https://t.co/sU4TuuTgEA pic.twitter.com/YGrGsgUNLe

– CryptoRank platform (@CryptoRank_io) February 23, 2022

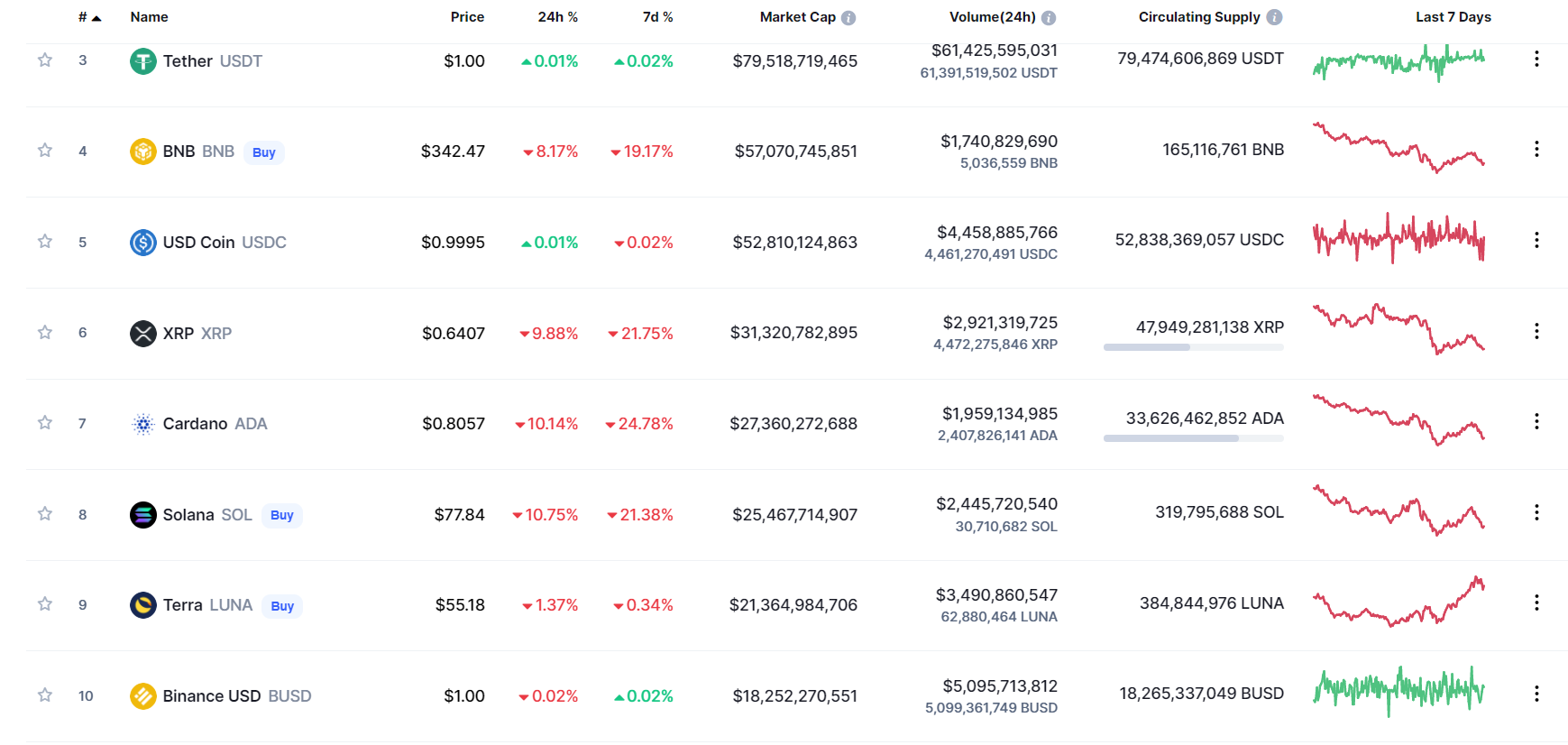

In February, 3 stablecoins created the marketplace major ten, like Tether (USDT), USD Coin (USDC) and BUSD, which with each other now account for 9% of complete marketplace capitalization.

While USDT now accounts for 44% of the industry’s marketplace share, which has stagnated more than the previous 12 months, USDT is creating a robust mark with twenty% development in 2022 thanks to Circle’s significant work, the enterprise behind USDC. According to Arcane Research, if each USDT and USDC proceed to preserve this kind of development charges, by the finish of June this 12 months USDC will overtake USDT to turn into the biggest stablecoin by marketplace cap. Previously, Messari had also stated that USDC will turn into the “dominant” stablecoin on Ethereum.

Because in 2021, legal obscurity and lots of media allegations towards Tether’s enterprise brought on USDT to shed some of its place. In May 2021, Tether very first announced the varieties of corporations it owned, but transparency has not been verified. Just three months later on, the enterprise continued to publish a new audit report to bolster public viewpoint, but there have been nevertheless much more “worrying” indications.

The culmination of the incident was when Bloomberg out of the blue launched a “shocking” report on Tether, revealing the total shady image relating to the USDT reserve fund and the crew behind the enterprise. To make issues worse, Tether and Bitfinex continued to be fined $ 42.five million for the USDT escrow situation. It is really worth noting that there is an intervention by the US Assets Futures Trading Commission (CFTC). Therefore, the skepticism that Tether has enough reserves to help USDT stays a big query mark.

However, a very good indicator came for Tether this 12 months as the enterprise just finished the release of a new enterprise approval report on Feb.23, with complete assets higher than complete liabilities, Tether says, could warrant the worth of USDT issued to the marketplace, indicating that the trajectory of USDT now seems to be selecting up.

Synthetic currency 68

Maybe you are interested: