After the US sanctions, most hackers “quarantined” the Tornado Cash cryptocurrency mixer and fled to other platforms for refuge.

Trading on Tornado Cash has “cooled off” following US sanctions. Photo: Twitter Tornado Cash

Trading on Tornado Cash has “cooled off” following US sanctions. Photo: Twitter Tornado Cash

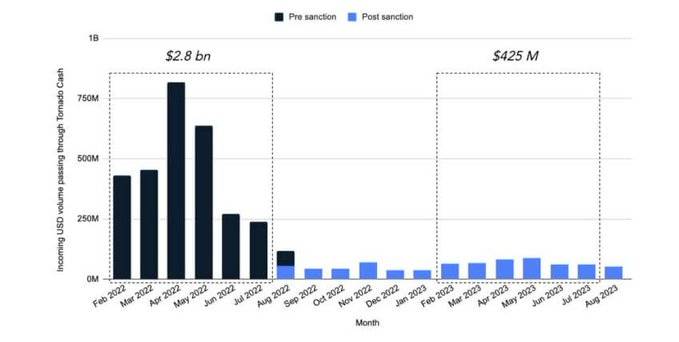

According to the most up-to-date report from blockchain analytics company TRM Labs, the use of cryptocurrency mixer Tornado Cash has dropped appreciably following US sanctions. KTornado Cash’s all round transaction volume fell 85%, from far more than $two.eight billion to $425 million.

Tornado Cash trading volume from February 2022 to August 2023. Source: TRM Labs

Tornado Cash trading volume from February 2022 to August 2023. Source: TRM Labs

The US Treasury Department’s Office of Foreign Assets Control (OFAC) positioned Tornado Cash on the sanctions checklist in August 2022, accusing it of becoming a revenue laundering device for undesirable actors well worth up to $seven billion bucks. US authorities arrested Roman Semanov, co-founder of this protocol, on August 23.

Essentially, Tornado Cash supports end users in exchanging tokens but nevertheless hides the movement of money on the Ethereum, BNB Chain, Arbitrum, Avalanche, and Optimism networks. The support itself is not malicious, but it is more and more starting to be a hub for crypto criminals and is utilised by them to hide stolen money.

The US Department of Justice has accused Tornado Cash of managing far more than $one billion in dirty revenue. The unique company especially named Lazarus Group, the infamous North Korean hacking group behind a series of main cybersecurity attacks all around the planet.

TRM’s investigate staff stated North Korean hackers shifted to employing other revenue-mixing platforms following the ban. However, Tornado Cash is nevertheless the favored alternative for some.

The report plainly states:

“Even though the government has crippled the Tornado Cash service, it still fails to stop the illegal elements. This is an obstacle that shows that the sanctions have not had a profound impact and that they are completely isolated to engage in illegal activities.”

In the latest context, THORChain is a new revenue laundering remedy for hackers. Statistics from the final four months reflect that in excess of 50% of the stolen ETH has been transferred from the THORSwap Router to the Bitcoin network. THORChain is remarkably regarded for its decentralization, but if it is only utilised by undesirable actors, it will sooner or later on be suppressed by foreign governments and share the similar fate as Tornado Cash.

And due to the over complicated trouble, THORSwap a short while ago determined to switch to short-term servicing mode and halt the exchange perform, at first to stop unlawful transactions, until eventually a superior remedy is located.

Coinlive compiled

Join the discussion on the hottest difficulties in the DeFi market place in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!