- Main event, leadership changes, market impact, financial shifts, or expert insights.

- Trump accuses Powell of personal bias.

- Potential influence on Fed’s rate decisions.

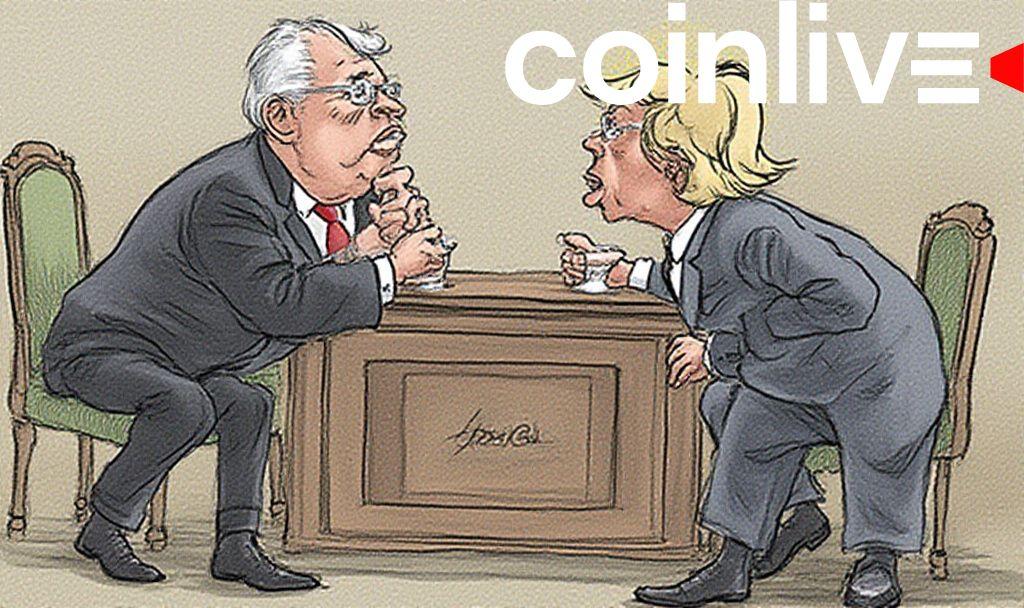

Trump criticized Federal Reserve Chair Jerome Powell on May 8, 2025, accusing him of not cutting interest rates due to personal reasons, escalating tensions between them.

The public criticism highlights concerns about political influence on the Fed, raising questions about its independence and possible market impacts.

President Trump’s criticism of Fed Chair Jerome Powell follows a Federal Reserve meeting that decided to keep interest rates steady. Trump’s claim that Powell is motivated by personal bias rather than economic factors marks an escalation in their ongoing conflict.

Jerome Powell has consistently maintained a cautious approach, adhering to economic indicators. Meanwhile, Trump publicly expressed dissatisfaction on his Truth Social platform, suggesting Powell’s actions are political rather than based on economic realities.

The Fed’s decision to maintain rates amid cooling inflation contrasts with the Bank of England’s recent rate cut, highlighting differing monetary strategies. Meanwhile, international markets watch closely as such policies can affect currency stability and capital flows.

Economists warn that the public dispute could undermine the Fed’s perceived independence. Powell, pressed by Trump’s comments, risks being seen as capitulating to political pressure, potentially altering standard monetary policy operations.

Jerome Powell is a fool for acting too late in cutting interest rates. — Donald Trump

The situation may result in Powell hesitating to adjust rates, even if economic conditions require flexibility. Precedents of Fed independence help buffer short-term tensions, but long-term standoffs could affect economic stability and policy credibility.