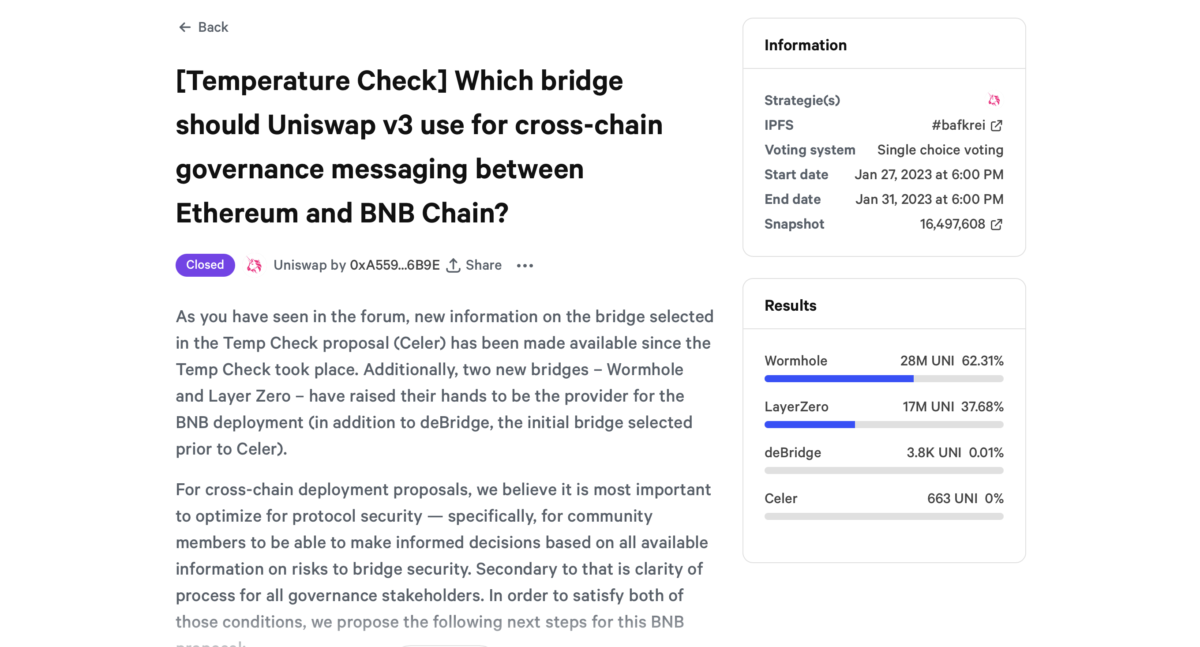

A vote by the Uniswap neighborhood to confirm and pick a cross-chain option for this exchange on BNB Chain at first leaning in favor of Wormhole. However, the last developments will be exceptionally unpredictable.

As a end result, today’s check benefits are not last. There will be a last vote to officially approve Wormhole as the help bridge among Ethereum and BNB Chain for the Uniswap exchange.

>> See additional: Uniswap V3 approaches growth on the BNB chain

However, with hundreds of hundreds of thousands of bucks of assets held, the behind-the-scenes battle of hedge money can shift benefits in several instructions.

This war incorporates money like a16z and Jump (backers of LayerZero and Wormhole, respectively). A supply at The Block exposed that a16z with 15 million tokens voted can’t participate in the verification system – Temperature Check – due to the latest token custody format.

Eddy Lazzazin, an investor in a16z, also confirmed the difficulty in a publish, saying the organization was unable to participate in the temperature-checking system.

“Just to be clear, we at a16z have been in a position to commit 15 million tokens and vote in favor of LayerZero if technically attainable. But we will have the appropriate to vote in long term Snapshot ballots. So with this temperature handle system, do not count on us.”

Another supply, the Uniswap Foundation, has not nevertheless mentioned irrespective of whether or not it will help LayerZero. According to latest info, Wormhole may well have won with all over eleven million votes.

A supply near to the task mentioned Wormhole expects a16z to help temperature handle findings, and that if a16z goes towards neighborhood values to deliberately reverse this system, the supply will be exceptionally shocked.

A16z’s rep confirmed the company’s ideas to participate in any on-chain voting. Jump has not nevertheless commented on the matter.

The debate among these two bridges primarily revolves all over the difficulty of variations in protection mechanisms. Last evening, supporters of Wormhole and LayerZero each pushed UNI token voters to vote for them. A side story is that LayerZero has a short while ago been published constantly by the neighborhood accusing this task of exploiting protection holes on the bridge to handle partners.

>> See additional: Summary of the heated debate on LayerZero

Besides the protection difficulty, the money story is also exceptionally intriguing as the winning bridge will entice a big sum of assets to deposit. The traders behind the bridges will, of program, be searching to capitalize on them immediately after the official benefits are finalized.

A LayerZero rep confirmed:

“We think the goal of Temperature Check is to capture management aspirations and I believe that is exceptionally clear. After the temperature check out, I believe Uniswap must include each of these selections to the last voting system so that the neighborhood can definitely participate in the choice.”

Synthetic currency68

Maybe you are interested: