[ad_1]

The KDJ indicator is a preferred technical indicator utilized by a lot of traders for quick phrase trading. So what is the KDJ indicator? How quick is it to navigate with this indicator?

Today’s class routine of Commercial class 101 of 68 Trading will reveal to you “everything” about the KDJ indicator. Let’s talk to now!

Get concerned Investment Community 68 Trading on Telegram for technical evaluation of probable coins right here: Channel announcement | Discussion on the channel

What is the KDJ Indicator?

The KDJ indicator is a major indicator with fairly large sensitivity and accuracy. This technical indicator is normally utilized to analyze and predict alterations in quick-phrase value developments. Therefore, if your pastime is scalping or quick searching, KDJ will certainly be an incredibly practical instrument.

KDJ was formed and produced on the basis of the stochastic indicator. The only big difference among KDJ and Stochastic is that there is a J signal line. Therefore, the KDJ indicator consists of three signal lines with the following meanings:

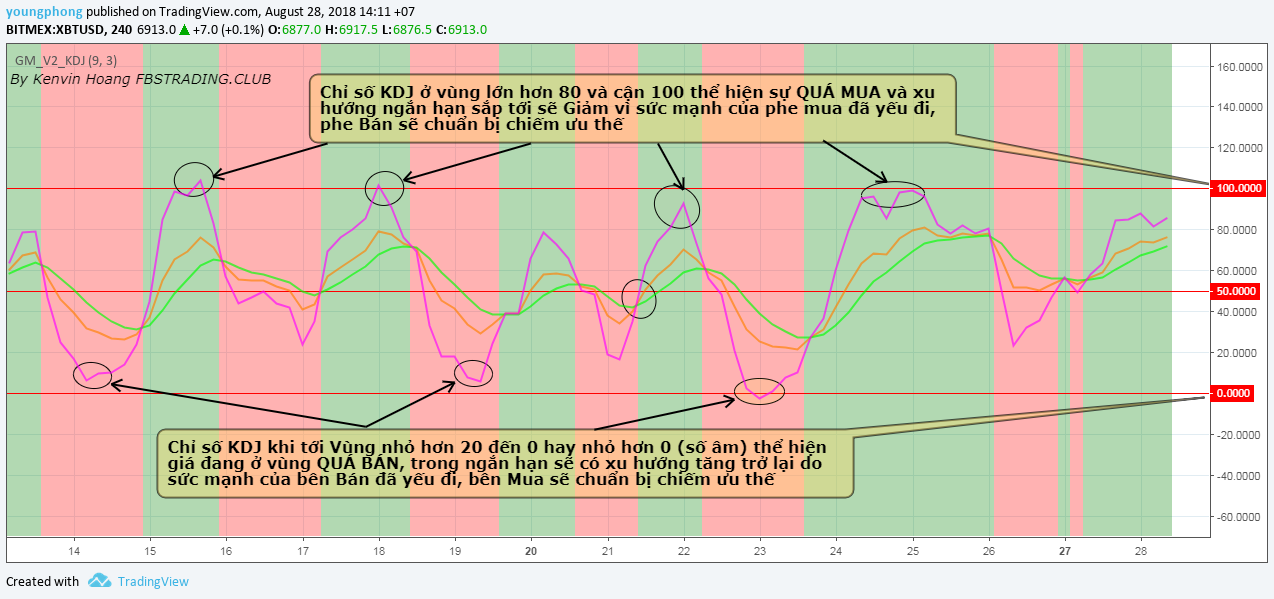

- The worth of two signal lines K (yellow) and D (green) will be displayed if it is in the overbought (over 80) or oversold (under twenty) zone.

- The signal line J (purple) represents the divergence of the existing worth K from the worth of the line D. The worth J can exceed the area. [0, 100].

- The J line is also a signal line to observe out for when employing the KDJ indicator for trading.

The which means of the KDJ báo indicator

KDJ indicator if within overbought zone [80, 100] so the following prediction will be a downward trend Short phrase. Because at this minute the obtaining electrical power has decreased and the sellers will prevail.

Conversely, if the KDJ indicator goes down oversold region [0, 20] or significantly less than can type a bullish trend Future. Because at this level the electrical power of the sellers has weakened just as the customers will prevail.

How to trade with KDJ .indicator

As pointed out at the starting of the lesson, the KDJ indicator will be ideal for scalping or trading in quick phrase frames this kind of as H4, H1, M30, M15, and so forth. You can area an purchase with some signals as follows:

- When all 3 lines converge over the overbought degree, with the D line over the K line and the K line over the J line, you can think about putting a quick purchase.

- Conversely, you can enter a lengthy place when these three lines converge under the oversold degree. Where, the purple line (line J) is at the bottom, the yellow line (line K) is in the center, and the green line (line D) is the highest.

Also, noting that the J line demonstrates indications of “curving up” or “curving down”, ie when the value has reached the overbought / oversold regions.

summary

The KDJ indicator is a technical evaluation instrument ideal for quick phrase trading. However, to get the ideal final results, traders need to mix with some other indicators like ADX (normal directional indicator) or ATR (normal actual array indicator).

I hope this 68 Trading textbook has aided you get extra expertise and knowledge to “navigate” efficiently. Don’t overlook to check out the “Trading Class 101” segment frequently to update the most practical and intriguing lesson strategies!

Synthetic currency 68

See also other articles or blog posts on Trading Class 101:

[ad_2]