To prevent starting to be a “second UST”, the USDD algorithmic stablecoin has undergone severe alterations to be certain enough ensures.

As reported by Coinlive, Decentralized USD (USDD) is a new algorithmic stablecoin that was launched on the TRON blockchain in early May 2022, just days prior to the collapse of LUNA-UST, resulting in an raise in the complete capitalization of the two cryptocurrencies. to 60 billion bucks, “evaporated” from the marketplace in just two weeks.

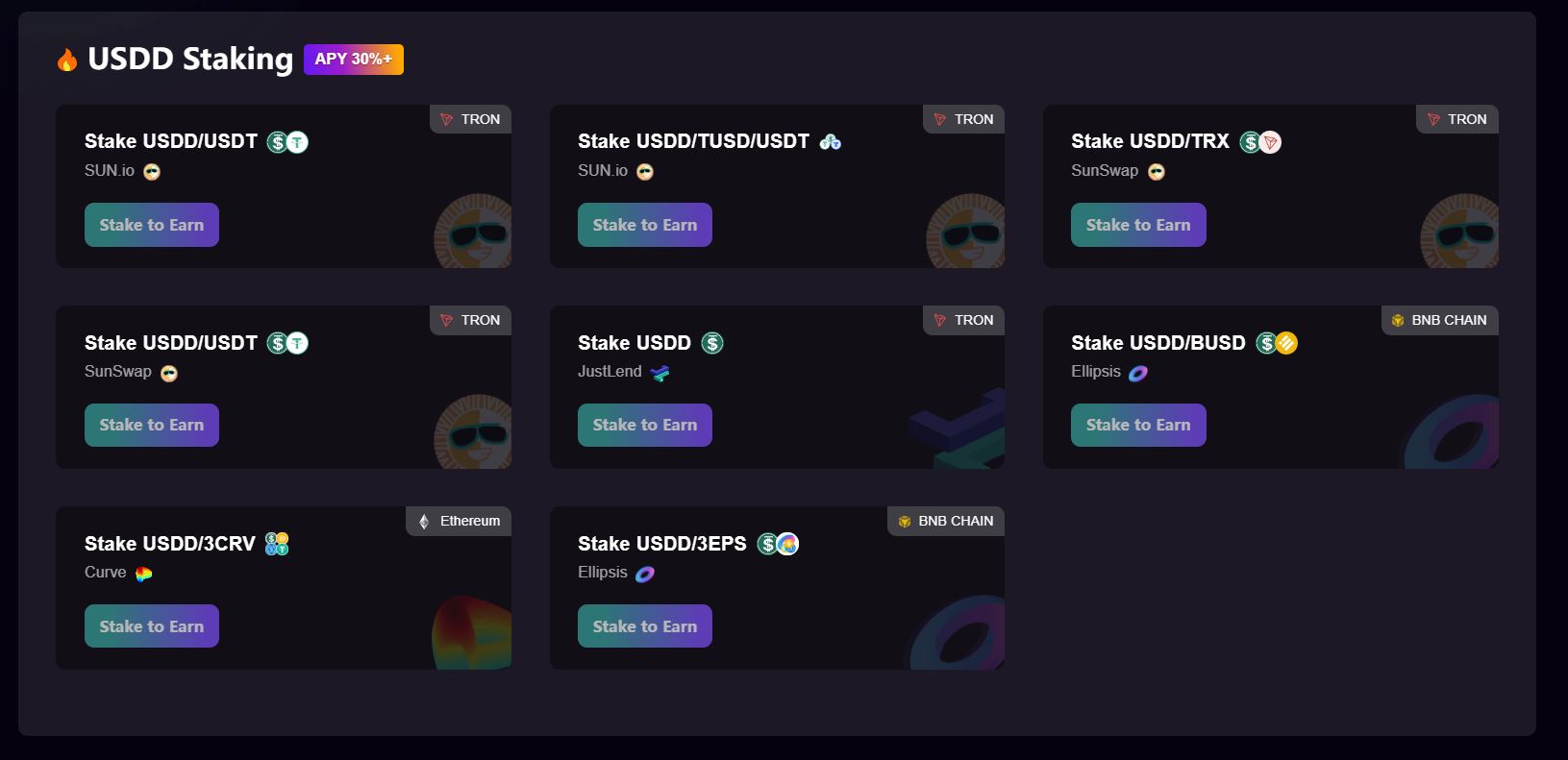

USDD can be regarded as a “copy” of the LUNA-UST model, when applying TRX mastering to make USDD, building a margin fund in other cryptocurrencies for USDD and supporting a thirty.% APY curiosity when sending USDD in the protocols supported by the venture .

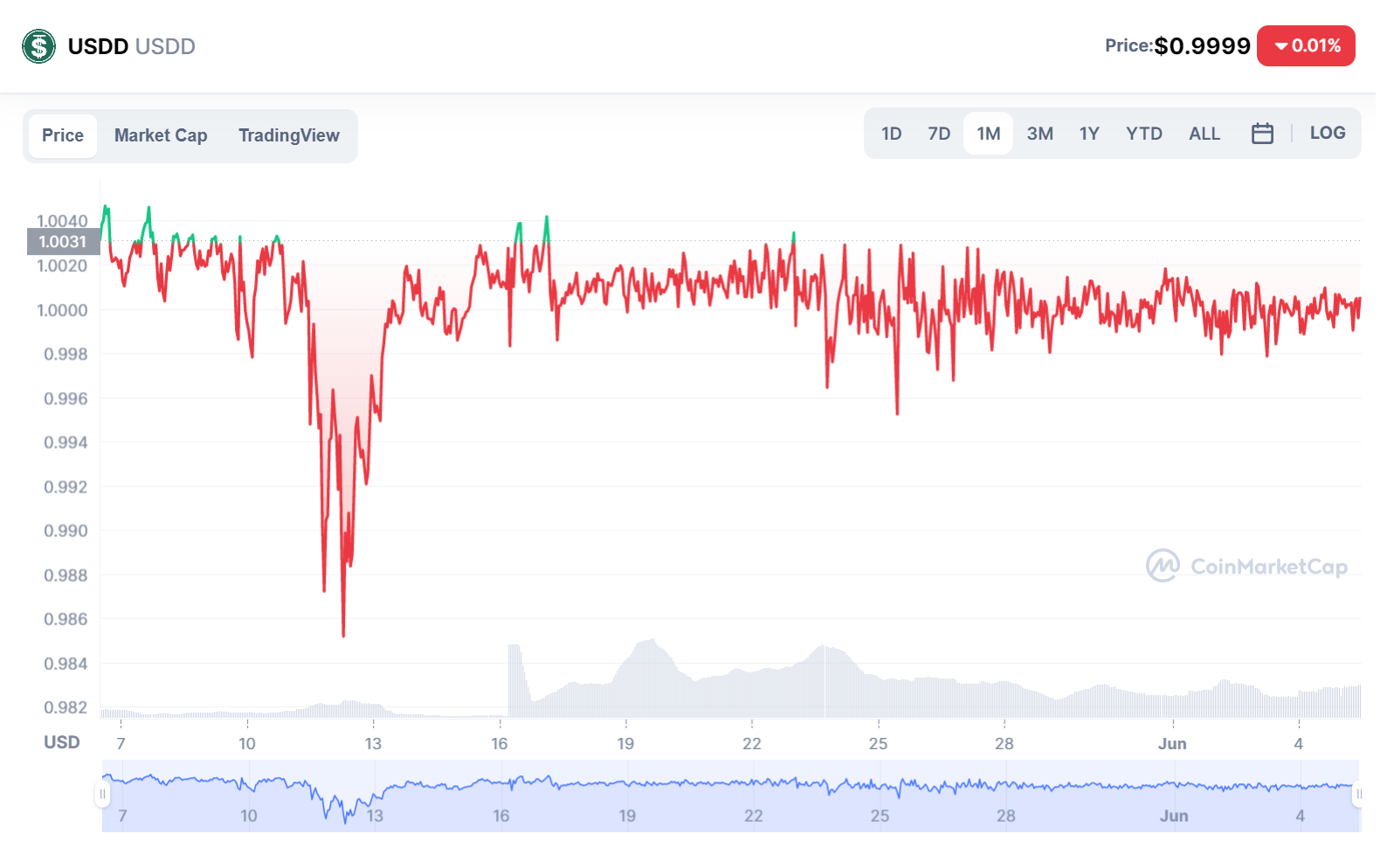

During the final month of its existence, USDD also recorded a robust de-peg (dropping the USD one mark) on May twelve, when the complete cryptocurrency marketplace was offered off following the collapse of LUNA-UST. Not just USDD, several other stablecoins are also impacted this kind of as Tether (USDT), USDX from Kava, USDN from Waves or DEI from Deus Finance.

In buy to cut down collateral chance, one particular of the good reasons that led to the collapse of UST, USDD on the afternoon of June 5th claimed that it has in the previous enhanced the sum of collateral per USDD to above 200%. Specifically, at the time of creating, the USDD parameters are as follows:

– USDD issued worth: 667,521,101 USD

– Value of TRX burned: eight,297,232,883 TRX (about 667,521,101 USD)

– Holding BTC: 13,040 BTC

USDT Holdings: USDT 240 million billion

– Holding TRX: one.eight billion TRX

Thus, it can be viewed that though there are only USD 667 million in circulation, the sum of assets employed to help them is much more than USD one.four billion. The helpful margin is at present 217%, substantially increased than the 120% that the major algorithmic stablecoin on Ethereum, DAI, is retaining. The venture claims that the margin fee can adjust above time, but strives to usually remain over 130%.

#USDD the assure ratio is at present above 200% !!

🛠️As one particular of the safest decentralized #stablecoin, #USDD delight in a assured assure ratio of at least 130%, increased than the 120% set by DAI, which is regarded as a model of the sector. pic.twitter.com/8XuIHehxUp

– USDD (@usddio) June 5, 2022

Earlier, in the announcement of the constitution, USDD announced that it would create a “TRON DAO Reserve” hedge fund with assets up to $ ten billion, related to what Luna Foundation Guard intends to do. This fund is obtaining the help of several major cryptocurrency investment money, such as Alameda Research, Amber Group, Poloniex, Ankr, Mirana, Multichain, FalconX and TPS Capital.

TRON founder Justin Sun, who is also behind USDD, mentioned:

“We want USDD to have a hybrid model. On the one particular hand there is the algorithm to preserve the stablecoins steady, on the other hand there is the TRON DAO Reserve.

The APY degree of twenty-thirty% has so far been maintained on the SUN.io, SunSwap, JustLend, Curve, Ellipsis platforms, whilst USDD is traded on Uniswap, PancakeSwap, KyberSwap, Poloniex, Huobi Global, KuCoin, Gate.io and Bybit.

In addition to USDD, several algorithmic stablecoins are even now energetic just after the UST collapse, this kind of as DAI and SAI on Ethereum, USN on Near, fUSD on Fantom, aUSD on Acala, USDX on Kava, USDN on Waves, DEI from Deus Finance, .. .

Synthetic currency 68

Maybe you are interested: