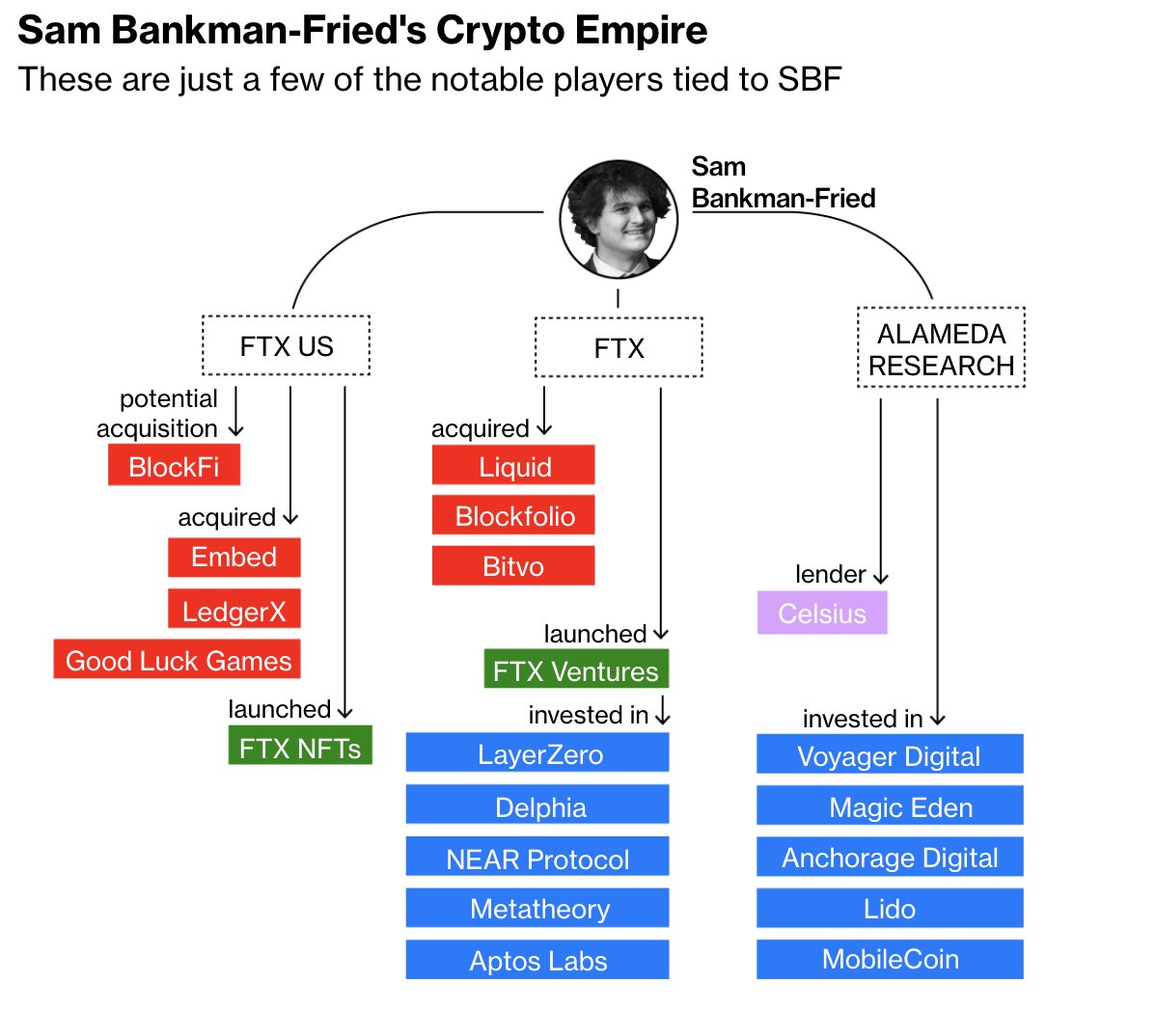

This 12 months, the Alameda Research investment fund has witnessed a series of “failures” in lending choices, forcing the FTX exchange to stage in to the rescue.

