Almost divided by ten given that the peak of October 2021, Olympus DAO (OHM) has develop into a sizzling subject of discussion on the Twitter social network. However, if you are mindful and adhere to the examination of the KOLs, you may possibly have by some means predicted this “Black Swan” occasion.

Unexpected fall from Olympus (OHM)

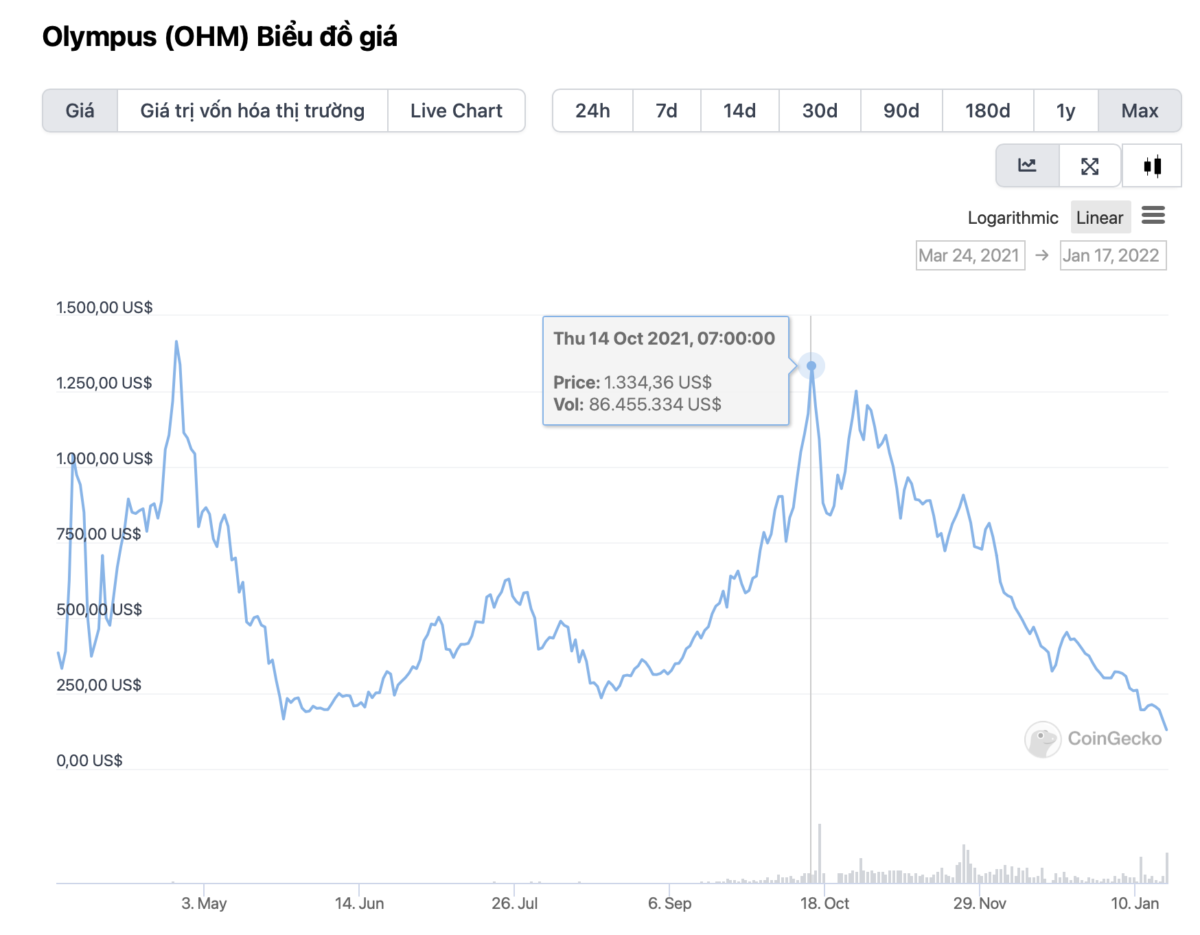

Since October 2021, the value of OHM has fallen practically ten instances, from the USD 1300 region to all-around USD 130 at the time of creating.

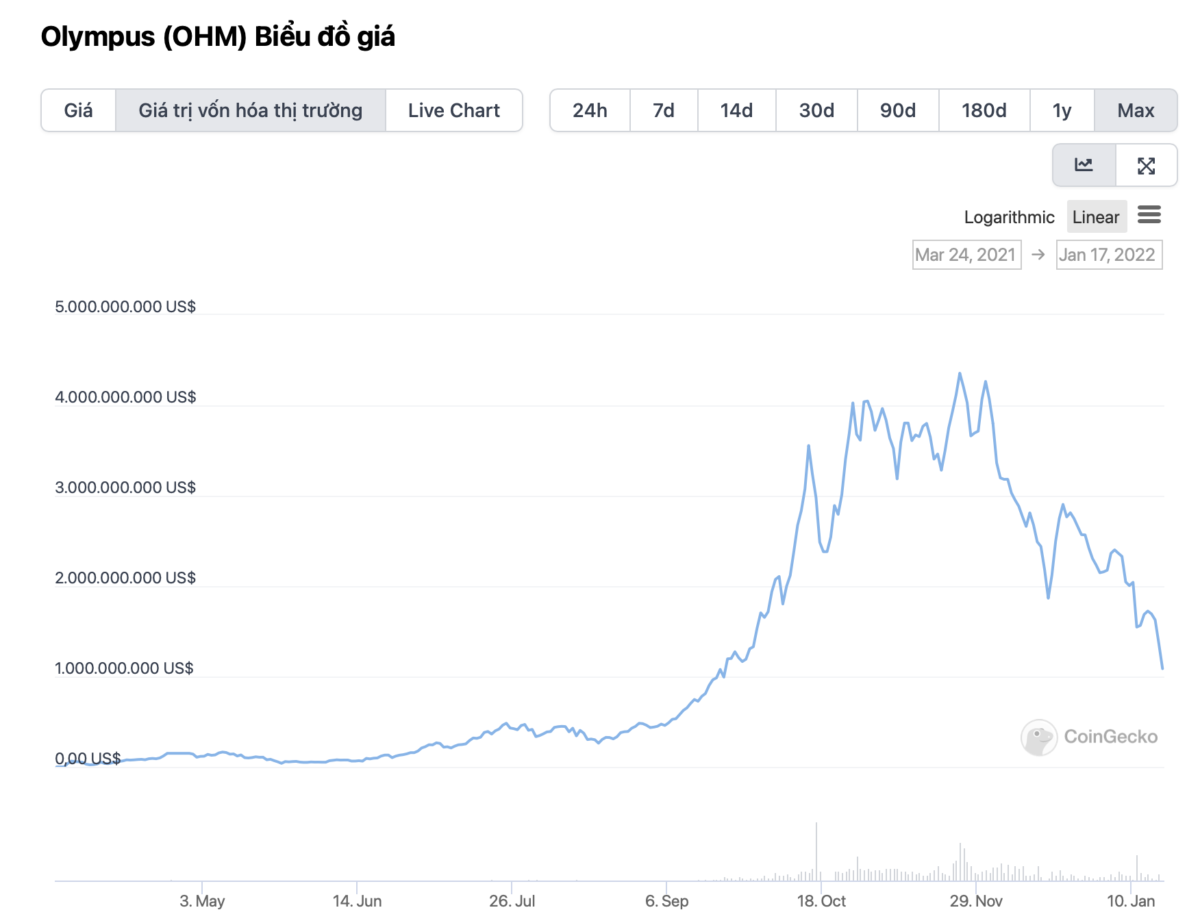

However, a single indicator that couple of men and women shell out consideration to is that OHM’s marketplace cap has also split four from the area of $ four.four billion to the recent $ one billion.

And as typical, when a volatile move happens, the query lots of traders are asking is “What is the reason for this dip?”.

(three,three) gets to be (one, -one)

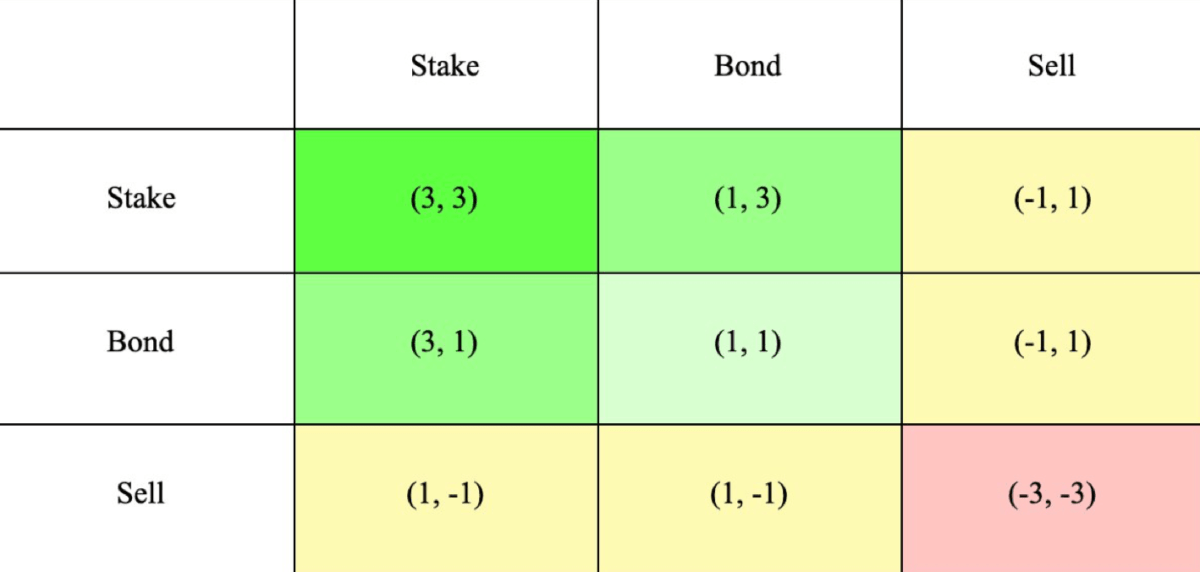

If you have been following this task from the earliest days, you should have heard about the game concept model (three,three) talked about by Olympus. To discover much more about the versions (three, three), you can click to read through the report beneath!

>> See much more: Olympus (OHM) – The DAO trend leader or the new “pyramid model”?

As talked about in the publish over, three holes of Olympus It consists of:

- If in two gamers, there is a vendor, they are broken only in one/three of circumstances. In the other two circumstances they nevertheless have a minimum revenue. For this explanation, the offering strain triggers the model to slowly move in the direction of the box (one, -one).

- The binding model encounters the “chicken egg” challenge. Self for a very low price reduction, could lead to Bond will not be appealing, no a single will volunteer to get Bonds, therefore lacking the acquiring electrical power for OHM. But in return if the price reduction is large, induce raise in symbolic emissions, as a result making robust income strain.

- The treasury is not large ample to cover the OHM spread. And why an OHM token is not disproved (protected) by a sufficiently massive worth, reinforces the offering strain when the marketplace fluctuates. This also triggers the game to shift from (one, -one) to (-three, -three).

What Twitter says about the Olympus model

As typical, KOLs on Twitter also constantly deliver their “analysis and comment” on the OHM model. However, in this report, I would like to summarize only the two much more thorough arguments of the two sides for – towards. The initial counter-argument is from Jordi.

The epic “Smoke and Mirrors” trilogy continues with the unusual sequel that is even greater than the unique-

: ‘𝗙𝗮𝘁𝗵𝗲𝗿

A master class on setting up your Ponzi empire The traditional caveman Learn the ten Commandmentshttps://t.co/eLk59QG7FB– Jordi Alexander (@gametheorizing) January 15, 2022

Jordi mostly attacks Olympus as a Ponzi scheme, with Social media advertising on Twitter with a winning vision. It is simple to see, on Twitter there are consistently variations of (three,three) in the naming of the accounts of lots of KOLs.

Also, jordi thinks the Olympus model generates massive token issuances marketplace. Another component that jordi attacks is that Super wonderful APY by OHM.

And conversely, meowny is the Twitter account that refuted the over arguments.

i had read through that report circulating about ohm from jordi and i truly will not comprehend why it was so well-liked

appeared to truly confuse much more what ohm * truly * is just to persuade men and women it can be a ponzi for dramatic results and its counterexamples will not help that

– mewny (@ mewn21) January 17, 2022

Mowny thinks Ohm nevertheless has a steady income stream from the help of liquidity advancement platforms, particularly with the Olympus Pro solution line. In this regard, meowny also pointed to an instance this kind of as UNI – floor ADM employed to function with out transaction costs to reassign to holders.

Even in current days, Olympus forked versions have also suffered steep declines. At the similar time, the model (three,three) is relatively intricate for lots of newbies. Therefore, I hope you guys can get the time to exploration new versions in DeFi, in advance of generating the selection to “take the knife”, particularly in the context of tasks with a short while ago robust downward momentum.

Note, the over report is for informational functions only and need to not be regarded investment assistance!

Synthetic currency 68

Maybe you are interested: