- Main event, leadership changes, market impact, financial shifts, or expert insights.

- Trump proposes rate cuts to 1% or lower.

- BTC price volatility amid potential lower rates.

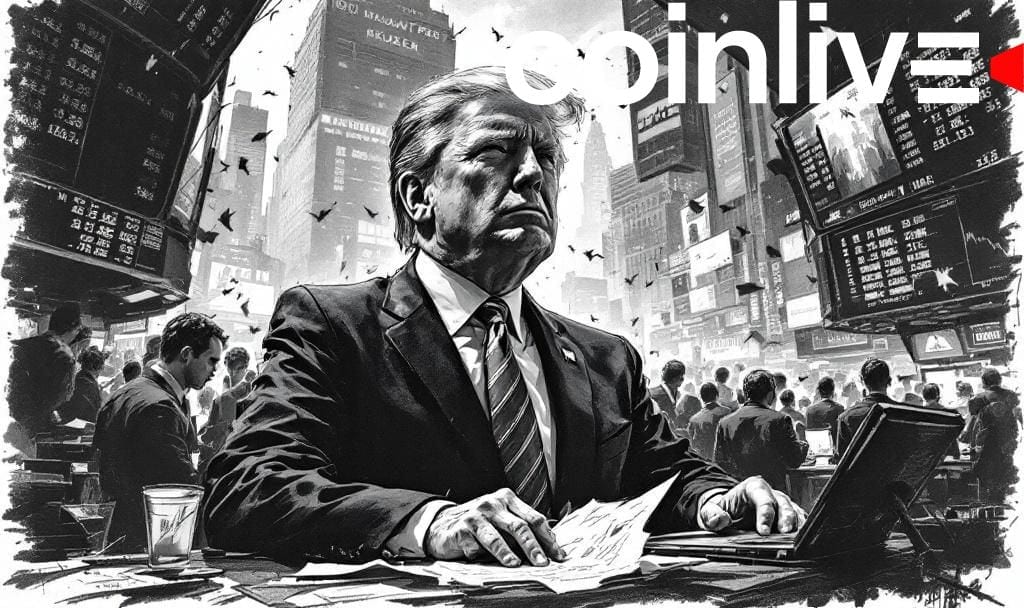

President Trump announced on December 1, 2025, his decision for the next Federal Reserve chair, aligning with his push for potential interest-rate cuts.

Market speculation links Trump’s pick to possible rate reductions, impacting cryptocurrencies like Bitcoin, which fell amid a December selloff as expectations of lower rates grew.

President Donald Trump recently expressed his desire for a strategic reduction in interest rates, suggesting they should be 1% or lower by next year. This proposal is seen as an initiative to stimulate economic growth through significant rate cuts.

“I know who I am going to pick, yeah… We’ll be announcing it.” — Donald Trump, U.S. President.source

Key figures involved include President Trump, who is set to announce his Federal Reserve chair nominee expected to align with his interest rate vision. Kevin Hassett, a top contender, has echoed sentiments supporting additional cuts if justified by current data.

Reduced interest rates are expected to impact financial markets significantly. Analysts note potential changes in Bitcoin (BTC) and Ethereum (ETH) prices, as these cryptocurrencies are responsive to rate adjustments that influence investor inclination towards riskier assets.

This financial pivot highlights potential ramifications across economic, political, and social landscapes, affecting monetary policy decision-making. The Federal Reserve’s anticipated rate cuts aim at bolstering economic activity and could transform market dynamics.

Insights suggest probable financial trends, including volatile cryptocurrency performances due to economic policy shifts. Historical data from previous rate cuts reveal an upward trajectory for BTC and ETH, forecasting continued speculation on similar outcomes.