See a lot more about Price Action:

In the prior sections, we realized a whole lot about technical evaluation and some value action trading tactics. Today’s report I want to share an equally significant subject with you: capital management and the trading mindset.

Why capital management?

For me personally, to be prosperous in trading, I will need three components:

- Exchange strategy

- Capital management strategy

- Business psychology

These are the three indispensable components to establish the accomplishment of a trader. First, you will need to have an successful trading strategy with a excellent payout percentage. Next, you will need to have a capital management prepare for just about every trade buy to make positive that if you have a halt reduction, your account will not be impacted also considerably. At that second, your trading psychology will be incredibly cozy, you can shut down your laptop / cellphone to do other function and wait for the market place to react.

Conversely, by missing only one particular of the 3 components described over, your trading benefits will surely not be excellent.

For instance:

– There is a excellent trading strategy, but you are incredibly “all-in”, so you only will need a very little fluctuation (even if not stoploss), but your account has “evaporated” a whole lot, foremost to instability and psychological reduction .

– You have a excellent strategy of capital management, but the trading strategy is not successful, or even with no a certain strategy, which prospects to a large price of reduction, the consequence is nonetheless a reduction.

Therefore, capital management is one particular of the factors you will need to study and adhere to immediately after coaching your trading strategy.

Also, immediately after shedding and shrinking the account, we will have to earn a lot more to “mend”. Let’s obtain out the% of development needed to recover the account immediately after losses of distinct degrees in the following table:

| Loss degree | % Growth necessary to carry account back to unique degree |

| five% | five.three% |

| 10% | eleven.one% |

| 15% | 17.six% |

| twenty% | 25% |

| 25% | 33% |

| thirty% | 42.9% |

| forty% | 66.seven% |

| 50% | one hundred% |

| 60% | 150% |

| 75% | 300% |

| 90% | 900% |

Therefore, when the reduction is only five%, we only will need a five.three% revenue to break even. However, when you eliminate 50%, you will need x2 to return to shore, when you eliminate 90%, you will need … x9 accounts. This is nearly incredibly hard.

How to handle the capital

For excellent capital management, the initially basis is a excellent trading strategy. I’ll speak a very little about the notion of possibility / reward ratio (also recognized as R: R for quick). A: R is the romantic relationship in between the possibility and the return of the transaction.

For instance: Long BTC at twenty,000, halt reduction at 19,000 and get revenue at 22,000, so R: R = one: two.

A excellent trading approach is normally a mixture of a large win price and R: R.

For instance: Your trading strategy has a 50% win price, R: R reaches one: two. So immediately after ten orders, on typical, there are five winning orders (+ 10R) and five shedding orders (-5R), in summary, you nonetheless have a + 5R revenue.

Therefore, a excellent trading mindset and strategy is to only spot orders when R: R> one, which usually means you will need to establish that the revenue need to be better than the possibility. The greater this ratio, the better the prolonged-phrase income on the market place.

So, 1R equals how considerably% of the bill is acceptable? Normally, for excellent capital management, you will need to place 1R = two% – five% of your account.

For instance: Account with $ five,000, assuming capital management with 1R = two% of the account = $ one hundred. Therefore, if you adhere to the guidelines and make positive you spot the buy accurately, immediately after ten orders with a win price of 50% and R : R = one: two, the revenue will be + 5R = 500 USD, equivalent to ten% account.

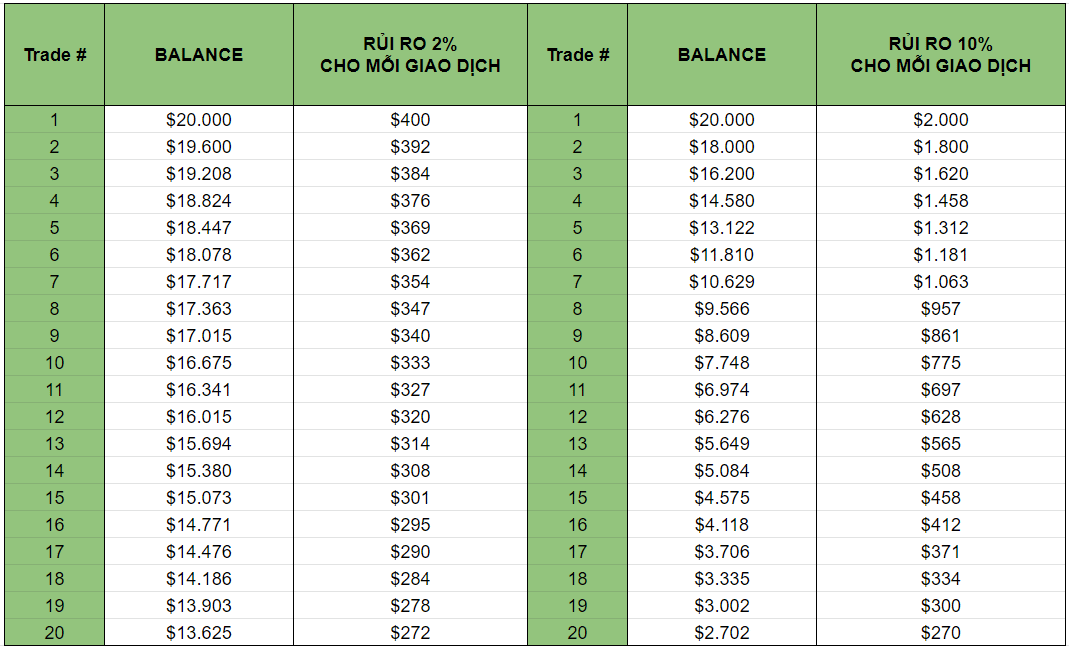

So why only two% – five% of the bill? Please adhere to the table under:

With two% account possibility, immediately after twenty consecutive reduction orders, you nonetheless have a lot more than 68% of your account. Conversely, with a ten% possibility, immediately after twenty consecutive reduction orders, you only have … one.35% of your account. In truth, it is really hard to eliminate twenty trades in a row, but four-five trades are doable, and if you happen to be not mindful, it can be eight-ten trades. Therefore, the two% is positive for us to have capital to return to the market place.

How to determine the entry volume

To determine the entry volume, we will need to depend on the halt reduction.

For instance: Long BTC at twenty,000, halt-reduction at 19,000 (equal to a lessen of five%). With a capital of five,000 and 1R = two% of the account = one hundred USD, then:

Investment capital = one hundred: five% = 2000 USD

Here, dependent on the degree of leverage, you can customize the ideal volume of capital.

For instance: with a leverage of x10, the starting up capital is 200 USD.

Note

The examples over are capital management for rookies. In truth, when you trade for a prolonged time and accumulate a whole lot of working experience, you can acknowledge which trades have a large probability of winning, so you can flexibly change the trading volume a lot more to make a lot more income.

Therefore, in this report, I have presented to you how to handle capital so that you can “survive” and be prosperous in the market place. Do you handle your capital like this? Leave a comment to talk about! See you guys in the upcoming posts!

Poseidon

See other content articles analyzing other likely DeFi tasks from the writer of Poseidon: