Although the market place in early 2022 was particularly bleak, THORChain’s TVL however grew drastically, demonstrating the continued income movement into the venture. So what is the purpose? Let’s overview RUNE’s profitable techniques with Coinlive these days!

one. THORChain and RUNE

THORChain is a decentralized cross-chain protocol primarily based on Tendermint & Cosmos-SDK, with the aim of growing liquidity for crypto assets.

The extraordinary attributes of THORChain:

- Allows exchange of native coins / tokens on a lot of unique chains. For instance, trade BTC for ETH and vice versa.

- Decentralized, no will need to register for an account, KYC … like Binance, FTX exchanges …

- No tokenization of assets (wBTC, renBTC …). Asset styles are stored unchanged and traded.

THORChain’s major product or service is THORChain DEX, an AMM that makes it possible for any person to trade and deliver liquidity in cryptocurrencies.

THORChain DEX runs on Bancor’s technological innovation named “Bancor’s continuous loan pool”. The cryptographic assets will be deposited in the liquidity pool linked with the RUNE token, the native token of THORChain.

RUNE is the native token of THORChain. RUNE can be utilised in THORChain for:

- Payment

- Administration

- Preferential rewards

- Network protection

About payment

RUNE is the settlement asset for all pools (participating in the liquidity of most pools). When you want to join a pool on THORChain, the mixed expected asset ratio is one: one (which includes your Token / Coin and RUNE).

For instance, a pool with $ one million in BTC should also have $ one million in RUNE.

Network protection

The nodes participating in THORChain should deposit a amount of RUNE with double the worth of RUNE in the pool to make sure the security of the network.

Administration

Users can use RUNE to vote for the pools they want. Pools with the most votes will have larger rewards.

Reward

RUNE is also utilised to reward suppliers and liquidity nodes.

two. How THORChain performs

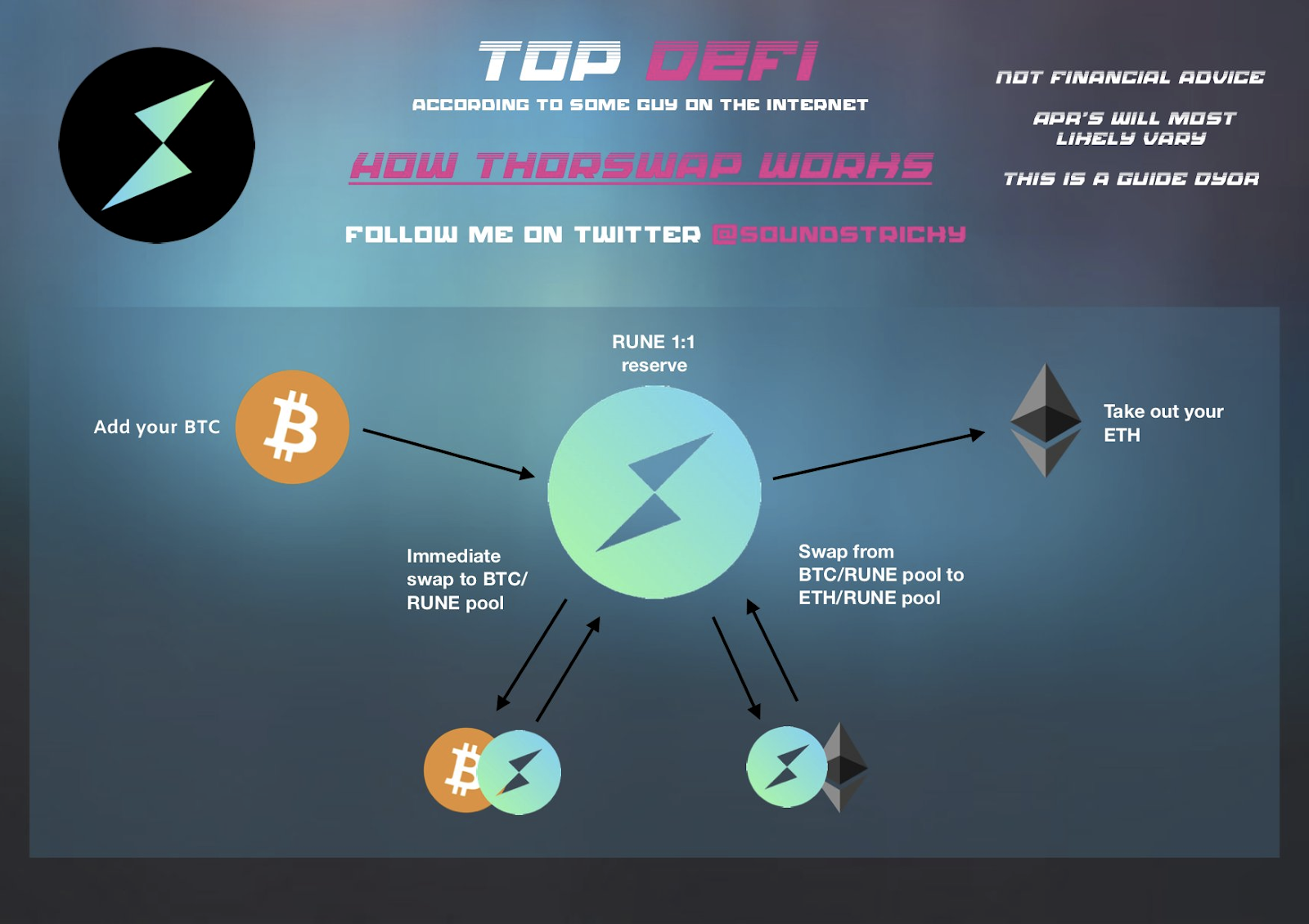

When a consumer would like to exchange BTC for ETH, the transaction will be executed sequentially as follows:

BTC will be positioned in THORChain and traded with RUNE in the BTC / RUNE pool. RUNE from the BTC / RUNE pool will be brought to the ETH / RUNE pool and exchanged for ETH, then returned to the consumer. Essentially, THORChain double-traded with RUNE as an intermediate asset.

three. Recent important updates of RUNE

Over the previous month, the complete worth frozen on THORChain has doubled regardless of the market place correction.

This development is the consequence of important updates in current instances:

Update Chaosnet

Enable synthetic sources with the elimination of Impermanent Leak. This makes it possible for customers to exchange native coins / tokens on tier one in a a lot less costly and more quickly way. This is 1 of the causes THORChain’s TVL has improved radically in current instances.

Collaboration with Terra

If Terra aims to develop a decentralized stablecoin, THORChain aims to develop a decentralized cross-chain DEX. With this cooperation, LUNA and UST will maximize liquidity (when other native coins can be traded straight) and THORChain will also maximize TVL.

Keep in thoughts that when TVL increases, the locked RUNE worth will be higher (one: one ratio in the pool and one: two in contrast to the nodes) => RUNE continues to maximize in cost.

This is a move that gains the two Terra and THORChain.

Therefore, the introduction of important updates in the previous has induced TVL on THORChain to maximize => RUNE is much more caught => RUNE increases in cost.

four. Skins in the game

Currently, whilst THORChain has grown very well, the ecosystem has not designed a lot. On THORChain, there is only one product or service constructed, that is THORS exchange. You can use stablecoins to deliver liquidity on the platform or take into consideration hodl THOR tokens.

What do you consider of THORChain and RUNE? Don’t fail to remember to depart a comment to talk about with us!

Poseidon

Maybe you are interested: