After the collapse of LUNA-UST, the local community started to be on the alert for algorithmic stablecoins with related curiosity payment mechanisms. And TRON-USDD is topic to an particularly large threat of depeg. However, I did not assume this story to come this quickly.

* This submit was up to date at seven:00 pm on June 13, 2022.

USDD dipeg

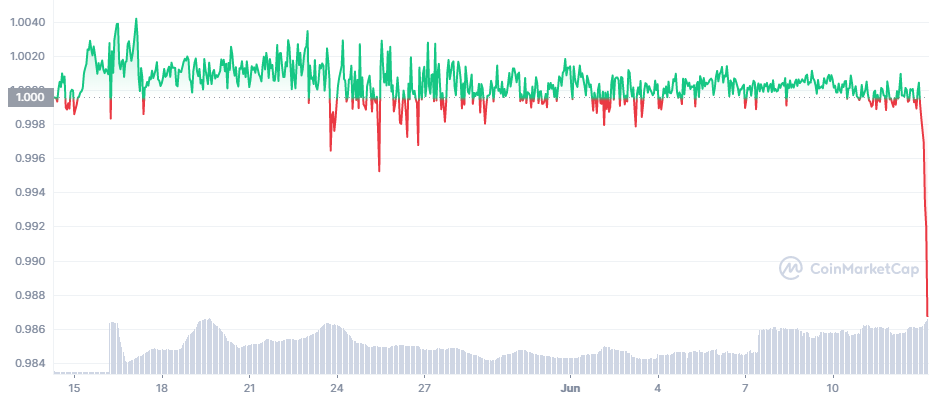

In the early afternoon of June 13, 2022 (Southern Institute time), when Bitcoin and Ethereum set a new lower for 2022, Celsius was about to go “default”, a new “ghost” continued to seem getting ready to threaten. as well a great deal the marketplace. volatility – USDD is depeg.

If you join Vietnamese cryptocurrency communities and groups, you will probable see numerous individuals warn that USDD commences shedding factors.

The “ghost” of the LUNA-UST crash is so major that we are pretty distrustful of the TRON stablecoin.

Big query mark on USDD collateral

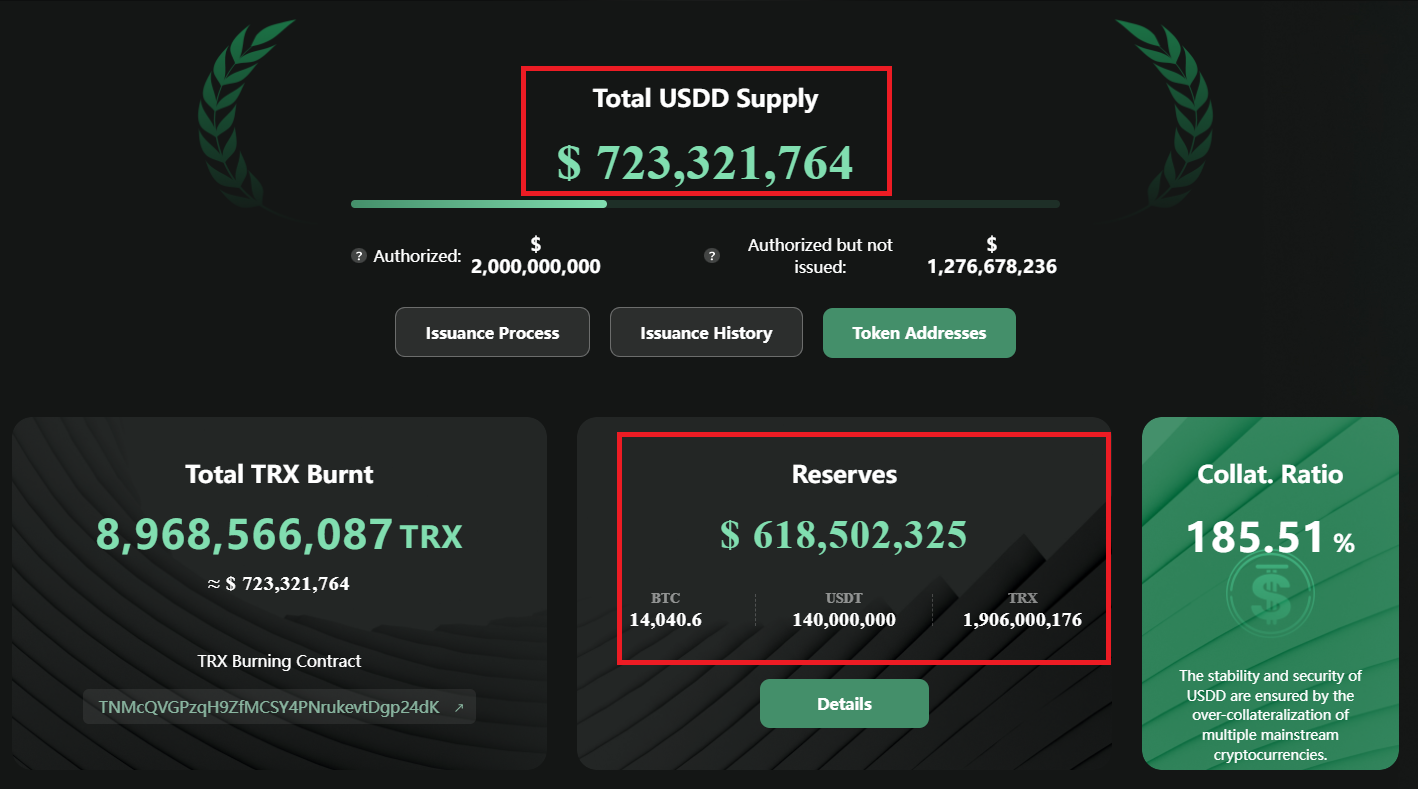

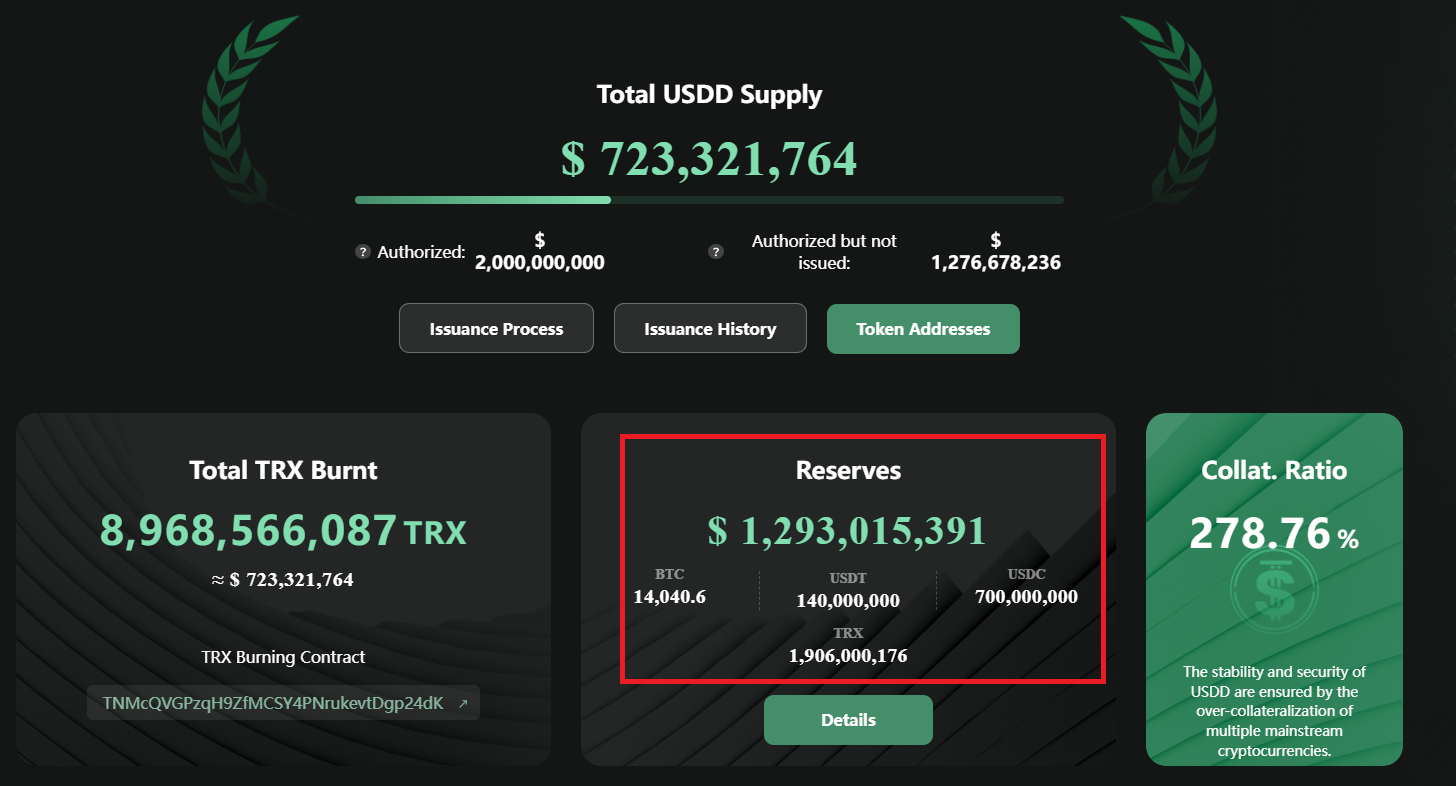

According to information from https://tdr.org/#/ – USDD reserves and ensures on-chain site, USDD has complete provide of USD one.28 billion but only 723 million bucks existing.

The reality that USDD is absolutely sure to be 200% assured is primarily based on the calculation:

Collateral Ratio (collateral ratio – CR for quick)

CR = (complete collateral + complete worth of TRX burned) / complete USDD issued

CR = ($ 618 million + $ 723 million) / $ 723 million = 185%

That is why in Figure one the CR is proven as 185.51%. This variety is explained by TRON DAO Reserve (TDR):

USDD is normally supported greater so appreciated. So if there is a situation of reduction of the peg, it normally will be have a surplus collateral sum per USDD.

However, is this correct?

Potential Risks

As Coinlive explained in the posting The reality behind the USDD stablecoin’s “200% margin”:

The reality that TRON will take the sum of TRX burned as collateral is not appropriatemainly because TRX is by nature a volatile asset.

Therefore, we should really rather determine:

CR = Total Guarantee / Total USDD issued

CR = $ 618 million / $ 723 = 85.48%

Therefore, in practice USDD does not have a a hundred% promise. And Tron’s existing stockpile also has numerous concerns to talk about.

Let’s get into the examination!

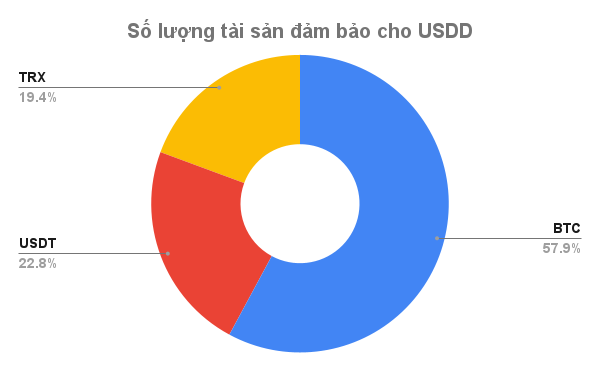

- 57.9% of the assets are Bitcoin

- 19.four% in the kind of TRX, a hugely volatile currency. Whether the price tag of TRX goes up or down will influence the complete worth of reserve assets >> Will influence USDD

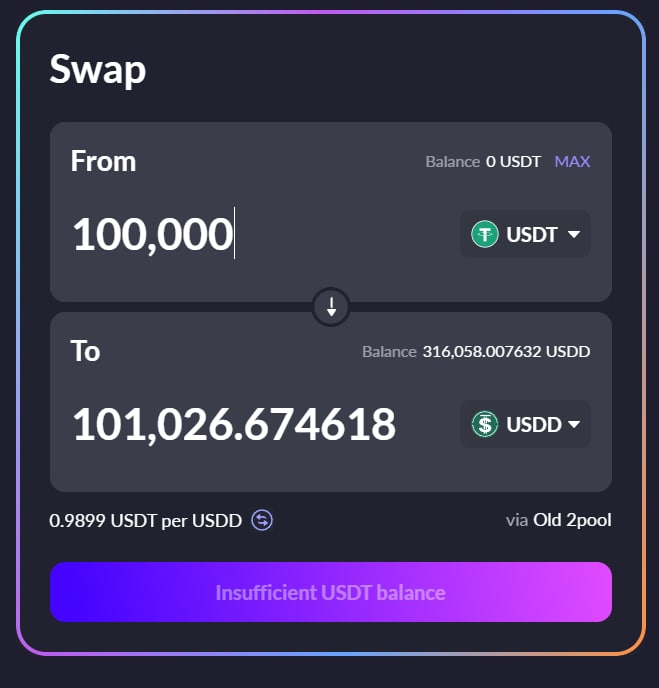

- 22.eight% is USDT, it seems to be like a stablecoin that does not fluctuate in price tag, but is it correct?

USDT is much more than just USDT!

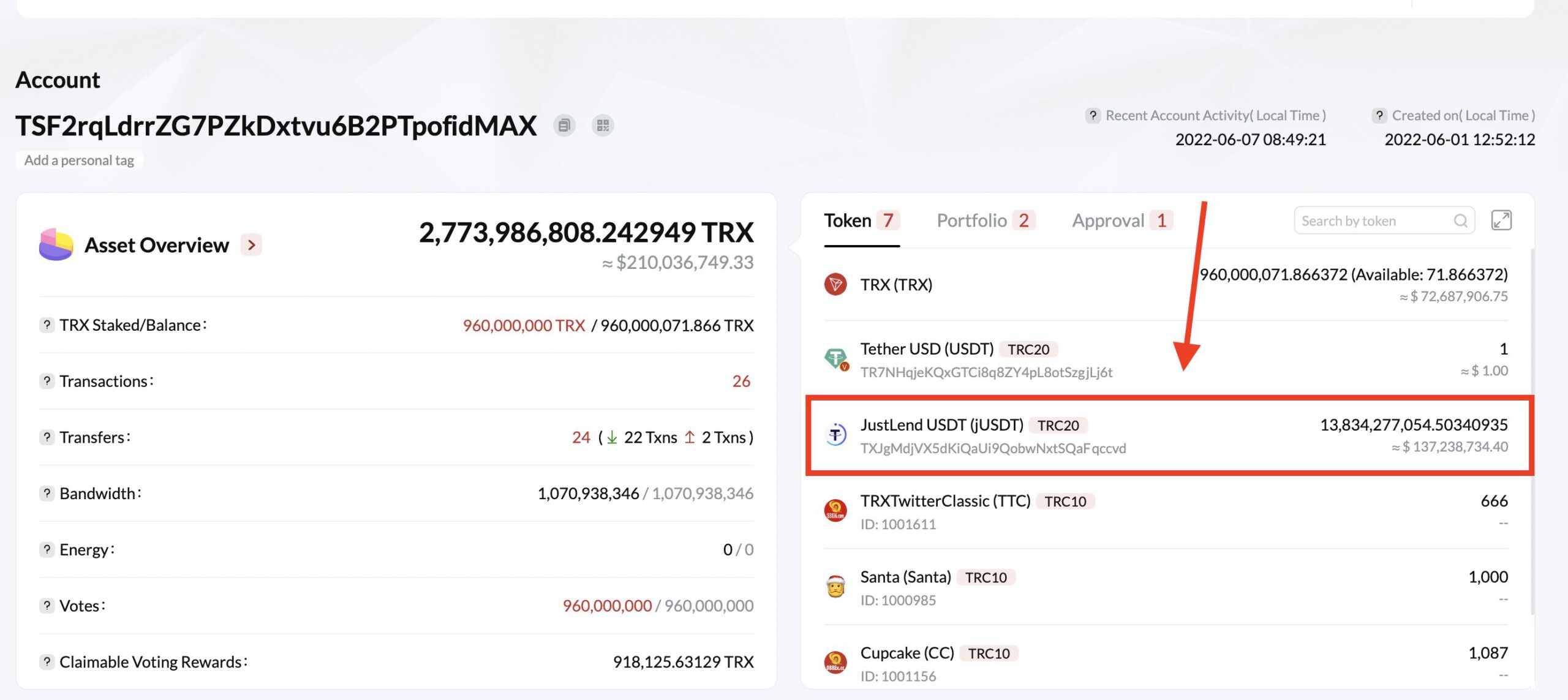

According to on-chain information, TDR has deposited this 140 million USDT into JustLend, the lending platform of the TRON ecosystem, to earn extra income.

This action is also very understandable, mainly because “we shouldn’t let the money stand still”. However, the moment the token is sent to the lending platform, this USDT will be topic to the probable threat of the JustLend protocol currently being breached >> reduction of assets.

Reserving money with as well volatile assets

Also, much more just lately Justin Sun announced that he has offered all over USDT a hundred million in his reserve fund to invest in much more BTC and TRX. (this sum of assets was not reflected in the fund stability)

.@trondaoriserva moved #USDT reserve to invest in much more #BTC And #TRX as a reserve. https://t.co/mkK2aEAR2n

– SE Justin Sun (@justinsuntron) June 7, 2022

Of program, promoting USDT, a stablecoin, to invest in much more BTC and TRX, two hugely volatile currencies, is a hazardous action for the collateral fund.

If BTC and TRX carry on to be heavily dumped whilst the existing USDD provide rises, the threat of unsecured USDD increases.

Forecasts and alerts

To be honest, the existing USDD provide is even now very lower, not sufficient to make a major effect on the marketplace. The local community frequently jokes that: “Justin Sun has enough money to secure USDD”.

If the USDD had been to deviate “slightly” from the peg, the existing reserve of assets would be adequate to drive the USDD to the $ one mark without the need of creating drastic volatility.

With USDD shorted by FUD and the local community as a -50% funding price on Binance, Justin Sun announced that TDR will area $ two billion to battle the “short army”.

Shorting funding price #TRX On @binance it is damaging at 500% in April. @trondaoriserva will deploy $ two billion to battle them. I will not assume they can even final 24 hrs. The quick squeeze is coming. pic.twitter.com/VRExM6UK70

– SE Justin Sun (@justinsuntron) June 13, 2022

“I will not assume the TRX shorts will final 24 hrs! Watch out for that quick squeeze! “

And TDR also speedily purchased an additional 700 million USDC to continue to keep the USDD peg.

USDC 700 million was injected @trondaoriserva for #USDD pegs. Well carried out! https://t.co/r11PnBte4g

– SE Justin Sun (@justinsuntron) June 13, 2022

As of seven:00 pm on June 13, 2022 (Vietnam time), USDD’s complete reserve assets are up to date as follows:

TRON DAO Reserve consequently invested USDC 200 million shopping for TRX on the marketplace to retain the price tag of the token.

Do our components https://t.co/x5fQ2GJhs4

– SE Justin Sun (@justinsuntron) June 13, 2022

Do our component. https://t.co/ykZj4R3pVE

– SE Justin Sun (@justinsuntron) June 13, 2022

However, we have to spend focus to the existing marketplace problem:

- The default threat of Celsius is pretty large

- Many of the big DeFi protocols rely heavily on stETH

- If stETH peg reduction continues >> Mass liquidation threat >> ETH discharges strongly, BTC and other coins will not escape the very same fate

- The chain result leads to the marketplace to bleed

- BTC and TRX plummeted >> Guaranteed asset worth for USDD fell

And like a snowball result, something which is on the brink of collapse will trigger customers to continue to keep panicking to promote / get liquidated. At that time, it would be challenging for TRON DAO Reserve to retain adequate collateral for the USDD.

Giovanna

Maybe you are interested: