[ad_1]

The MA is taken into account a “national” technical indicator by many merchants at the moment. Whether you’re a novice or seasoned skilled, the MA on-line performs an necessary position of their resolution making.

So what’s Alzheimer’s? What varieties of MA strains are there? How to make use of MA to get one of the best impact? Everything will probably be answered on this Trading 101 class. Let’s prepare for the lesson!

Get concerned Investment Community 68 Trading on Telegram for technical evaluation of potential cash right here: Channel announcement | Discussion on the channel

What is Alzheimer’s?

The shifting common, often known as the shifting common, is set by the common of the value sequence over a given time period. This is a highly regarded indicator in technical evaluation that merchants usually use. The MA is split into 3 varieties, together with:

SMA (easy shifting common)

It is an easy shifting common, calculated as the common of the closing costs over a given trading interval.

EMA (exponential shifting common)

This is a shifting common of energy, calculated utilizing the exponential formulation. EMAs often deal with latest worth actions. For this motive, this indicator is kind of delicate to short-term fluctuations, it may well acknowledge irregular indicators quicker than the SMA.

WMA (weighted shifting common)

This is a linear weighted common, which focuses on the parameters with the best frequency. This implies that the WMA will deal with excessive quantity worth will increase and take note of the standard of the cash move.

Of the three shifting averages above, the SMA is the favored alternative of many merchants at the moment. Therefore, on this article, Coinlive will proceed to introduce this indicator in additional depth!

SMA row classification and formulation for calculating the SMA row.

SMA is assessed into 3 well-liked varieties, together with:

- Short-term SMA: SMA (7), SMA (14) or SMA (20)

- Medium-term SMA: SMA (50)

- Long-term SMA: SMA (100); SMA (200)

Where, SMA (7) signifies the 7-day shifting common, which is set based mostly on the closing worth of the earlier 7 days. The SMA is calculated in line with the next formulation:

SMA (N) = (P1 + P2 + P3 + .. + Pn) / N

Inside:

- P1: closing worth on day 1

- P2: closing worth on Monday

- P3: closing worth on Tuesday

- Pn: closing worth of day no

- N: Number of days chosen to find out the SMA

Pros and cons of the SMA line

Advantages

The SMA is a sluggish indicator, so it eliminates short-term noise fluctuations. In the long term, the SMA can be a really dependable technical indicator.

SMA is of appreciable sensible nature. That is, it intently displays investor sentiment at assist or resistance ranges.

Defect

If you’re a dealer who usually trades shortly akin to M30, M15, M10 or M5, the SMA won’t be an efficient alternative. Because the sensitivity to short-term fluctuations of this shifting common of costs is comparatively low.

How to make use of shifting averages successfully

Use as a assist / resistance

The shifting common can be utilized as each assist and resistance. Similar to most different indicators, the longer the time-frame you employ, the stronger the assist / resistance.

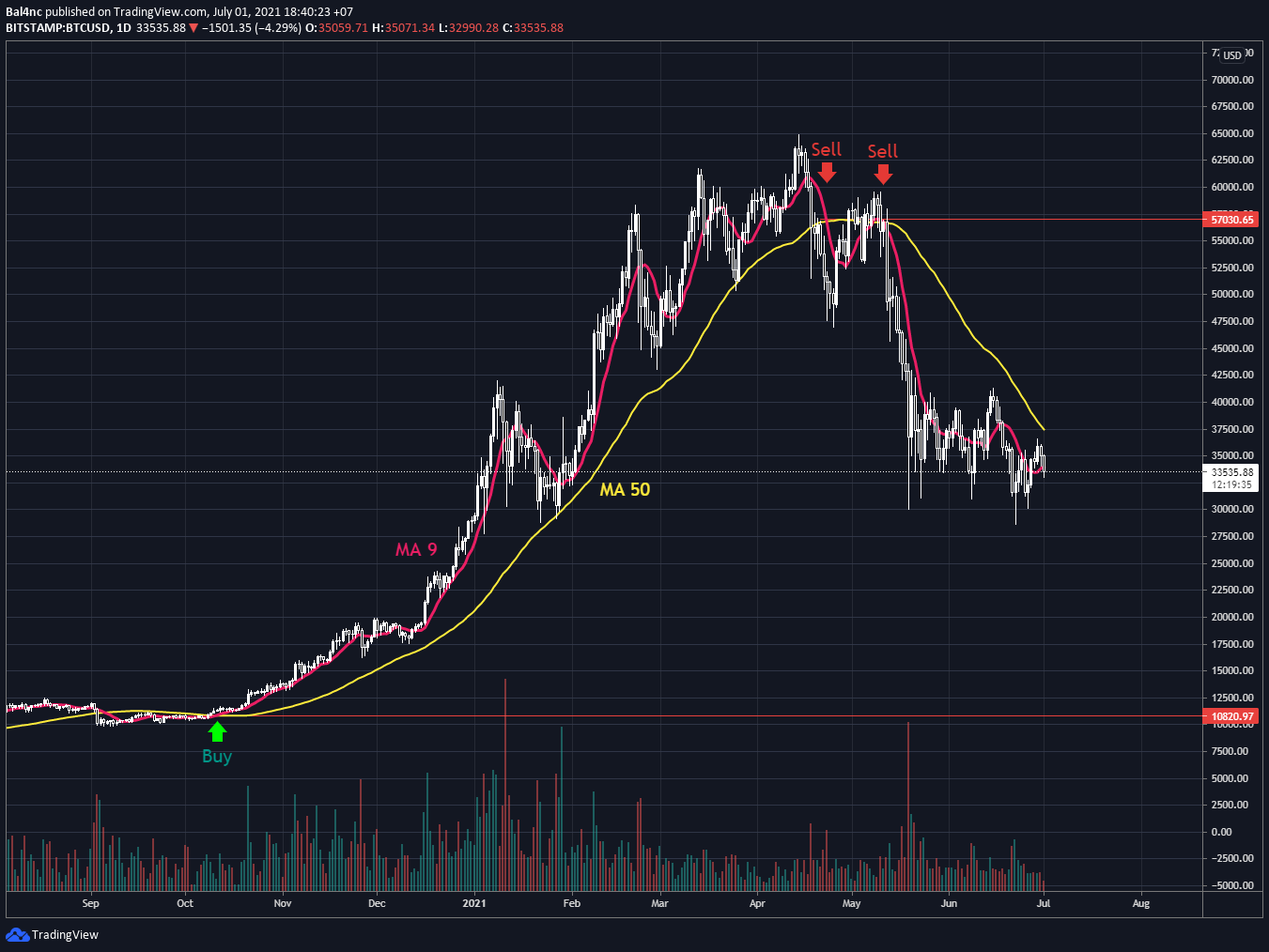

Two MA strains intersect

Determining the market pattern with the crossing of two SMA strains is a well-liked manner of trading at the moment. To apply this strategy, a short-term SMA and a medium / long-term SMA.

The that means when these 2 SMA strains intersect is as follows:

- Short time period SMA crosses above long run SMA: bullish trade sign -> you possibly can go lengthy

- Short-term SMA falls under the long-term SMA: bearish trade sign -> you possibly can go quick

Slope of MA

The slope of a shifting common, particularly over a protracted time period, can assist you clearly establish market tendencies.

- If the MA is up, it reveals that the market is in an uptrend.

- If the MA is flat and begins to fall, the market is more likely to enter a downtrend section.

However, it ought to be famous that the shifting common is a sluggish indicator. The slope of the MA additionally solely helps to establish the pattern extra clearly. Therefore, a single AG won’t be able to establish a market reversal sign.

abstract

The MA line will usually promote the simplest space utilized in medium to long run transactions. Therefore, if you’re a dealer who usually trade on quick frames, you need to mix another technical indicators. This will mean you can make higher income or a minimum of be sure your account would not run out.

I hope at the moment’s lesson plan has helped you higher perceive what Alzheimer’s is and discover some methods to trade with Alzheimer’s. Don’t neglect to comply with Coin Trading Class 101 101 68 to study extra attention-grabbing and helpful classes!

[ad_2]