As of June 2022, Alameda Research is believed to have a $ 500 million loan agreement with Voyager Digital, the cryptocurrency loan provider stated. bankruptcy in July 2022and this is the starting of the existing chain of results on the FTX exchange, in accordance to sources of Reuters. Alameda and FTX have extended been acknowledged to have a “close” romantic relationship when they had been founded and run by billionaire Sam Bankman-Fried, despite the fact that they constantly declare to be two independent entities.

Tracing the story, Voyager is one particular of the names immediately impacted by the investment fund Three Arrows Capital goes bankrupt. It all begun with the liquidity crisis on the following cryptocurrency industry LUNA-UST collapses in May 2022. The traveler is now lent a big quantity of dollars to Three Arrows Capital of end users and did not reply in time, primary to the inability to shell out debt obligations.

Source Reuters claimed that Alameda Research was one particular of the names hit by the subsequent liquidity crisis due to the fact Voyager went bankrupt and other key crypto institutions had been also caught with the dollars. However, it is not doable to ascertain the total extent of the harm suffered by Alameda.

Despite holding $ 15 billion in assets, Alameda was even now in this kind of poverty that FTX CEO Sam Bankman-Fried had to conserve himself. Sam observed a way transfer at least $ four billion of FTX to Alameda. In return, Alameda Research will ensure the loan with its very own FTT token and a seven.six% stake in the Robinhood exchange.

It is well worth mentioning portion of this $ four billion is buyer deposits. Although the actual quantity is not established, it is reported that Bankman-Fried has not informed other FTX leaders of the pitch to help Alameda.

Seeking to help Alameda, SBF has transferred at least $ four billion in FTX money to them.

A portion of these FTX money had been buyer deposits.

The seeds of FTX’s downfall had been sown months earlier, immediately after SBF stepped in to bail out other cryptocurrency corporations.https://t.co/pkrvc6OAT1 pic.twitter.com/hof6eo8PRa

– Hsaka (@HsakaTrades) November 10, 2022

Without stopping right here, on two/eleven, CoinDesk launched information of a leaked stability sheet displaying that the bulk of Alameda’s $ 14.six billion assets are in FTT tokens. Alameda CEO Caroline Ellison tweeted in response that the stability sheet was “incomplete,” with the fund even now getting $ ten billion of unregistered assets.

However, this raised considerations about Alameda’s monetary overall health. As a end result, Binance CEO CZ announced the sale of all FTT holdings as “the truth is gradually coming to light”. FTX was then massively “rushed to the banks” by end users and forced to block withdrawals, ending the month with the title of Sam’s “billionaire” when His fortune “evaporated” $ 14.six billion overnightand a series of grim occasions surrounding FTX starts right here.

On the afternoon of November ten, inner messages leaked involving FTX CEO Sam Bankman-Fried and his employees, revealing that the exchange will place all its efforts into one particular ultimate fundraiser to revive all the things following week. FTX had previously been canceled by Binance and is now rumored to be searching at Justin Sun. There are other sources that the FTX – Alameda reduction is up to $ eight billion, as the primary motive Binance moved away.

Coinlive has published a series of articles or blog posts summarizing the Binance drama – FTX, readers can see extra right here:

– Binance liquidates all $ 580 million investments in the FTT token of the FTX exchange

– Users massively withdraw from FTX

– The complete industry was heavily dumped, FTT misplaced 22 USD

– Binance reaches agreement to invest in back FTX

– The assets of the CEO of FTX are down by $ 14.six billion, Write a letter apologizing to the traders

– CZ urges exchanges to supply evidence of buyer deposit

– The Solana method is a “carrier of battle”

– Binance cancels FTX acquisition and most up-to-date updates

– Continuously numerous organizations declare “solidarity” from FTX

Synthetic currency 68