Prior to The Merge, Ethereum Optimism’s scaling remedy reached $ one billion in complete locked-in worth (TVL) in just a handful of weeks.

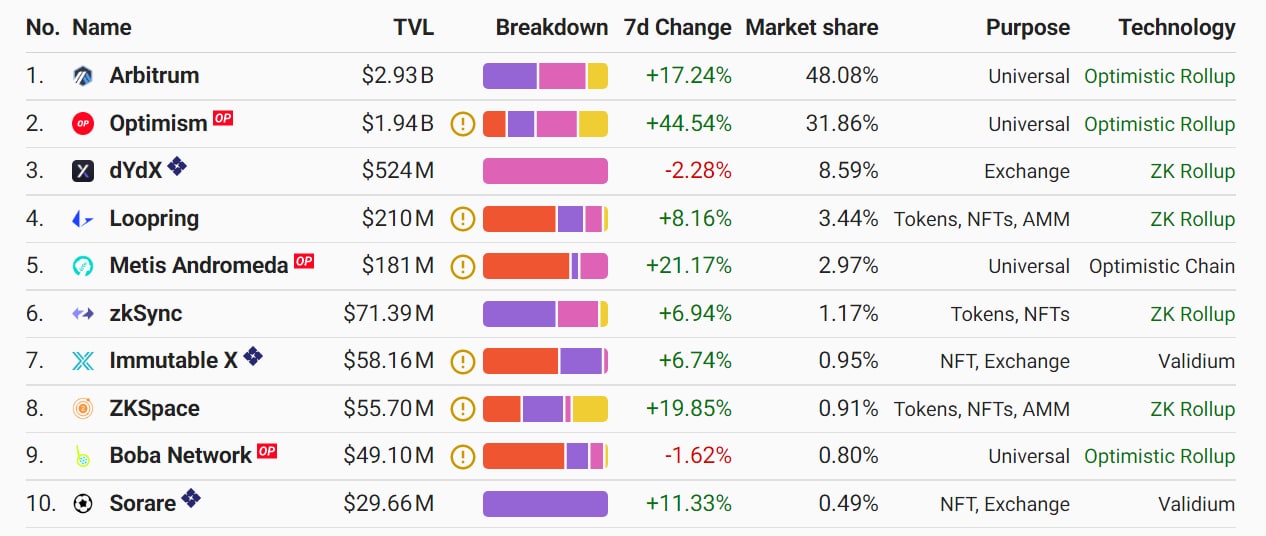

To adhere to information transferred from DefiLama, the complete locked worth (TVL) on Optimism, a degree two scaling remedy for Ethereum, has greater by 284% in the previous month. This outcome comes in significant component from the lending actions on Aave.

The “increased clarity” surrounding The Merge’s consolidation has spurred a substantial inflow of capital in a row into Ethereum merchandise above the previous 7 weeks, in accordance to Cointelegraph. CoinShares. Ethereum has set the implementation date for this historic second on September 19th.

As a Tier two Ethereum blockchain, Optimism extends the ecosystem as a result of rollups, in other phrases off-chain computation to velocity transactions. Transactions are saved on Optimism and finished on Ethereum.

The task is at present dwelling to 35 protocols, which include the Synthetix derivatives exchange, the decentralized exchange Uniswap and the automated market place maker Velodrome. Due to the large volume of consumer orders on exchanges (which include purchase cancellations), the latest Ethereum blockchain capability of thirty transactions per 2nd seems to be overpowering and unresponsive. However, some gurus predict that the network’s capacity to scale to one hundred,000 transactions per 2nd just after the results of The Merge along with Tier two options could appreciably boost this capability.

Ally Zach, Messari researcher, mentioned:

“Currently, if Ethereum’s architecture and rollups are combined, Ethereum’s current transaction throughput levels of 15-45 TPS can scale up to 1,000 – 4,000 TPS.”

This is also why OP and Layer-two tokens have “flown to the roof” once again considering the fact that the starting of July. In unique, the selling price of OP has also greater drastically by 300% in just above a month. and is at present trading all-around one.64 USD mark.

But OP seems to have had a rather difficult June, due to the controversy above the consumer airdrop occasion, the undesirable market place, and the truth that OP is not staying made use of to spend transaction costs on the optimism that drove the token selling price up. abruptly came down.

Synthetic currency 68

Maybe you are interested: